Terry Smith’s annual letter to investors in his Fundsmith Equity Fund has become something of an event. He’s opinionated, informed, and usually has something spicy to say.

This year’s letter came with an extra dose of anticipation, as we knew Smith would have to discuss why the Fundsmith Equity Fund fell in value and underperformed global equity markets last year. A rare event indeed.

Megan reviewed Terry Smith’s letter in depth recently, so I won’t repeat her comments here. But one idea from the letter that caught my interest was the possibility that the kind of quality companies Fundsmith buys are now more attractively valued than they have been in recent years.

Sure, the fund fell last year. But for long-term investors wanting to buy shares in quality businesses, falling share prices are often good news.

I started to wonder. If I tried to build a portfolio of UK shares Terry Smith might buy today, what might I end up with? Would they be companies I’d want to buy today?

I decided to build a stock screen to try and find out.

Reading the manual

One thing that Terry Smith and Warren Buffett have in common is that they don’t mind sharing details of their investment approach. Fundsmith provides an owner’s manual on its website that provides a very clear description of the kind of companies the fund buys, and the financial metrics on which Smith and his team focus.

To refresh my memory, I reread the owner’s manual and noted down the key criteria Fundsmith uses to assess stocks. I then checked the website for the fund’s current sector weightings and top holdings.

Finally, I looked at the table of portfolio financial metrics that’s always included in Fundsmith’s annual letter. This shows the weighted average financial characteristics of the fund’s portfolio, as if it were a single company. I’m a big fan of this technique, which Ed wrote about last year in “The perfect stock does not exist…”.

Source: Fundsmith 2022 annual letter

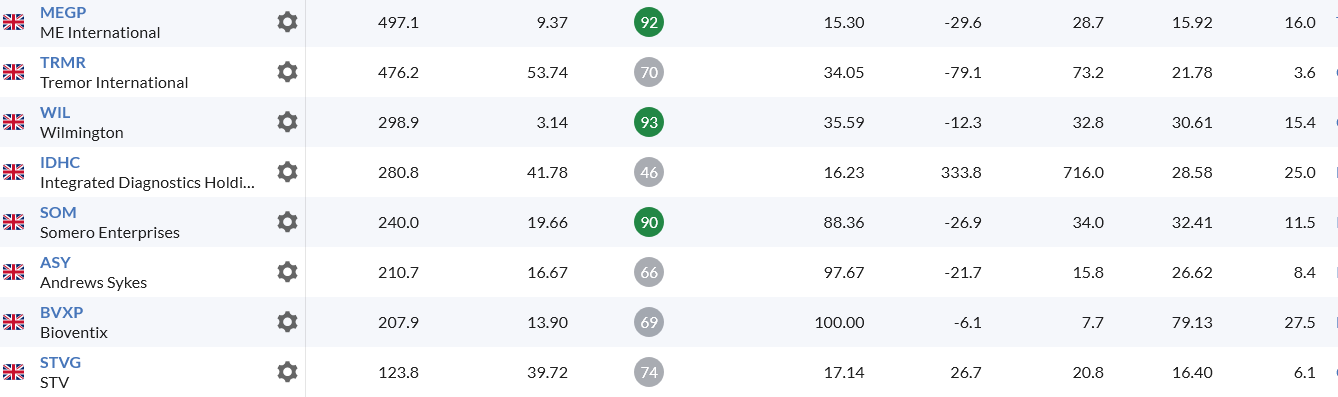

Armed with this information, I built a screen which I think highlights stocks Smith might consider, if he restricted his investment universe to the UK instead of investing globally.

Terry Smith screening criteria

Fundsmith’s stated investment…