Good morning, it's Paul here with a new thread for discussion of results from Boohoo (LON:BOO) (I hold) due out imminently on 5 May 2021.

We decided a little while ago that the market cap of BOO at £4.3bn is much too high to continue discussing it in the Small Cap Value Reports (SCVR). Hence a separate discussion here will avoid cluttering up the SCVR for today, so please keep the discussion of BOO on this separate thread.

Just before the results come out, here's a quick summary of previous guidance, which we can use to measure performance today against:

- Strong peak trading

- 4 months to 31 Dec 2020: 40% revenue growth

- 10 months to 31 Dec 2020: 42% revenue growth

- Guidance for 12 months to 28 Feb 2021: 36-38% (raised from previous range of 28-32%), adj EBITDA margin c.10%

- Medium-term guidance: 25% p.a. revenue growth, and adj EBITDA margin of 10%

Stockopedia shows broker consensus for FY 02/2021 of: 8.47p

Fingers crossed!

.

Useful links:

Click here for the presentation slide deck

Click here to view webcasts on video recording (select "view online")

Here are my notes from the actual FY 02/2021 results -

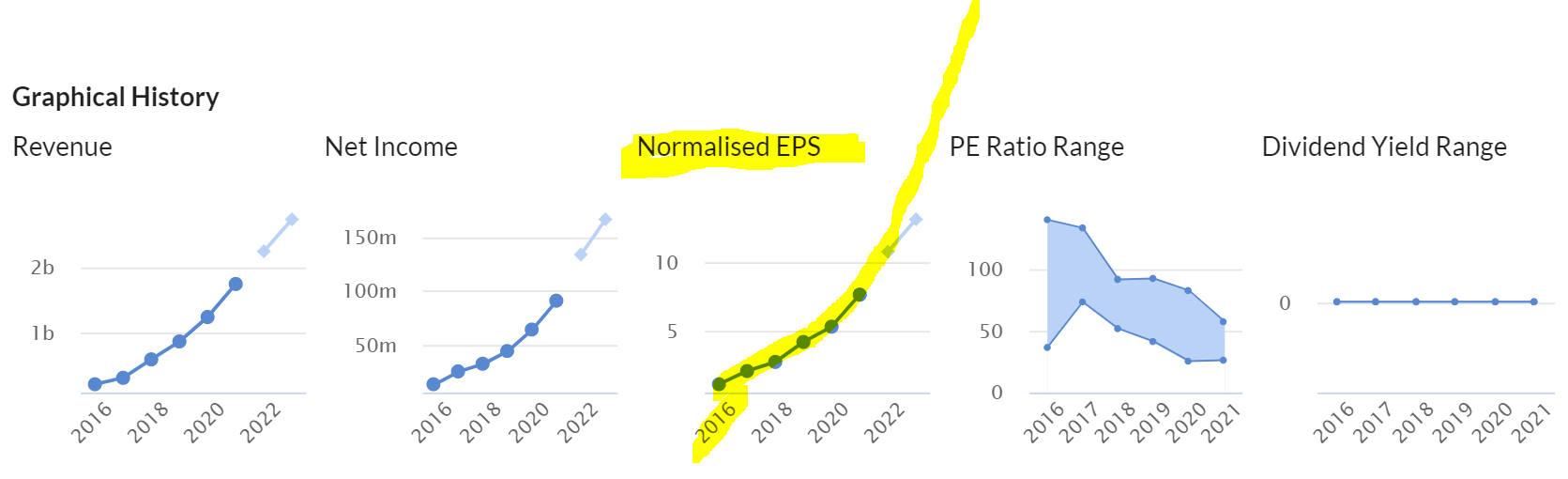

- Revenues: up 40% - ahead of guidance of 36-38%

- Adj EBITDA margin of 10.0% in line with guidance

- Adj EPS 8.67p is a beat against broker consensus of 8.47p (2.4% ahead)

- Adj EPS of 8.67p is up 47% on last year

- Strongest growth geographically was in USA, at +65%

New guidance for FY 02/2022: 25% revenue growth (of which 5% from newly-acquired brands) - note that guidance tends to be raised as years progress.

Current trading - trading in first few weeks of new financial year has been “encouraging”

Returns rate - benefit from a lower customer returns rate in FY 02/2021 is expected to “begin to unwind”

Carriage & freight costs - significantly elevated, expected to continue

Lockdowns - mixed effects - some benefits (e.g. lower returns rate, less competition), but core product categories saw “significant declines” (i.e. not selling party/clubwear so much during lockdowns)

Re-opening - already seeing “early benefits” from this, i.e. resumption of sales in party/clubwear

Gross margins in established brands expected to be maintained

Adj EBITDA guidance: 9.5% to 10.0%, slightly lower than previous 10% guidance, due to investment required in new brands

Seasonality -…