I attended the Ceres Power Holdings (LON:CWR) AGM earlier today, having been a modest holder for a few years.

Ceres Power is a UK based developer and licensor of solid oxide fuel cell technology. The company was spun out of pioneering research by Prof. Brian Steele at Imperial College and continues to develop and license significant world leading IP in the form of patents and trade secrets.

As an investment this is all about the future potential. It has a market cap of £357m and produces no profit. Any dividends are probably four or more years away. It has a StockRank of 27 and is classed as a Momentum Trap. So if that rules it out for you, move on now!

Fuel cells convert fuels such as natural gas or hydrogen into energy by combining them with an oxidant. If the cells are fuelled by hydrogen, the only products are energy and water - zero carbon power if the hydrogen is produced renewably. Ceres products can operate today on natural gas and switch over to hydrogen seamlessly as and when a hydrogen distribution network is built. Therefore after many years in development the technology and the company find themselves at the heart of addressing global concerns. Ceres themselves say they are surprised by the strength of interest and demand. Targeted markets include static Combined Heat and Power systems for data centres and other large buildings, range extender systems for buses and HGV’s, and EV charging stations. The solid oxide fuel cells are relatively heavy but cost effective to produce, being made from commercial grade steel and ceramics without any precious or scarce materials. They can complement renewable intermittent power generation, being suited to a decentralised grid and offering greater overall efficiency than traditional centralised gas turbines.

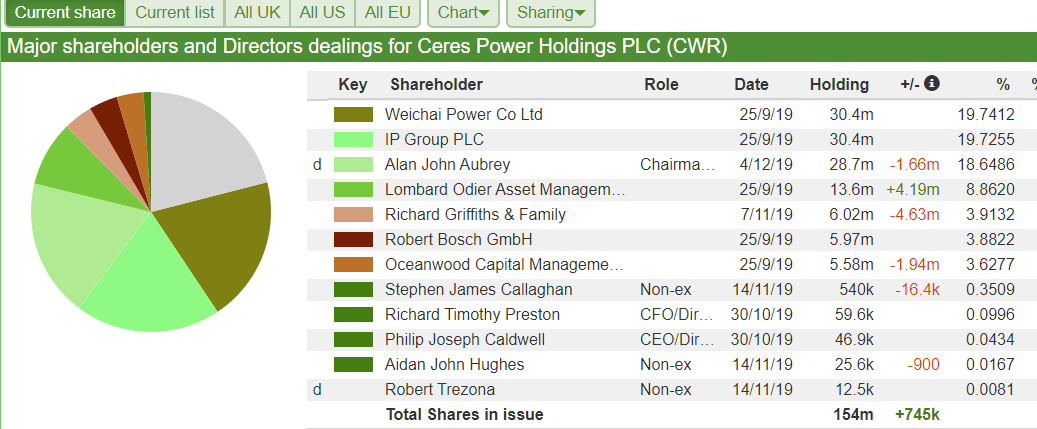

The business model is a licensing one. Ceres develop and license their technology to top-tier global partners like Bosch, Cummins, Honda, Doosan in South Korea, Weichai Power in China and Miura in Japan. To date they are loss making, although revenues have recently been doubling year on year and the losses are reducing. Income so far comes from joint development work with prospective partners and fees for technology transfer. Gross margins are around 50% for that work. As those partners move into production Ceres anticipate an inflection point in 3-4 years when they will be earning significant royalties at little…