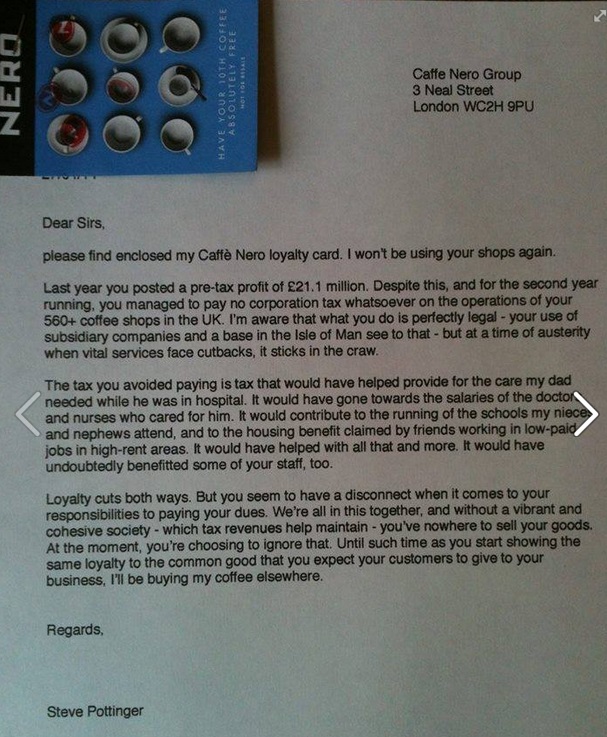

There is a well-written letter doing the rounds on Facebook written by someone called Steve Pottinger, in which he returns his Caffe Nero loyalty card to the company, saying that he will not be a customer any more, due to the fact that the company made a profit of £21.1m, yet paid nothing in Corporation Tax (the UK's tax on company profits, currently charged at 21% of profits).

There is a well-written letter doing the rounds on Facebook written by someone called Steve Pottinger, in which he returns his Caffe Nero loyalty card to the company, saying that he will not be a customer any more, due to the fact that the company made a profit of £21.1m, yet paid nothing in Corporation Tax (the UK's tax on company profits, currently charged at 21% of profits).

Groups like "Occupy" have been vocal about tax avoidance in recent years, and rightly so in my opinion. It's a disgrace that international companies treat corporate tax as optional.

Of course it's also a disgrace that the tax system is so riddled with loopholes that it is possible to structure corporate affairs in such a way that tax can be avoided.

However, what interests me is whether we can get to a point where consumer pressure & boycotts do so much damage to companies which engage in aggressive tax avoidance, that they are forced through self interest into paying their fair share in tax? This is an interesting way in which people power, through the internet, could change things for the better.

Some people think that tax avoidance is laudable. I think that is perverse. How on earth are we going to pay for schools, hospitals, and everything else, if everyone is trying to wriggle out of paying their fair share? A social conscience is important, and more people need to develop one. Equally, the tax system needs to be reformed so that opportunities to avoid tax are eliminated.

Anyway, I have often found that previous Occupy campaigns have been ill-informed, e.g. they don't understand the basics about companies being allowed to carry forward tax losses from previous years, etc. Therefore I decided to do a little digging on Caffe Nero's accounts, to see if Steve Pottinger's letter to them is justified or not.

I downloaded the accounts for Caffe Nero Group Ltd (co. no. 4129005), which are clearly the main group accounts for the UK operations of Caffe Nero - the registered office is 3 Neal Street, London, and the principal activity is given as the operation of 519 Caffe Nero branded stores in the UK.

As you can see from the group statement of comprehensive income below (the P&L basically), this group paid nil corporation tax in…