Investing in quality stocks is all about earning big returns over long periods – without much trading.

Fundsmith founder Terry Smith uses the tagline "Buy good companies, Don’t overpay, Do nothing" on his fund’s annual reports.

Legendary investor Warren Buffett has said that when he finds a great business, his favourite holding period is "forever".

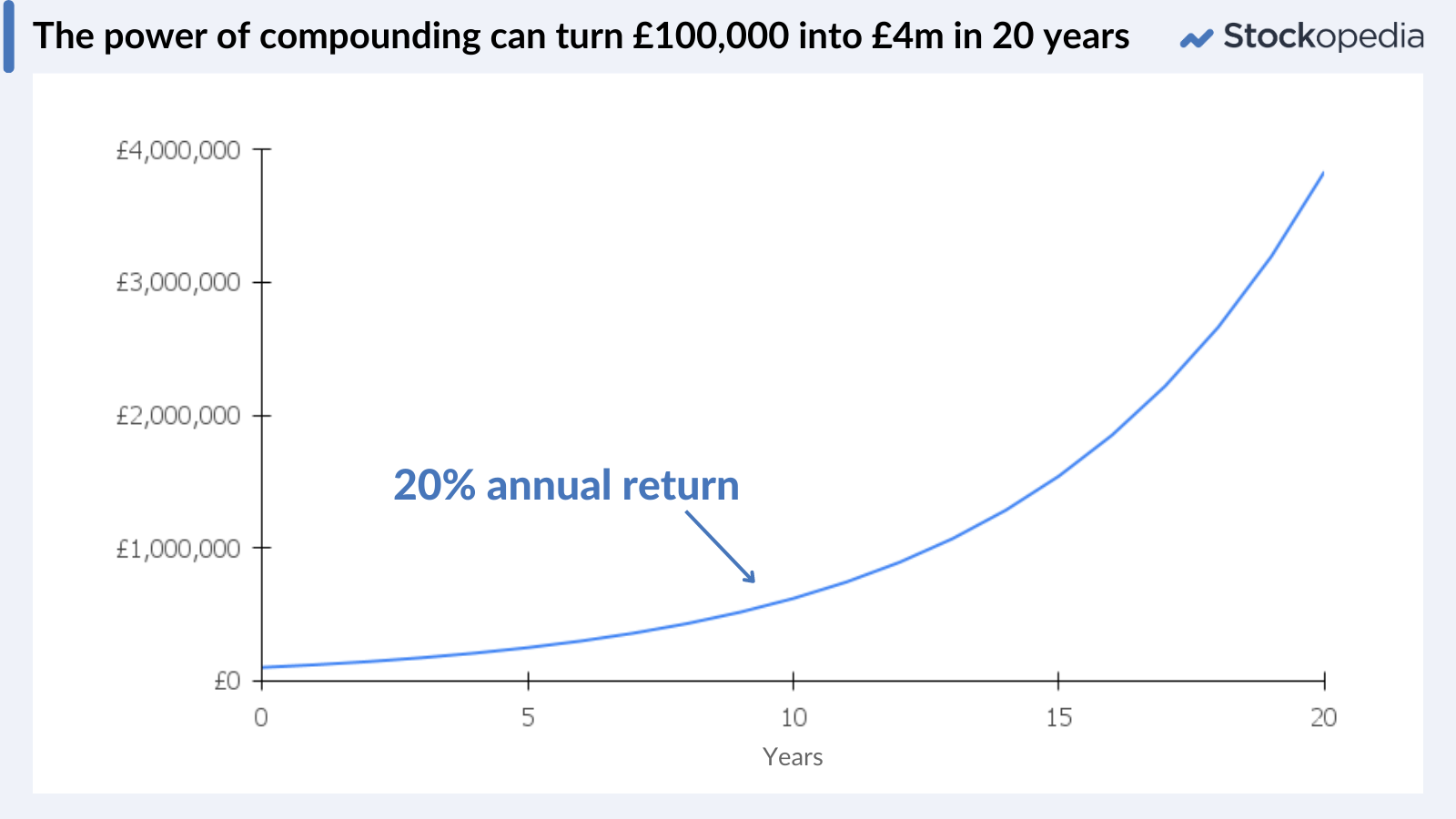

Earlier this week, Megan discussed the concept of quality compounding and explained why the power of compounding means that such businesses can sometimes outperform for very long periods.

In this piece, I’m going to convert the ideas Megan discussed into a set of screening rules and build a screen to try and find quality compounders.

Getting started with screens

I’ve been using Stockopedia’s screening tools for many years, but I suffer occasional pangs of fear when faced with an empty screen; where do I start?

Over time, I’ve developed a strategy that allows me to build the screen I want by following a series of simple steps. I find that the best way to start is by making a short list of the characteristics I’m trying to capture.

In this case, I’ve used Megan’s Compounding Quality guide to create a short list of requirements:

Minimum size

High returns on capital employed

Strong profit margins

Good cash conversion

Consistent revenue growth

Low levels of gearing

Now it’s time to start creating the screen. Stockopedia allows you to store up to 20 in your account, so there’s plenty of scope for experimenting. To get started, choose Screens -> New Screen from the sitewide navigation bar:

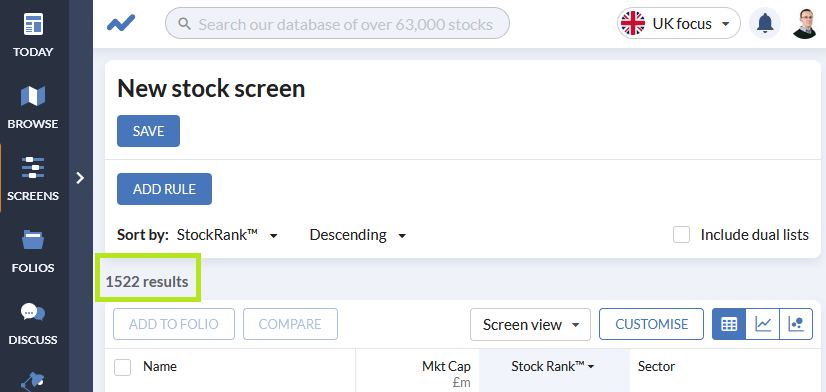

You’ll now be presented with a blank screen that’s ready for you to start adding rules.

Note the screen always shows the number of stocks that qualify at the top of the list of results (circled). I tend to keep an eye on this as I add rules, so I can see the impact of each change.

When you’re building a screen, the results list updates in real time. This makes it easy to see the impact of new rules and changes. Stockopedia’s screener is a really powerful tool, in my view – I couldn’t imagine investing without using screens.

Building the screen

For me, the first stage in any screen is defining my investable universe. Are there any stocks…