Many readers will know Warren Buffett as one of the world’s top investors. The Oracle of Omaha strikes us as sharp, witty and don’t forget he has a photographic memory. Many people buy a stock just because Buffett bought the very same stock. But fewer people realise that this blind, unquestioning faith in heroes once got him into a spot of bother… way back in 1950. At the time, Buffett idolised Ben Graham and David Dodd, the founding fathers of value investing. He had memorised their textbook, Securities Analysis, and later admitted, ‘I knew the book even better than Dodd.’

Warren was still a student at Columbia, networking to improve his job prospects. Through a chance encounter, he found himself having lunch with a man called Lou Green, one of Ben Graham’s business associates. They bounced investment ideas.

Lou Green asked, ‘Why did you buy Marshall-Wells?’

Warren replied, ‘Because Ben Graham bought it.’ Then his stomach churned. Warren later recalled: ‘I’ll never forget the way he looked at me.’

There was a long pause, then Green said: ‘Strike one!’

Buffett was with this impressive character, and then all of a sudden he was ‘striking’ out. The key lesson is this… You have to think for yourself! Blind faith in heroes had led Warren to make the faux pas.

Does every Padawan need a Jedi Master?

We should perhaps be a little more forgiving towards Warren. Having a mentor is essential, especially when starting out. Movie lovers will know that every Harry Potter needs a Dumbledore. Every Luke Skywalker needs an Obi-Wan Kenobi.

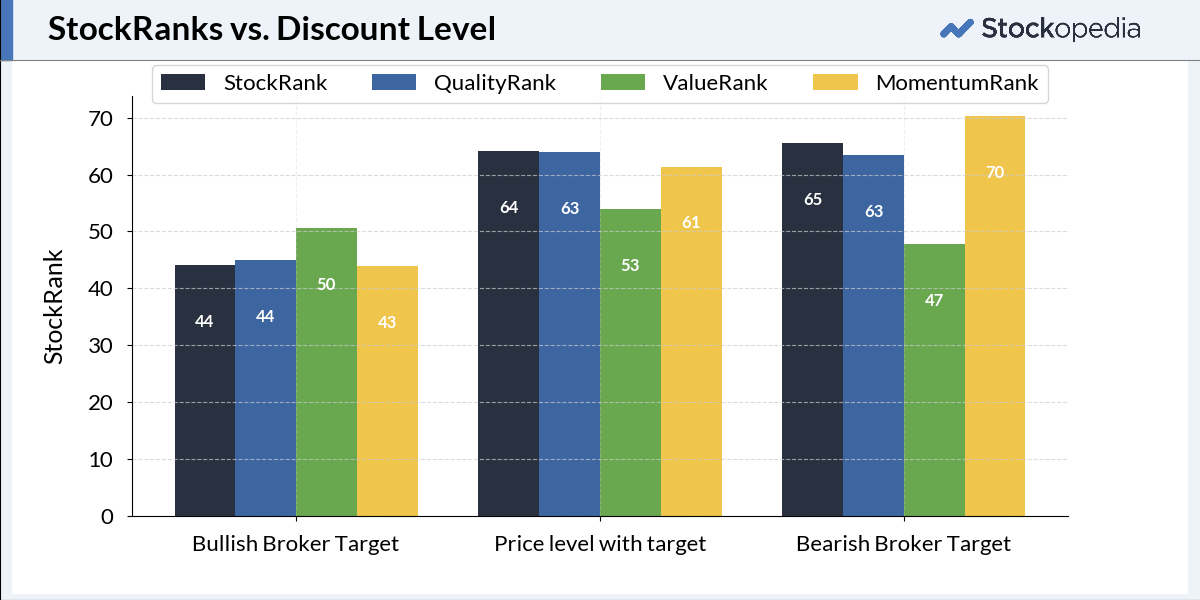

Investing, particularly private investing, can be a lonely business. We do not have direct access to Warren Buffett or the stock-market equivalent of Dumbledore. So when I started out, the “experts” I gravitated toward tended to be brokers. Their recommendations were structured in a way that was easy to understand. I looked at brokers’ price targets and made one of two conclusions:

- If a stock was trading at a discount - i.e. below the broker's target - I assumed brokers were optimistic and bullish. I saw a buying opportunity;

- If a stock was trading at a premium - i.e. above the broker's target - I assumed brokers were pessimistic and bearish. I saw a selling opportunity.

Everything seemed clear and actionable. I absorbed broker targets with the same level of trust as someone following…