City Of London Investment (LON:CLIG) is a pioneer in the Emerging Market closed-end fund (CEF) space. Its long term outlook, consistent investment processes and proven track record of outperformance has attracted a stable base of institutional clients and fund inflows over the years.

Following great success in the early 90s as an emerging market specialist, CLIG used its CEF knowledge to expand into other areas. Today, the group markets five CEF strategies:

- Emerging Markets CEF - the original CLIG product that has been marketed for decades

- Frontier Markets CEF - an extension of the EM core equity product that focuses on the smallest or pre-emerging markets with high growth potential

- Developed Markets CEF - targeting global developed markets

- Opportunistic Value - a global, bottom-up, high-conviction fund

- Tactical Income - a multi-sector fund focused on generating tax-efficient income for US investors

On top of this, CLIG launched two Real Estate Investment Trust products in January 2019 that focus on emerging market and global REITs.

Given last year’s stories of star fund managers and style drifts, it is reassuring to hear CLIG discuss its investment process:

We have always strived to develop and nurture an investment process which does not rely on 'star' fund managers, but rather upon a series of analytical procedures that can produce repeatable and sustainable first or second quartile performance versus our peers.

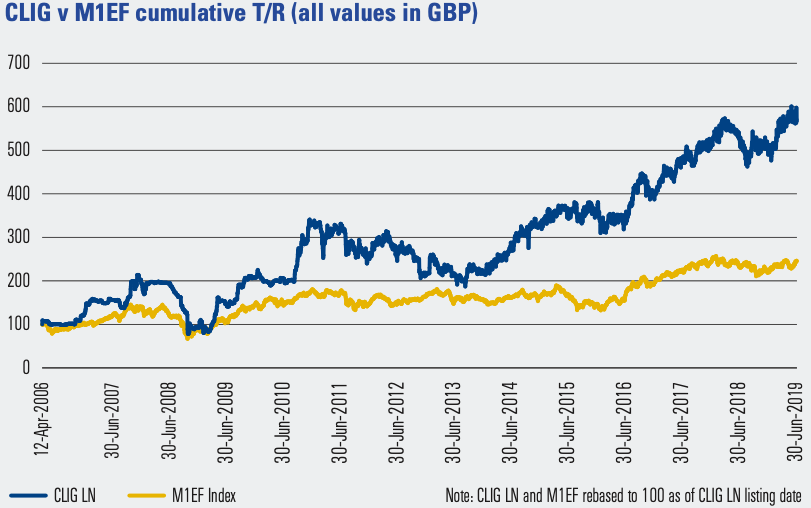

This process seems to work. According to the company, CLIG’s cumulative total return since inception through 31st December 2019 was 540% (14.5% per annum) compared with the 152% cumulative return for M1EF over the same time period.

Source: FY19 Annual Report

Given the group’s process-driven multi-decade investment track record, its shareholder-friendly corporate culture, modest valuation and strong quality metrics, the early signs are promising that CLIG could be a good long term investment.

Valuation

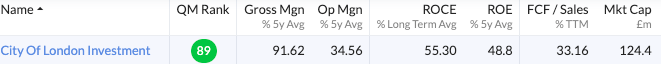

CLIG is a small cap financial Super Stock with extremely high levels of long term profitability and returns on capital.

It also generates a lot of cash and pays out a generous forecast dividend yield of 6.25%. Management has an encouraging attitude towards shareholders as shown in the Chairman’s Statement of the FY19 Annual Report:

Your Board attaches great importance to providing shareholders with a generous but stable flow of dividends, balanced by a policy of prudential capital management.

The group has established a solid history…

.jpg)