I bought Communisis (LON:CMS) after much dallying back in 2011, a choice that's proven to be rather fortuitous - the share price has roughly doubled in that time as the business has gone from strength to strength. Investor opinion on Communisis seems to have shifted from it being a unspectacular company in a dead-end industry to being an exciting multi-channel growth prospect. Frankly, the drivers of the revaluation of the business weren't really ones I fully grasped at the time, but in hindsight I think this was another case of the headline figures hiding the real growth prospects. The bulk of revenue coming from direct mail made the marketing and communications business as a whole look decidedly old hat, and disguised the fact that the newer, integrated segments are actually both extremely profitable and very fast growing.

I bought Communisis (LON:CMS) after much dallying back in 2011, a choice that's proven to be rather fortuitous - the share price has roughly doubled in that time as the business has gone from strength to strength. Investor opinion on Communisis seems to have shifted from it being a unspectacular company in a dead-end industry to being an exciting multi-channel growth prospect. Frankly, the drivers of the revaluation of the business weren't really ones I fully grasped at the time, but in hindsight I think this was another case of the headline figures hiding the real growth prospects. The bulk of revenue coming from direct mail made the marketing and communications business as a whole look decidedly old hat, and disguised the fact that the newer, integrated segments are actually both extremely profitable and very fast growing.

That is, I suspect, no longer a problem. Even just reading the media coverage you get a sense of a company which is now viewed in a different way; FT coverage opined that 'its universal approach and trusted brand - after years of printing cheque books and regulated financial material' helped to contribute to some of the recent success. Of course, this is all secondary and largely irrelevant. The one truest indicator of popular opinion is the market price. At least by the simple metrics, Communisis surely isn't looking as cheap any more; so my question is, after their results a couple of days ago, is there further to run or are we approaching the hopeful growth price territory?

The results

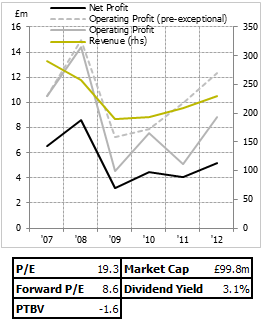

It's easy to see why there's a bit more interest given the results - operating profit is up 23% pre exceptional, margins continue their upward march and now sit at 6.5% (the CEO reckons they can get 10% in a few years) and headline revenues are up 10%. There's good specific tidbits, too - overseas revenue and revenue from non-financial services companies are both up, which might indicate a stronger business as both of these represent diversification away from their core. If you're wondering about future growth, management give a hint as to their opinion on that with their recent capital raising - they raised £20m gross in a share issue, which apparently will be used for 'restructuring costs, small acquisitions and working capital'.

Given the returns…

.png)