Avanti is communications company operating satellites. Currently they have 4 operational (ARTEMIS, HYLAS 1, HYLAS 2, HYLAS 2-B) with plans to launch 2 more in 2017 (HYLAS 3 & HYLAS 4).

They have been heavily loss making so far but promise rapid growth that will deliver profitability to the company in the future:

‘…management expects cash generation to grow swiftly as revenues exceed Avanti's largely fixed cost base.’ Q1 2016 Trading Statement

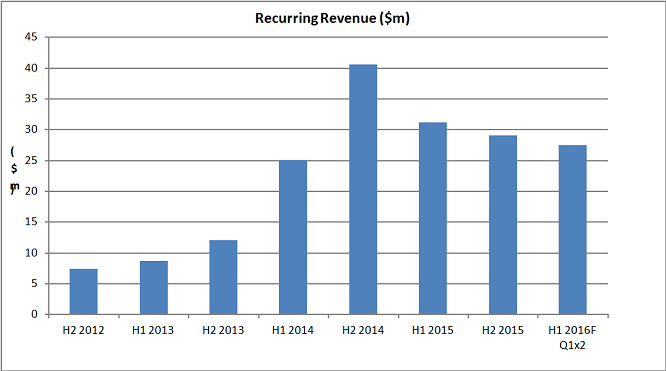

Things were going well on this front until H1 2015 when recurring revenue started to drop. (H1 2016 is estimated by doubling Q1 2016 revenue.)

[Note: H2 2015 showed a non-recurring revenue boost of 25.1m related to the sale of spectrum rights. However since the notes to the cash flow statement show this as a net cash cost to Avanti of $25.1 it seems fair to exclude this as revenue.]

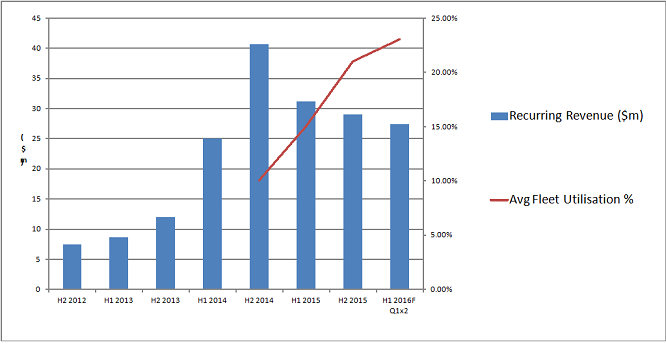

This sort of drop off in revenue can mean one of two things. Either customers are using less of £AVN ’s services, or they are paying less for them. This is what Avanti Communications (LON:AVN) say on this topic:

‘Average Fleet Utilisation was at the upper end of the 20% to 25% range during the period’ Q1 2016 Trading Statement

‘Avanti's average pricing remained stable.’ Q1 2016 Trading Statement

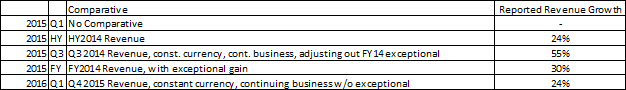

‘This was lower than Avanti's prevailing run rate of growth, due to a larger amount of equipment and government revenue in the previous year, which, although recurring, tends to be recognised on a non-linear basis.’ Q1 2016 Trading Statement

‘Avanti's Fleet Utilisation was within the 20% to 25% band at the end of 2015, having increased from the 10% to 15% range in the prior year.’ 2015 FY Results

Based on these comments I’ve added estimate of the utilisation to the revenue graph :

So it seems that data rates are stable but

customers are paying less for £AVN’s equipment or value added services meaning

that rapidly increasing utilisation is not turning into increasing revenue.

What is interesting is to scale up the Q1 2016 revenue to get the maximum theoretical revenue at full utilisation as Avanti suggest we do in their 2015 annual report:

If we take 23% as ‘the upper end of the 20% to 25% range’ then based on the Q1 2016 revenue of $13.6m at the current pricing the maximum theoretical revenue…

.JPG)