Castleton Technology (LON:CTP) Final results out today look positive

This is a good summary from Dean Dickinson, CEO of Castleton, :

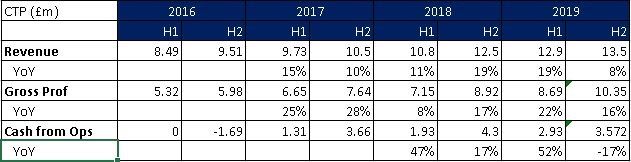

"It has been another year of significant progress for Castleton, delivering strong organic growth at both revenue and EBITDA level underpinned by healthy cash generation. This has not only resulted in the continued reduction in net debt, but it has also enabled operational growth through the acquisition of Deeplake

(Earnings per share at a basic level were 5.08p, compared to earnings per share of 5.23p in the previous year)

I also noticed that a maiden (first) dividend of 1p per share has been announced - its good to see the start of Dividend payments and is usually a good sign

Not sure about this line

The one area that has not yet lived up to our expectations is our Australian Operation (reported within our Software Solutions division) - we have taken action to address this, but it has had a slight impact on our outlook for next year.

Also...

Trading since the end of the financial year has been in line with expectations and we expect to see seasonality between the two halves of the financial year, with earnings and cash flows being stronger in the second half than the first half.

Why is it that so many companies are H2 weighted?? Is this just them being optimistic that they can recover lacklustre progress in the first half? We seen this recently with Filta Group (LON:FLTA) and the market didn't like it...