See part one here: this leads directly on.

Introduction

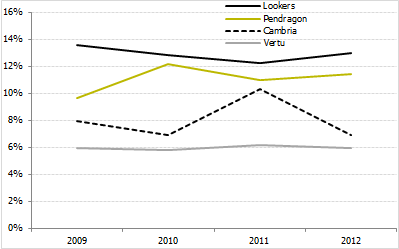

I finished part one, after a brief introduction and a discussion of the industry, with a soap opera-esque - ok, perhaps not quite that good - cliffhanger relating to returns on capital. I'll reproduce the graph and the question just below, since it very nicely sets the scene for this post:

The most important point is, of course, returns on capital. What does the company do with my money inside the business? How well does it use it? Lookers uses it very well indeed - they earn consistently higher returns on capital than their competitors, even while acquiring (you might expect it to take a while for big acquisitions to get 'firing' and drag down returns in the interim). Vertu's lowly valuation in asset terms is also explained - its returns on capital sit stubbornly at a rather low 6%...

... My next post will focus on that big question, then. What really separates the performance of these businesses, and where are they likely to go?

It's a lofty ambition - as investors we're used to dealing with rather incomplete information, as we scavenge what we can from financial statements and use our intuition to try and make informed investment decisions. We can never be 100% sure of our conclusions, of course, but with the inherent unpredictability we can never hope to be. Rather, we can look at the past to inform us toward what will happen in the future. The structure of this post is all about teasing ideas from the data we have. So, without further ado.

The DuPont Identity (or, at least, a warped version)

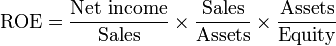

The DuPont identity is a useful formula for investors because it helps us break down exactly where companies differ. Stated mathematically, and shamelessly pulled from Wikipedia, here it is:

For those who turn off at the sight of maths, and I count myself as one of those, it really is pretty simple. The right hand side of the equation can be stated in more colloquial terms:

Net income/sales: Net profit margin Sales/assets: Asset turnover - how many £ in revenue is derived from £1 of company assets Assets/equity: Financial leverage - how much debt the company is using to finance its operations.

These are essentially the three ways a…

.png)