First time poster, keen to hear any feedback in the comments!

I recently came across this company through one of my screens and would be keen to hear other peoples thoughts.

Who are they?

Ituran Location and Control Ltd. is a provider of location-based services, consisting of stolen vehicle recovery (SVR), fleet management services and other tracking services. They have a global reach as seen below - and are moving more into emerging markets such as India.

They work directly with some big insurers and car companies such as BNP paribas, AIG, Allianz, VW, GM and more.

What are the financials like?

- Really steady revenues over the last 5 years

- Operating margin of 20% over the last 3 years highlights their market leader position

- Return on capital employed 29% on average over the last 3 years showing really good management and capital allocation

- Price to free cashflow of 10.3

- Dividend yield of 5.64%

- Total current assets: 179 (53 in cash)

- Total current liabilities: 92.5 (no real short term debt)

- Total assets: 319

- Total liabilities: 144 (0.59 in total debt)

Overall I am very happy with the financials here so lets look at the future prospects of the business.

What are the future prospects?

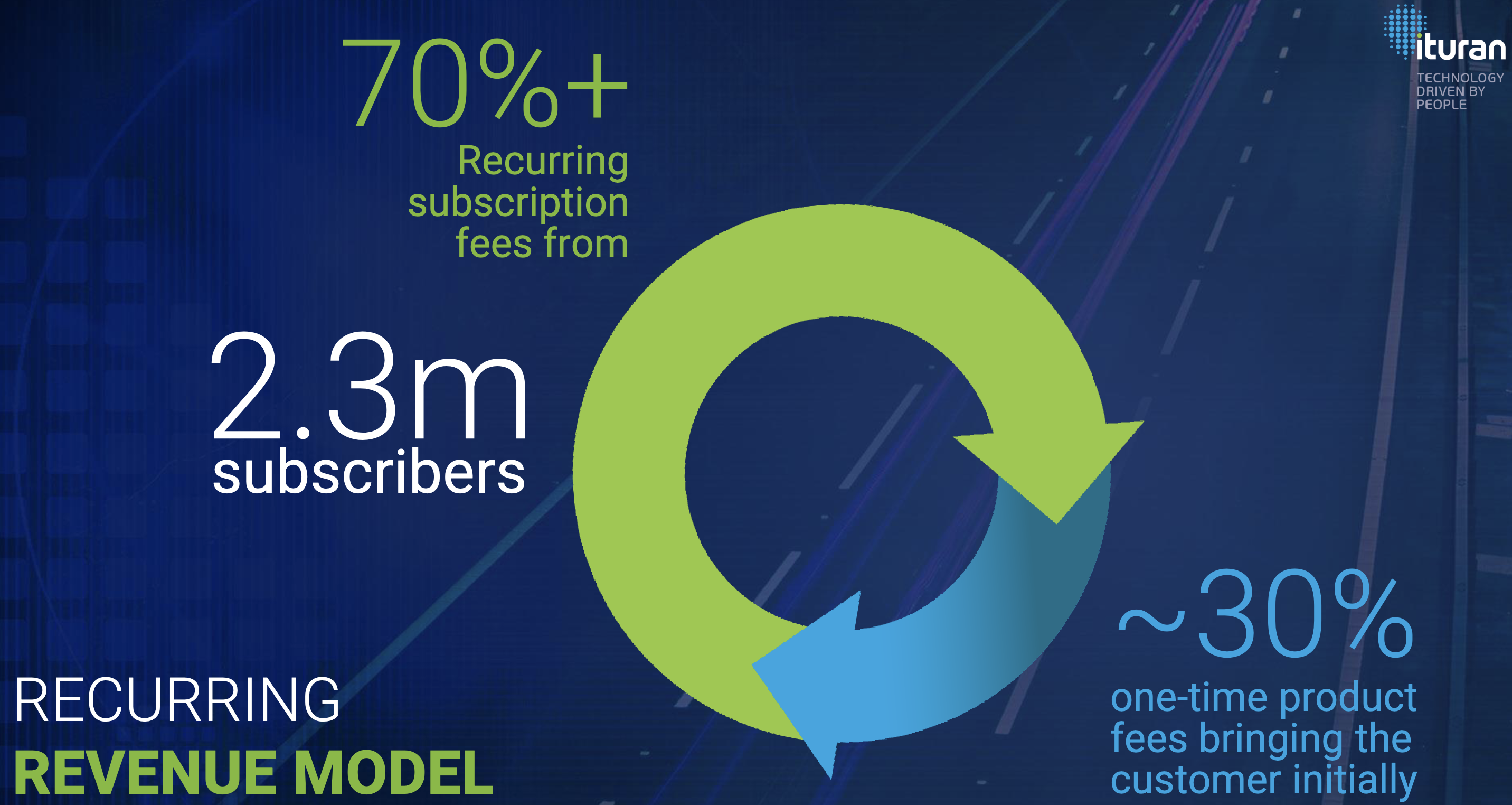

Subscriber growth has been growing steadily since 2004 up to 2.3m overall subscribers.

More importantly, 70% of their revenue comes from recurring subscriptions which gives them a really sustainable business model.

As they venture more into the technology side of Big Data, they have a solid base of customers to gather data on.

What are the concerns?

- As car manufacturers integrate security and connectivity in their cars perhaps there is less of a need for ITRN's products

- Share price is flat for the last 4 years

- Headquartered in Israel which brings the geographical concerns into play

- Not huge barriers to entry as the products are not too complex

Overall I really like this business, the financials are solid and its practically debt free. Its just the kind of boring business that I like.

What are your thoughts, is there anything glaring that I have missed?