I have great respect for the credibility of the Stockrank system and it is not a coincidence that >70% of my holdings have a SR>80. However, my single biggest holding Burford Capital (LON:BUR) is notably different with the lowest SR of all - Just 45. Worse it is classified as a “Momentum Trap” because of its strong M (100) and low Q (36) and V (14) scores. Yet it has been my best preforming company by a mile.

It’s not only the SR that take a cautious view of BUR because broker forecasts have repeatedly underestimated Burford Capital (LON:BUR) earning potential. Today’s H1 earnings announcement has again surprised to the upside and the house broker has upgraded its full year EPS by +74%, adding that they are unsure how to value the company.

This strengthens my view that it is important to look at a company as a whole and consider news, growth potential and its metrics. As ever please DYOR. Ian

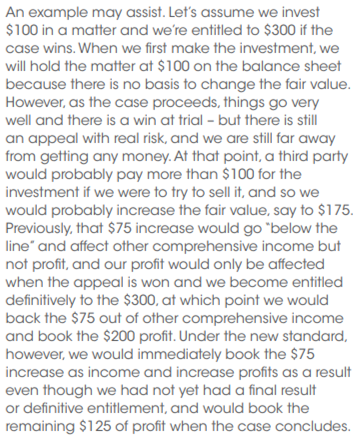

I do think that Burford Capital (LON:BUR) are as conservative as the accountancy regulations allow them to be in recognising income. I think the CEO would prefer not to book any income at all until the cash has been received as he is very aware of and frequently emphasises the point that nothing is certain in their business until the other side has actually paid up.

They hold their investments at their sunk cost until they have a legal basis for writing them up such as an offer to settle, winning a case, winning an appeal etc.

The CEO said in the recent results call that they have only ever written down the value of two investments that they had previously written up.