I am opening this thread so we can discuss all things relating to (BOO) Boohoo.

This is also going to take the pressure off Paul Scott Small Cap Value Report,

So please gentlemen please feel free.

I am opening this thread so we can discuss all things relating to (BOO) Boohoo.

This is also going to take the pressure off Paul Scott Small Cap Value Report,

So please gentlemen please feel free.

I am 70 years old and I am the Chairmen and major shareholder in a Mechanical and Electrical contracting business based in Tanzania East Africa. I spend 3 months a year in the UK and 9 months in Tanzania. I have always been interested in the stock market and started buying shares in the 1970s. But started trading seriously since 2007. I only trade the UK market and mainly spread bet with IG Index for the last 8 years. more »

Hertz stock did make a little fly up today.

https://www.bloomberg.com/news...

Should we put in? Or it will fall as quick as flight up.

£BOO. PwC resigns audit

PwC audits Exxon Mobil, Chevron, Ford, Marathon Oil, Philip Morris (yes Philip Morris) Raytheon amongst others. https://t.co/UkmNPbhc7S?amp=1

Words fail me. So polluting big oil, tobacco & bombs are fine but an online retailer is not.

This, like SLA dumping Booho shares when it had BAT Loan notes in the same fund, is just virtue signalling.

Here’s the problem. I have no doubt Boohoo (LON:BOO) will find an auditor, I have no doubt they will weather the new negative in their share price. But I think it’s time to admit that it’s time for Boohoo (LON:BOO) to find a new home. Why deal with a UK market that refuses to reward obvious progress with disinterest and a stiff upper lip?

Can you imagine how US investors would deal with allegations of second tier suppliers being paid below minimum wage in Leicester? I don’t know either but I’m guessing it wouldn’t be met with the kind of self-destructive behaviour the UK investment community seems intent on here. Can you imagine a US based accounting firm being worried about their own image when being asked to audit a company? Of course not, the auditor’s job is to do the books for the shareholders, good or bad and put the results out. Their own reputation in the process is only relevant if they fail to do that.

It’s time for Boohoo (LON:BOO) to move to the US, a golden land where they can be invested in by people who are ready for a company like this. Let’s start the movement here and now...

(I don’t currently hold but really want to again...)

PwC audits Exxon Mobil, Chevron, Ford, Marathon Oil, Philip Morris (yes Philip Morris) Raytheon amongst others. https://t.co/UkmNPbhc7S?amp=1

Words fail me. So polluting big oil, tobacco & bombs are fine but an online retailer is not.

I think you are missing the potential narrative there Michael. PWC (AFAIK) aren't interested in the ethics or ESG characteristics of the business. They may however be concerned if they thought a business may be involved in fraud ; especially if they were also concerned that they do not have the competence to spot any such fraud.

My first experience of the big audit firms was over 3 decades ago when I dealt with the "C" (&L at the time) of PWC. Their forensic questioning really put me under pressure : "Aha, so tell me Mr Gromley I have noticed that in the last year your volumes decreased and yet you report increased revenues, how do you explain that? " Me : "We put the prices up and sold proportionately more of our more expensive products." C : "Ah, thank you very much for your time".)

I'm sure I could report more startling lack of insight over the years (having worked with PWC and most of the other majors) , but that one always stays with me - especially given how worried I was having been given about 10 hours notice that the auditors wanted to ask me some questions tomorrow morning.

If I owned BOO I'd double down on my forensic analysis of their accounts (particularly the notes) and make sure I can match up the long run cash generation with earnings and assets.

The proximity of a shortseller report (from someone who tends to do some decent work even if they turn out wrong here) with auditor resignation would make me worried. There's no room for a slip up here given multiple. I'm not scaremongering...just being rational. If I owned or was interested in owning I wouldn't knee jerk buy any falls here without doing my work personally and in depth. Ignore what the crowd think unless there is extreme revulsion and particularly don't get swept up in group based indignant bull narratives.

IMO there are reasons to worry about BOO

1) corporate governance

2) The Leics nexus. It rumbles on as there are issues that clearly boo were part of.

3) PLT's success was built on gouging shareholders. Economics were taken/cannibalised from the main boo brand and transferred to PLT...so enriching the family at expense of shareholders. PLT did not pay a fair price for the development and infrastructure support given and so the payouts to PLT family members are 'generous'.

4) They seem to over raise cash relative to their reported cash generation. This may be entirely as they can and so they fill their coffers in advance. It could also be a hint that cash generation is not as sustainably great as perceived. I don't know...I'm just pointing out an oddity IMO. Perhaps the huge (IMO unwarranted) payments to PLT explain why they have so heavily dipped investors for cash. I'm out of date but when I looked more closely at boo back in 2017 and 18 I felt that their cash flow was hard to be sure of and that they employed some fairly aggressive practices.

5) They over-incentivised the new CEO (non founder). IMO obvs...but if I want to be cynical I think that he's got a lot of money dangled in front of him to go with or tidy over any historic issues.

I'm a natural sceptic so I look at all things like above. I own companies where I'm not happy with some things....but never on super high multiples...high multiple stocks I own have got to be super pure.

Best wishes on the buying....

I would have thought if there were obvious links from Boohoo (LON:BOO) the crooked suppliers staring PWC in the face then the Alison Levitt QC would have found something. Rather she cleared BOO of deliberate wrongdoing or connections even though damming their oversight of their distributors. At face value BOO do seem yo be putting in place a raft of measures and many changes to correct this. They stated this in their RNS regards the report . Could the tendering for a new auditor be part of this 'change'? PWC are not beyond reproach themselves when it comes to their business dealings.

Terry the Trader did a good deed trying to switch boo discussions to here. TBC I don’t mind what gets talked about in SCVR (and have never complained!) but we’d have all done ourselves a solid to put that febrile nonsense in a safe space ;)

Yes its in black and white.

PwC appear to be happy to remain until a new auditor is appointed, very normal. There may be no falling out at all in fact, either the firm considers that the audit is higher risk than it was and do not wish to continue or the company was already putting the tender out for a new firm and the journos getting a bit creative to create another BOO story.

Either way they were happy to sign off the audit on 21 April and next April it will be another auditor.

To repeat others, its very normal for a firm to replace their auditors ever 4 or 5 years, its a red flag if they hang onto their auditors forever as clearly it shows the auditor partner is too close to the company.

The Nile is not just a river in Africa.

its very normal for a firm to replace their auditors ever 4 or 5 years,

Indeed but it VERY abnormal for a company to re-elect their auditors an AGM and then a few weeks later announce they are seeking a new auditor.

I have no position here and no insight, but to be frank the more baseless "defences" I see of the company the more I am inclined to look to the short side.

Kamani bought back less than 1% of what he sold back in December (35m shares and Kane sold 15m both at £2.85). In the scheme of things not a ringing endorsement. That said he did buy 5m shares back in July at £2.14 so maybe he feels his work is done. Anyway, in Kamani terms the purchase is at best weak perfunctory signalling. The CFO purchase although small could be judged as more significant (if you think 10k shares matters given that the stock is "very cheap").

I'd be more impressed by a meaningful buy by the 'outsider' CEO...which might come...as he has much cleaner eyes for everything. Of course he may not feel the need as he has such a massive bonus package (he owns near zero shares as he awaits the money pot)

Clearly boo's share price may be much higher than it is today in a few weeks to years time as its does have a growth engine and growth is everything at the moment. However, I believe a sober assessment would see many risks to business model, management and fulfilment of shareholder interests. Probity and honour are qualities that can be found generally lacking in many walk of life particularly when it comes to status and money (observation rather than moralising)...the hints are that the balance at boo is a bit out of kilter. This could create un-tradable event risk.

This sort of event risk exists in many stocks (particularly fast growing and/or small) but its not always as clearly signposted as at boo....and its hard to argue that concerns have retarded valuation of the business and that the scepticism is in the price. The buying points for boo are on a spectrum of mild to extreme euphoria with no scepticism. Buying at mild euphoria may prove profitable and so good value. I'm not credulous/smart enough (delete as appropriate) to buy...and so must face my mega growth purgatory.

I think the shareholder base looks weak. Given recent woes and falls I'm surprised that they have not found more institutional support given size and growth rate. At the margin its down rather than up.

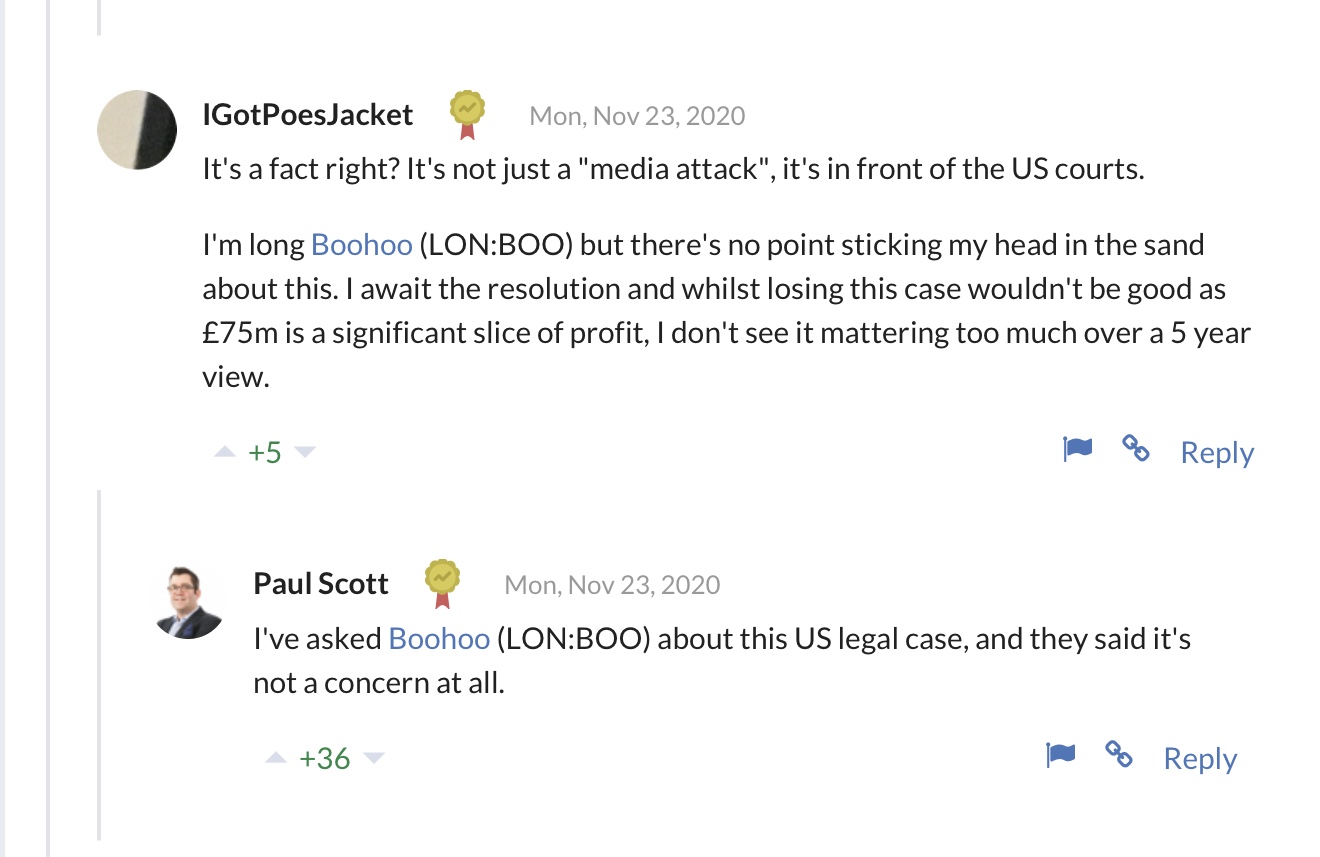

There is a $100m class action law suit against BooHoo in the US brought by AI Law. BooHoo's recent attempt to have it rejected has been dismissed by a judge. Senior executives will now have to appear to give evidence.

The case centres on claims that BooHoo issued 'fake' discounts and refunds to customers are being requested.

Does anyone have a view on this ?

Re: Boohoo (LON:BOO) - seems The Guardian is not ready to hand in the towel just yet:-

https://www.theguardian.com/business/2020/nov/27/critics-slam-pretty-little-things-8p-black-friday-dress-deal

Don't suppose any/many Guardian are potential customers anyway otherwise I'm sure they'll all be logging on to PLT website to stock up for Christmas

So you say but where and when? I can't find a reference. and besides, it must have been before the court rejected BooHoo's appeal.

I hold. All the news is surely already out there. I suspect this chain will do little than regurgitate old news, Paul will undoubtedly cover new news as it appears.

Leveson will improve governance, there may be an impact on margins in the short term, green credentials will become increasingly important to all fashion retailers and Boo I'm sure will not ignore this, there are many ways to skin that particular rabbit.

I do say, yes. The US court is still considering whether it actually has jurisdiction.

Monday Nov 23 SCVR:

Thanks for the replies. When I worked in retail some decades ago, the rule was that you had to have the item on sale at the 'inflated' price for eight weeks in one of your stores (usually the Outer Hebrides). I guess it's much harder online to use the same device.

The US is a litigious nation as we know, but on the other hand BOO are unlikely to say that they're very worried.