The best two performing guru searches since inception are both growth investing searches. I also really like Mark Minervini`s approach who I also believe would concentrate on growth, quality and momentum. Value is not so relevant if you are a trader as you can always account for value by just setting a stop loss.

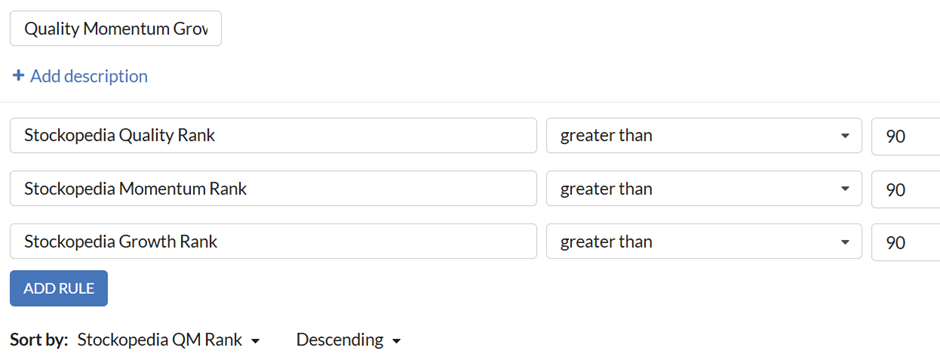

So I created a Quality Growth Momentum search (QGM) where you simply ask for Quality, Growth and Momentum to be greater than 90 and then sort it by either Quality Momentum or Growth Momentum.

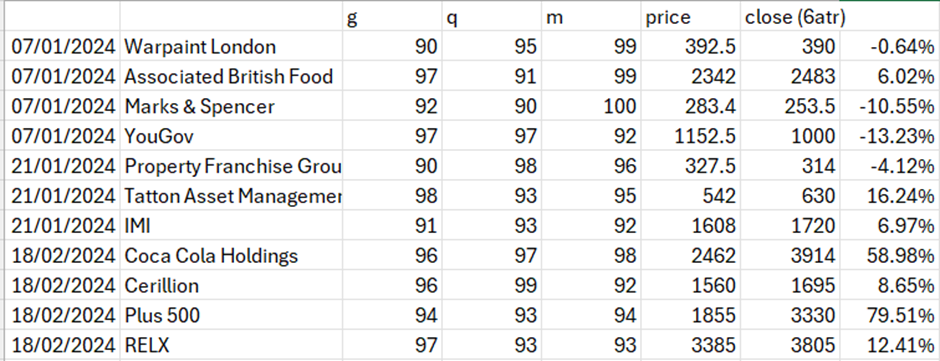

I downloaded some data at 3 points in January and February 2024, so how has this search done, if I traded it with a simple stop loss of 6 times average true range.

On average the search produced a return of 14.5%, though Coca Cola Holdings and Plus500 are still being held. YouGov was a spectacular failure hence the need for a stop loss. Marks & Spencer was probably a little overbought on 7th January, though I only have 3 data points, so it may well have triggered prior to this date, or if I just waited a few days then I could have got a fair entry and another reasonable return until January 2025. An ATR stop loss may not have been the best exit method for Warpaint London or Property Franchise as early in 2024 there were days when it hardly moved at all, so the stop was too tight.

Obviously it would have been better if I`d set up a folio for this approach and recorded how it did, and then replaced the shares which were stopped out. I will try and do this in future, but I think these are quite good results for a trading approach, so thought I would share these here, as it does demonstrate growth and momentum can be combined to produce a reasonable return.