The portfolio is leading a blessed existence at the moment, with results coming in above expectations left right and centre and most of the shares performing well above the FTSE. A combination of a smidgen of personal experience on variance and the long stretches luck can drag itself on for and a larger dollop of bemusement around why/how the shares are performing so strongly serves to keep any overconfidence in check, though. I am not feeling a particularly strong conviction on many of the shares in my portfolio at the moment - the only thing preventing a big sell-off is the dearth of new opportunities I've been coming up with. This has been noted by others on Twitter, though the exact combination of market factors (it is getting more expensive) and me becoming more picky is one I haven't really figured out yet!

The portfolio is leading a blessed existence at the moment, with results coming in above expectations left right and centre and most of the shares performing well above the FTSE. A combination of a smidgen of personal experience on variance and the long stretches luck can drag itself on for and a larger dollop of bemusement around why/how the shares are performing so strongly serves to keep any overconfidence in check, though. I am not feeling a particularly strong conviction on many of the shares in my portfolio at the moment - the only thing preventing a big sell-off is the dearth of new opportunities I've been coming up with. This has been noted by others on Twitter, though the exact combination of market factors (it is getting more expensive) and me becoming more picky is one I haven't really figured out yet!

The results

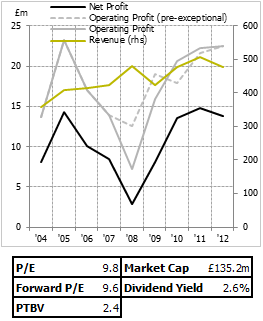

British Polythene Industries do exactly what you'd expect them to do - polythene and plastic products. They're a big player in the UK and European market, which appears to be a regional oligopoly with a few dominant players. The results were nothing groundbreaking - showing a decent improvement in operating profit alongside a small drop in revenue and volumes. The dividend is also up marginally. I suspect the main driver of the positive reception of the results was the outlook statement - almost unambiguously positive, with Cameron McLatchie, the chairman, noting that:

The prospects for 2013 look equally good, particularly for further improvement in our UK business. Current capital investment is targeting resilient and sustainable markets. We are confident that the prospects for growth in 2014 and beyond are now clear.

The UK issues are really the crux here. The UK business has been earning far worse returns than the mainland business for an extended period now - even with management's ongoing efforts to reorganise it. To put figures to it, Mainland Europe earnt £13.3m on £135.8m of revenue last year, using £58.6m of assets. UK earnt about 35% less operating profit on over double the revenue and almost 3 times the asset base. It is clearly a far less efficient and far less profitable story. To counteract this, management have been investing - restructuring , closing sites and spending on equipment. They have been rewarded with an uptick - they are doing better, after…

.png)