Colefax (LON:CFX) is a company that's been on and around the radar for a few years; I know Richard Beddard took a plunge a while back, and I recall vaguely giving them a once over way back when the Victoria debacle was going on, as I wondered how similar the companies were. Not that similar, I should hastily add, though I suppose they're in the same loose vein of work. Colefax are a producer of high-end fabrics and wallpapers - take a quick look at their website if you want a general idea of what sort of stuff we're talking about. Given the curtains look about twice as tall as I am, I fairly readily surmise I'm not exactly their target market, anyway..

Colefax (LON:CFX) is a company that's been on and around the radar for a few years; I know Richard Beddard took a plunge a while back, and I recall vaguely giving them a once over way back when the Victoria debacle was going on, as I wondered how similar the companies were. Not that similar, I should hastily add, though I suppose they're in the same loose vein of work. Colefax are a producer of high-end fabrics and wallpapers - take a quick look at their website if you want a general idea of what sort of stuff we're talking about. Given the curtains look about twice as tall as I am, I fairly readily surmise I'm not exactly their target market, anyway..

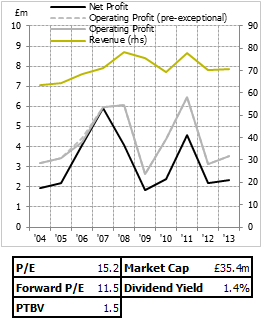

Those characteristics - high-end, lower volume and higher margin products - seemed to insulate them reasonably well during the recession, though not completely. The company has made a profit as far as back as the annual reports on their website go (12 years), and while the peak boom years of 2007 and 2008 do represent the real highlights of the company's performance, the performance on the whole is pretty resilient. Resilient but unexciting, it's probably fair to say, as revenues over the last 10 years have increased an underwhelming 10% (presumably volumes are down given inflation), hitting a peak of just over £78m in 2008.

Two questions immediately jump to mind, then, as possible points of interest. Firstly, do we expect revenues to recover? Are the revenue declines simply recessionary? Given the nature of their product offering (i.e. premium), I don't mind hypothesising a recessionary dip that'll come back up when consumers start spending a bit more freely. I'm hesitant to do that with undifferentiated, volume-driven goods which can be easily substituted among competitors, since volume gains usually get eroded by margin declines as competition works its magic. Secondly, what have returns done over the last 10 years? Do we see a trend? This hints at the competitiveness of the business as a whole.

On revenuesThe majority of the revenue decline seen in the business, by nature of the way they operate, comes from the US. That's where the group sells most of their fabrics, and the company noted in their…

.png)