Given the acute schizophrenia flowing through the banking sector, investor portfolios need financial muscle & liquidity to get through these periods of intense volatility.

So where to look?

Well many of the world’s best companies are listed abroad. Yet equally receive very little attention in the UK, despite offering attractive returns and being relatively easy to access.

Therefore over the next few months, I plan to construct a ‘model portfolio’ of high conviction & importantly durable international stocks, which hopefully can deliver double digit returns over the medium-long term.

Here in today's first instalment, I introduce two such companies alongside running through:

Objective of portfolio. Start

What type of stocks to include. 02:50

Investing climate. 03:40

Attractive hunting grounds. 07:05

Targeted returns. 09:05

#healthcare . 11:10

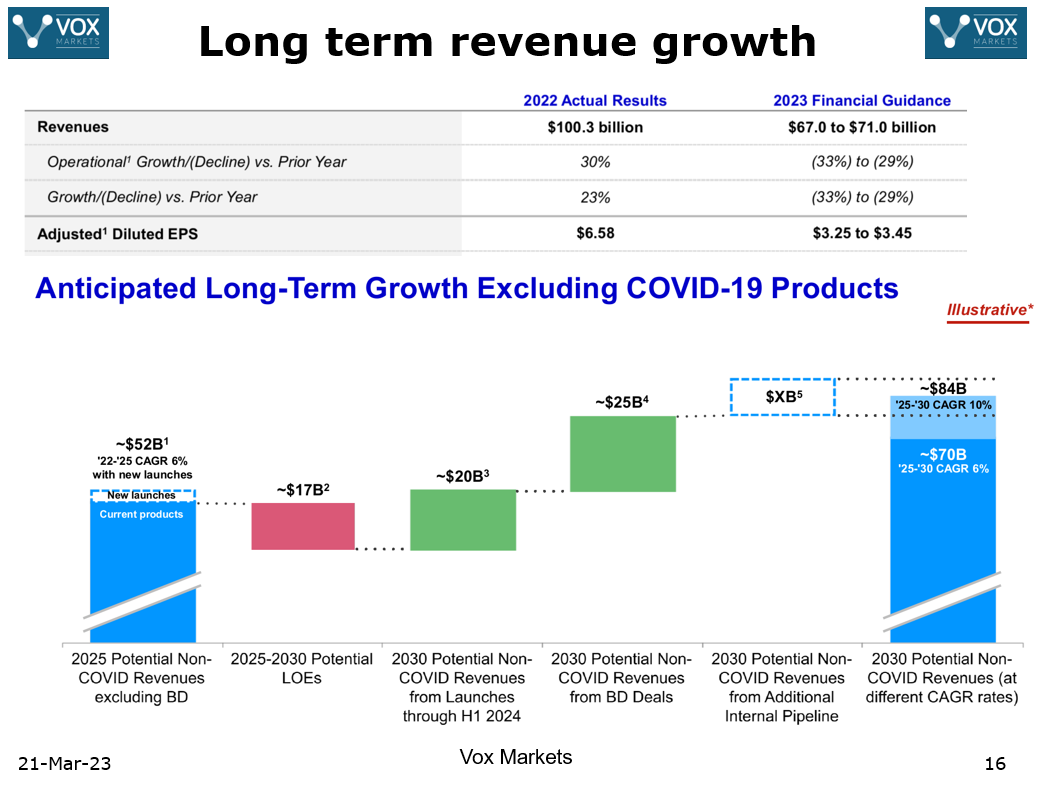

Pfizer. 12:55

Roche. 19:00

Disclaimer: I own both Pfizer & Roche Holdings

Great point BnB. ThermoFisher is a terrific company. Albeit I'm looking for a slightly cheaper entry point given its PER of >20x and PEG of 1.7x at $550/share