Since I'd covered Quarto and Quercus, and had looked at Haynes (a different but slightly connected company) in the past, it makes sense to finish by looking at their larger listed brother, Bloomsbury Publishing (LON:BMY) . Bloomsbury's rise to fame is like Quercus's turbocharged, I suppose; while Larsson's translated novels propelled Quercus up the food chain, Bloomsbury's fortunes were forever changed when a certain series of novels about a young wizard and some stuff he did in an enchanted castle took off in a way hardly seen before or since. It was a rather modern success story, too, in the multichannel nature of the way that Bloomsbury, JK Rowling, WB and co. managed to milk the franchise through so many different products and affiliations.

Since I'd covered Quarto and Quercus, and had looked at Haynes (a different but slightly connected company) in the past, it makes sense to finish by looking at their larger listed brother, Bloomsbury Publishing (LON:BMY) . Bloomsbury's rise to fame is like Quercus's turbocharged, I suppose; while Larsson's translated novels propelled Quercus up the food chain, Bloomsbury's fortunes were forever changed when a certain series of novels about a young wizard and some stuff he did in an enchanted castle took off in a way hardly seen before or since. It was a rather modern success story, too, in the multichannel nature of the way that Bloomsbury, JK Rowling, WB and co. managed to milk the franchise through so many different products and affiliations.

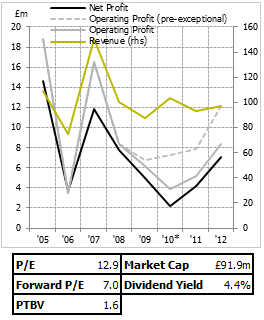

Still, all that furore is rather far in the past now. It made me feel rather old to read that it was in 1997 that the first Harry Potter book was released - a full 16 years ago - and so the company could rather be said to be over the best of those times. Like Quercus, they've reinvested the proceeds and become much bigger as a result.

One thing that's probably more apparent with Bloomsbury than Quercus, then, is the value of its intellectual property - Larsson's books were clearly valuable, but Harry Potter appears to be on another level (though notably Rowling did keep the digital rights). It's not just Harry Potter, either; they have a back catalogue of well over 10,000 titles. There's lots of different ways of thinking about an investment, then, and how much a business is really worth, and here's a different one for these book publishers: the way Quarto, Quercus and Bloomsbury account for publications is to amortise them over short time periods; Quercus use two years. That's to say, they spend X on bringing the book to market (these costs go to a balance sheet entry, prepayments) and then amortise that asset over the next couple of years, or before if they think the value of the title is 0. I see this as a bit like accelerated depreciation - a company can choose to amortise capital equipment more in its early years, even though it has a long lifespan. The net effect is to defer taxation. In the…

.png)