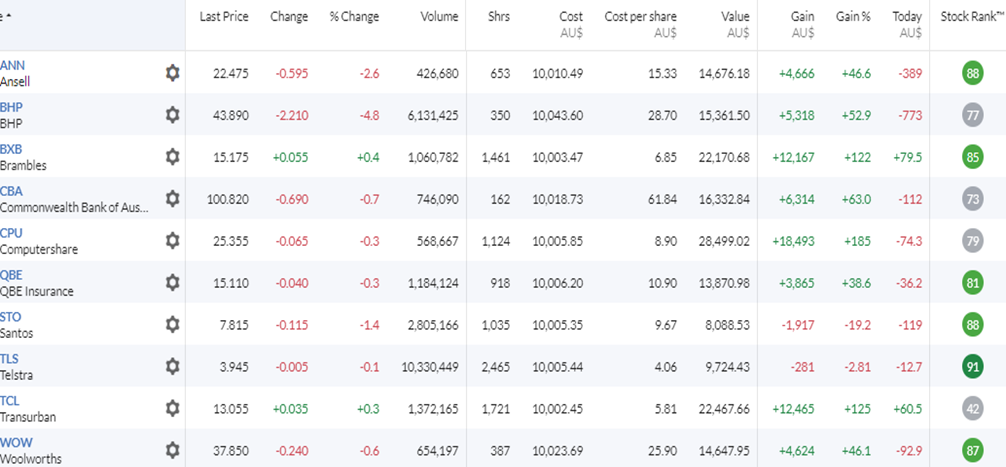

The theory is that you hold gold stocks in your portfolio to help manage risk and reduce volatility. To test this theory using one method, I picked 10 ASX200 stocks at random and gave them a 10% weighting in a portfolio of $100,000. Over the timeframe these weightings will change as the portfolio is passively managed with no rebalancing to ensure the original 10% weightings was done. I tested the theory with two different gold stocks: Newcrest Mining (ASX:NCM) and Evolution Mining (ASX:EVN) and used 0%, 10%, 20%, and 30% weightings to see how holding a gold stock in a portfolio would change the performance. The timeframe for the example is 10-years and 9-months, so from 1st Jan 2013 to 1st Sep September 2023 and only capital growth was measured.

Portfolio:

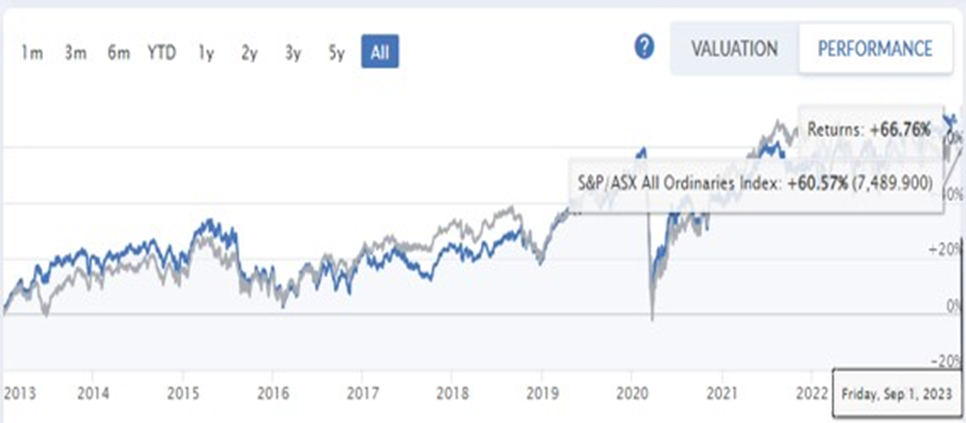

Portfolio 0% Gold Weighting:

Blue line Portfolio

Grey line ASX All Ords

NCM: Portfolio 10% Gold Weighting:

NCM: Portfolio 20% Gold Weighting:

NCM: Portfolio 30% Gold Weighting:

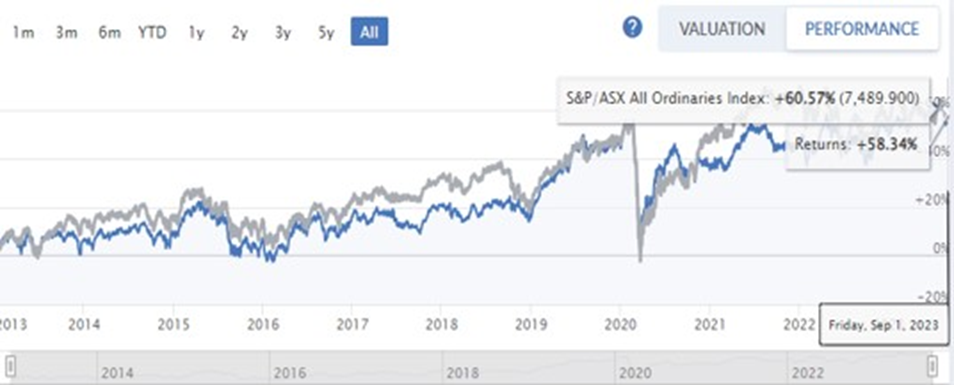

EVN: Portfolio 10% Gold Weighting

EVN: Portfolio 20% Gold Weighting

EVN: Portfolio 30% Gold Weighting

Looking at the above examples, the portfolios holding NCM generated significantly lower capital returns than the portfolios holding EVN and based on how the blue line of the portfolios tracked the ASX All Ords grey line during periods of high market volatility; it would appear on face value holding an individual gold stock in a portfolio in a passive way to reduce risk and volatility does not add much protection to a portfolio.

What I take away from this is that a diversified portfolio is a great way to manage risk, limit losses, preserve capital, while still generating capital growth and income over the long-term.

An exaggerated way to look at it is, if it was an investment of $100,000 in EVN over…