“Luck is what happens when preparation meets opportunity.” - Seneca

Timing & opportunity matters. Preparation & patience matters.

That last one is probably the hardest of all to master, patience. Especially in trading with the ease of opening online brokerage accounts and trading with little training or experience.

In this post I'll outline when and how Nicolas Darvas built his fortune of $2,000,000 within 18 months in the late 1950's. For perspective, that's equivalent to $50,000,000 in today's money.

Firstly, you must understand something about the market. It moves in one of two ways, trending or non-trending. Simply put, the market is either moving sideways, up or down.

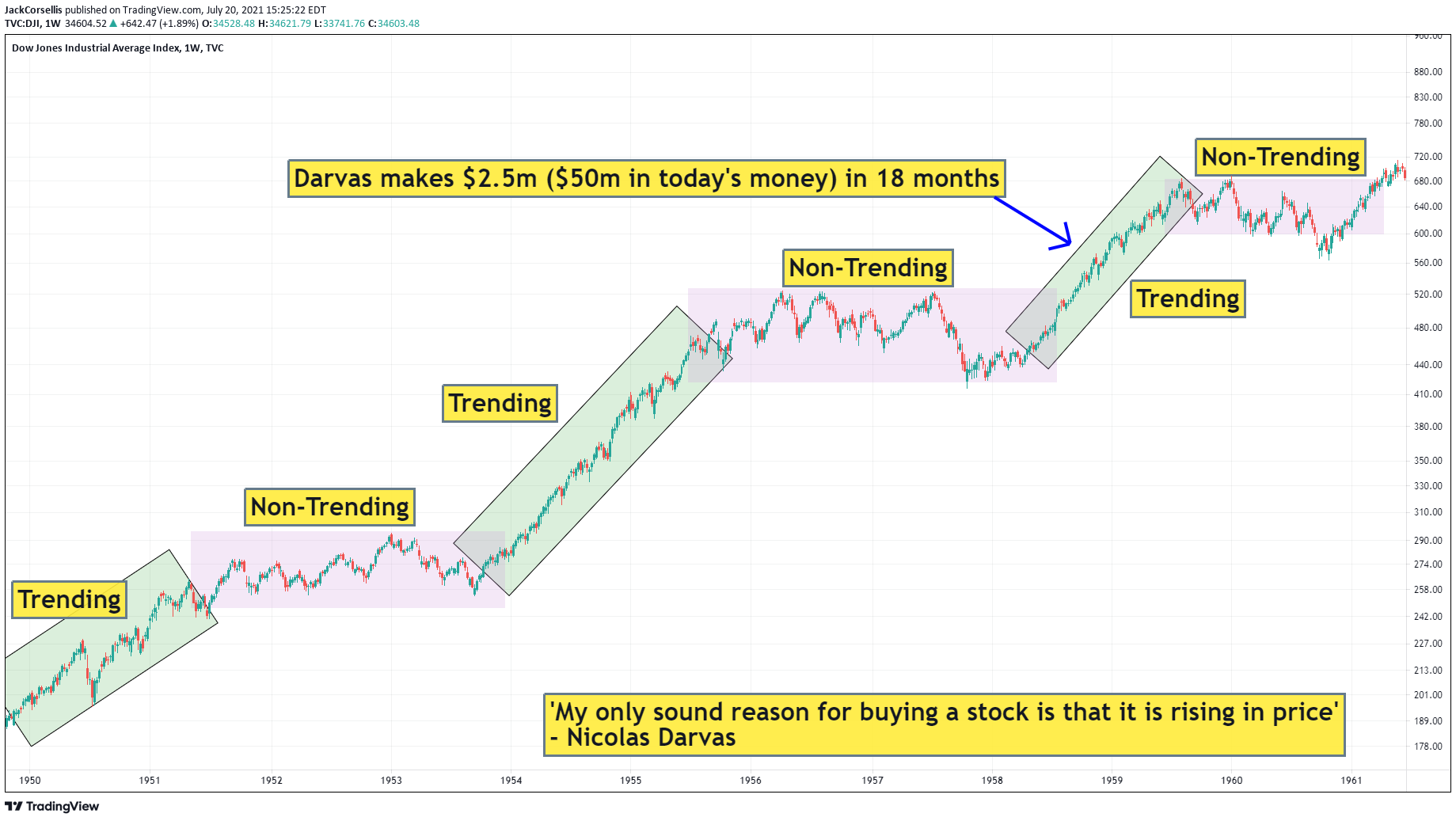

The chart below shows the Dow Jones and when Darvas made his fortune in the late 1950's. What do you notice about the market?

The market during this time was in a strong uptrend (green channel) as it transitioned from a sideways (non-trending) consolidation.

Great, so you now know what the market was doing when Darvas made his fortune - but what was Darvas doing?

Darvas had been studying the market for years before this point and paying his tuition fee (many losing trades spanning years) to Wall Street. I've never known or read about anyone making significant sums of money in the market without first paying this fee. Those will do make significant sums without first paying this fee, usually give it all back promptly... and then some.

During his tuition, which was a long period of preparation and patience, he learnt much of what not to do by experience. Some notable lessons being:

- Not to trade penny stocks;

- Never trade without a stop loss; and

- Don't snatch at profits, let winners run.

We can inverse these lessons to learn what rules Darvas implemented to make his fortune:

- Only trade the highest quality merchandise available (the leading stocks of the day with the strongest earnings and growth potential);

- Always trade with a protective stop loss; and

- Cut losses quickly and let winners run.

Now for the patience part. Do you think if Darvas had of applied those same rules he'd of been able to make his fortune several years earlier in a non-trending (choppy) market?

Personally, I don't. And the fact is he didn't. Why? Because timing matters. The market wasn't ready for his…