I have been reading with great interest the excellent "Strategy Map series" written so eloquently by both Ed Croft and Megan Boxhall,

As with all of Ed and Megan's articles, they are thought provoking and most importantly, lift us out of the day-to-day market noise to get us focused on investment strategy, rather than the daily claw scratching which can command so much of our time.

In order to access the entire series (great reading over the weekend AND MORE!) here are the links:

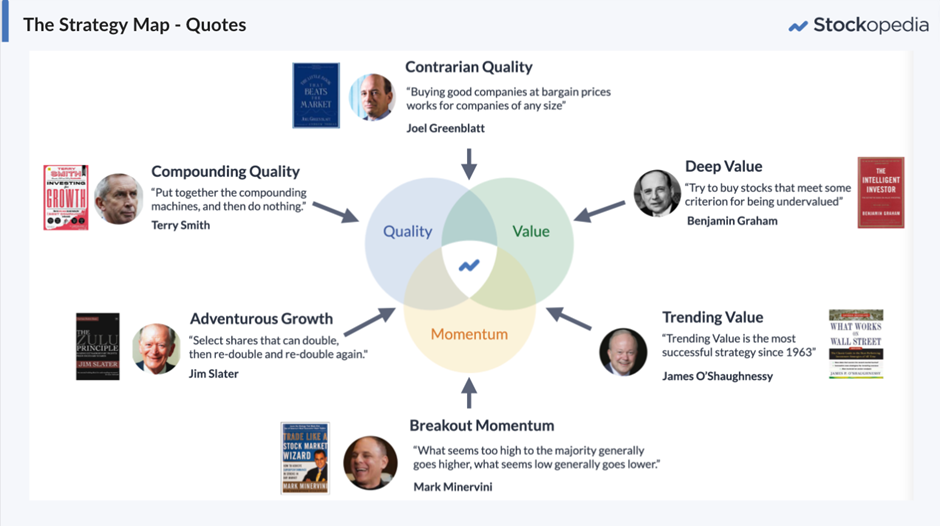

- Intro to the Strategy Map

- Compounding Quality

- Deep Value

- Contrarian Quality

- Breakout Momentum

- Trending Value

- Adventurous Growth

In one of the more recent contributions, Ed discusses the concept of "Trending Value" - the "strategy for opportunistic bargain hunters." I thought I would use it for inspiration for my latest contribution to the AFR (to be published next week) though I would like to share it with you now. The article covers much of what Ed says, however it adds a slightly local flavour to it plus also coloqualises some of the more complex concepts. Enjoy the read.... but please spend some time over the coming week to read each of Ed and Megan's contributions.

Chasing the perfect cheap wave - finding “Trending Value” stocks.

Buying stocks low and selling them high is a primal pursuit for investors. The reality for many trying to find deep value stocks is that it takes work, requires a keen interest in financial accounting and requires immense internal fortitude to maintain unwavering conviction, irrespective of how volatile price is.

Without getting into too much detail on how to identify deep value (editor note: read this article from Ed on the subject), the underlying premise is to buy into stocks trading at discounts to their intrinsic underlying value. These will be stocks often ignored by the market because they are either too small or have had / are having operational issues.

Value investors try to identify the price/value disconnect. As price often moves between over enthusiasm and over pessimism, the Value investor knows the true value is somewhere in between. So a stock viewed over pessimistically, through the passage of time and business improvement, will eventually revert back to a fair (intrinsic) value.

There are obvious risks when trying to identify value. The first, and most obvious, is that…