Last post, I looked at Communisis (LON:CMS) as an investment over the last couple of years - and why it's been so successful, as both a company and a share. Those two don't necessarily go hand-in-hand; the performance of any investment you make isn't just contingent on the performance of the operations underneath it all, but also on the price you purchase at. I concluded that, among other things, one of the key factors was the way the business had fundamentally changed (they were shifting to more advanced technology) while still appearing the same, a factor I think a shrewd investor might have been able to identify. There was, however, also a good deal of more intangible stuff - management have clearly performed well, for instance - that is perhaps harder to ascertain simply from the documents on their website.

Last post, I looked at Communisis (LON:CMS) as an investment over the last couple of years - and why it's been so successful, as both a company and a share. Those two don't necessarily go hand-in-hand; the performance of any investment you make isn't just contingent on the performance of the operations underneath it all, but also on the price you purchase at. I concluded that, among other things, one of the key factors was the way the business had fundamentally changed (they were shifting to more advanced technology) while still appearing the same, a factor I think a shrewd investor might have been able to identify. There was, however, also a good deal of more intangible stuff - management have clearly performed well, for instance - that is perhaps harder to ascertain simply from the documents on their website.

Either way, we are in the here and now, and the question any nervous holder always wants to know more than any other is what to do. For an investor who spends the vast majority of his time researching bombed out shares which look cheap, and mostly for perfectly valid reasons, holding a share which has quickly appreciated carries with it a lot of unease. It's not too bad if the value is easily defined - Barratt was an easy sell decision, because I bought on the basis that their land wasn't so grossly misvalued that they should trade a a price to book of 0.3, but equally I didn't feel that, even with whatever bullish sentiment is floating around, they're worth a lot more than their tangible assets. With a company like Communisis, though, the value has never been visible on the balance sheet; their business isn't worth a lot because it has a bunch of assets which can be easily converted into cash.

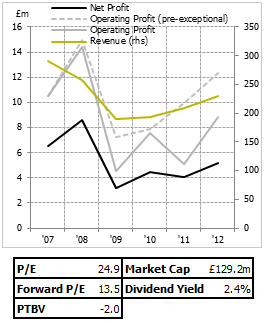

No, the value is in the way they go about doing business and the relationships they've built up - and that much becomes obvious if you look at the returns the business has enjoyed over the last few years. Over the last 5, they've averaged well over 20% returns on capital - mostly because their capital base is so small. Working capital is negative, so no tie-up there, and plant/equipment/leased assets are also fairly light, though I wonder if…

.png)