I have great respect for the credibility of the Stockrank system and it is not a coincidence that >70% of my holdings have a SR>80. However, my single biggest holding Burford Capital (LON:BUR) is notably different with the lowest SR of all - Just 45. Worse it is classified as a “Momentum Trap” because of its strong M (100) and low Q (36) and V (14) scores. Yet it has been my best preforming company by a mile.

It’s not only the SR that take a cautious view of BUR because broker forecasts have repeatedly underestimated Burford Capital (LON:BUR) earning potential. Today’s H1 earnings announcement has again surprised to the upside and the house broker has upgraded its full year EPS by +74%, adding that they are unsure how to value the company.

This strengthens my view that it is important to look at a company as a whole and consider news, growth potential and its metrics. As ever please DYOR. Ian

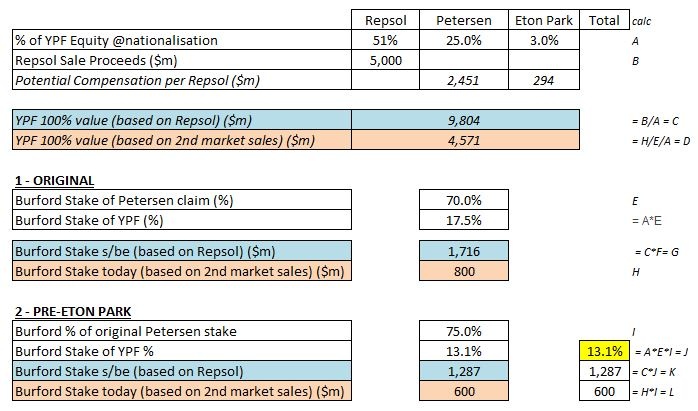

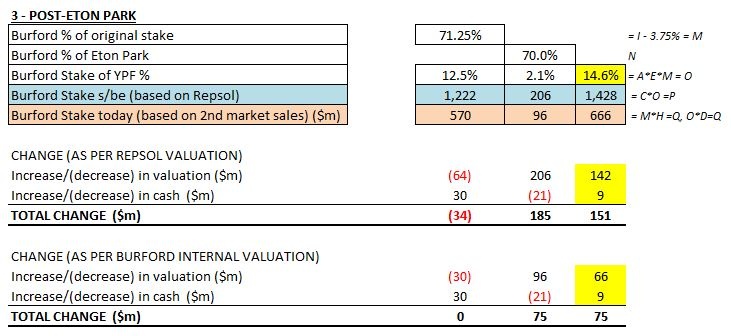

Since I don't have access to Numis' notes, it's impossible for me to see what their rationale is. Liberum (TP 1689p) and Hardman (no TP, sponsored research) attribute no extra value to the big Argentine case (Petersen) which might be viewed as an exceptional, and is only partly recognised in the accounts. Jefferies at 1747p and Berenberg at 1690p are the others I'm aware of.

The Petersen case is, of course, potentially huge, so why does it drag on so? After all, it seems currently to be stuck in the question of whether it's to be heard in NY or BA. Given Argentina's wish to become a normal member of the world community, yet struggling under debt and inflation, I suspect negotiations are underway upon a settlement whereby the assets are transferred back rather than a financial settlement agreed ("several billions" USD). That would leave Burford with a significant holding in one of the world's biggest fracking fields!