A recent MoneyWeek survey found that Investment Trusts are the second most popular investment in the UK after regular stocks and shares. Trusts are even more popular than mutual funds with UK private investors. Many readers will therefore be pleased to learn that we plan to provide more in depth analysis of UK Investment Trusts at Stockopedia.com as we go forward.

A key feature of our coverage will be a ranking system which seeks to identify Investment Trusts that have a higher probability chance of beating the market (ie. a TrustRank). We’ve already started to research the datapoints to include in a TrustRank. We thought we’d share our initial findings with you and throw it open to debate.

What is an Investment Trust?

Before getting into the nitty gritty, let’s take a moment to understand what Investment Trusts are. Investment Trusts (also known as closed-end trusts) are publicly traded companies, but while companies like Apple make money by selling phones, and firms like HP sell printers, Investment Trusts make money by investing in other companies.

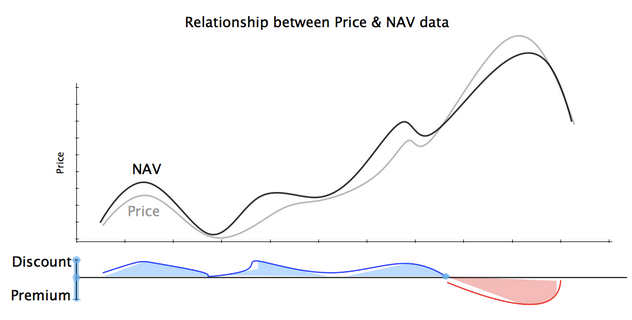

Trusts build portfolios of stocks, bonds and other investments (eg. property). In a nutshell, if you take account of liabilities, and divide the value of a Trust’s portfolios by the number of shares the Trust has issued, you get the Net Asset Value, or NAV (see below).

NAV = Trust’s Assets - Liabilities / Number of Shares the Trust has issued

However, because Trusts are publicly traded companies, their share price is determined by investor sentiment and the forces of market supply and demand. This means that share prices can become lower (or higher) than the NAV, creating opportunities for investors to buy Trusts at a discount (or premium) to the NAV (ie. the assets and investments which Trusts own). Is the mismatch between the NAV and the share price a dream come true for value investors…?

Cheap beats expensive

Benjamin Graham, the father of value investing and tutor of Warren Buffett, was amongst the first to notice that the value effect can work for Investment Trusts. He advised that 'if you want to put your money in investment funds, buy a group of closed-end shares at a discount of, say, 10% to 15% from asset value.' Why? Trusts trading at a discount tend to beat Trusts trading at a premium, at least over the…