I thought that the H1 2021 update today was worth listening to. The CEO mentioned that the YPF case had passed a significant milestone in that the "Fact Finding" stage was now closed, which he explained was usually one of the large "Tentpoles" in a litigation case.

He expects a trial date around Q2 2022. A favourable outcome for Burford Capital (LON:BUR) would net them more than 50% of their current market cap in gains. It's worth noting that they have already made back their original costs for this case, so this is a pure profit play, and (in my opinion) a free "call" option for stockholders.

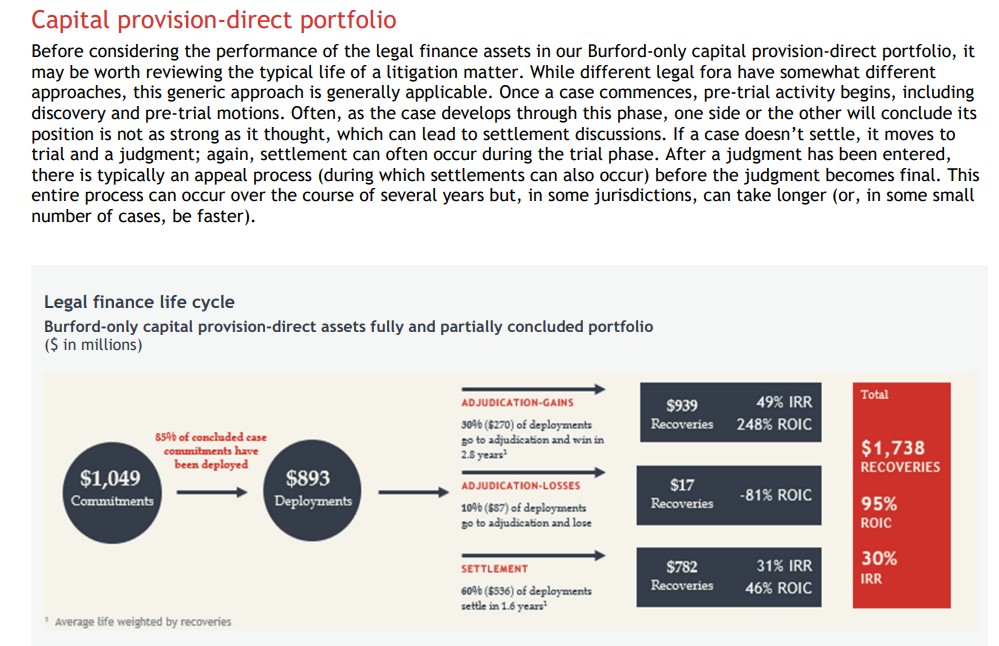

Its worth listening to the Chief Investment Officer as he talks through their historic completion statistics on their asymmetric nature of their risk reward. Its very rare to find returns like these without taking significant risks, but Burford Capital (LON:BUR) 's unique business model and risk management approach allow for it.

Also touched upon was their new largest deployment for an anti trust case against a large global tech company.

Other highlights can be found here:

As the biggest player in an expanding TAM, it's worth digging into this company and management. The stockopedia ratings really do not do it justice because the business model has erratic (but consistent and excellent IRR) returns due to the nature of the legal system. This is my no.2 position in my top 10 holdings, and I expect to be holding for a very long time.