Wednesday

BURBERRY

This British fashion brand has been among the favourite with wealthy emerging markets clients, especially in Asia.

Brief look

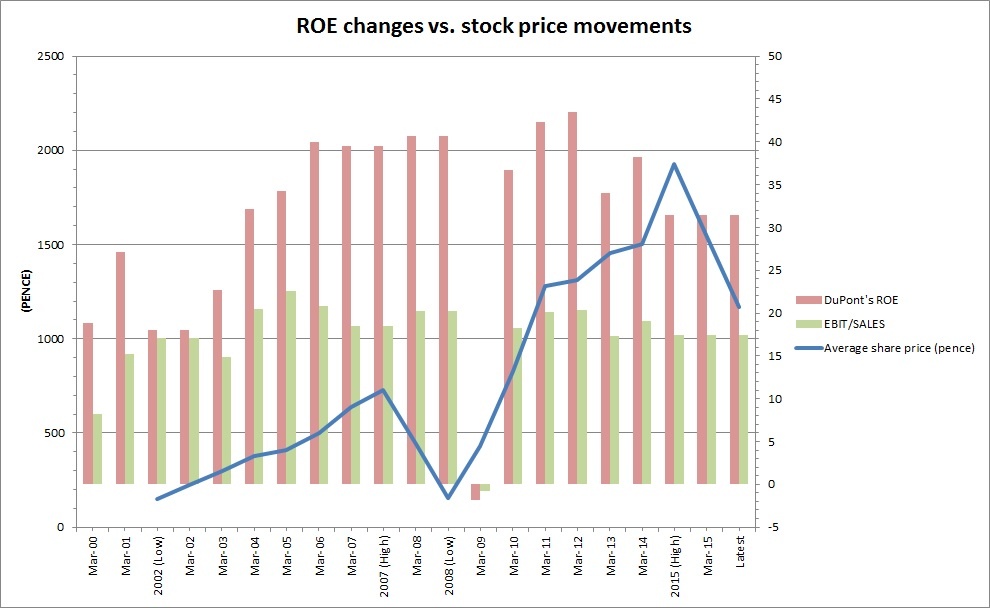

And so far the company has delivered a high return to shareholders.

Source: Burberry’s annual reports.

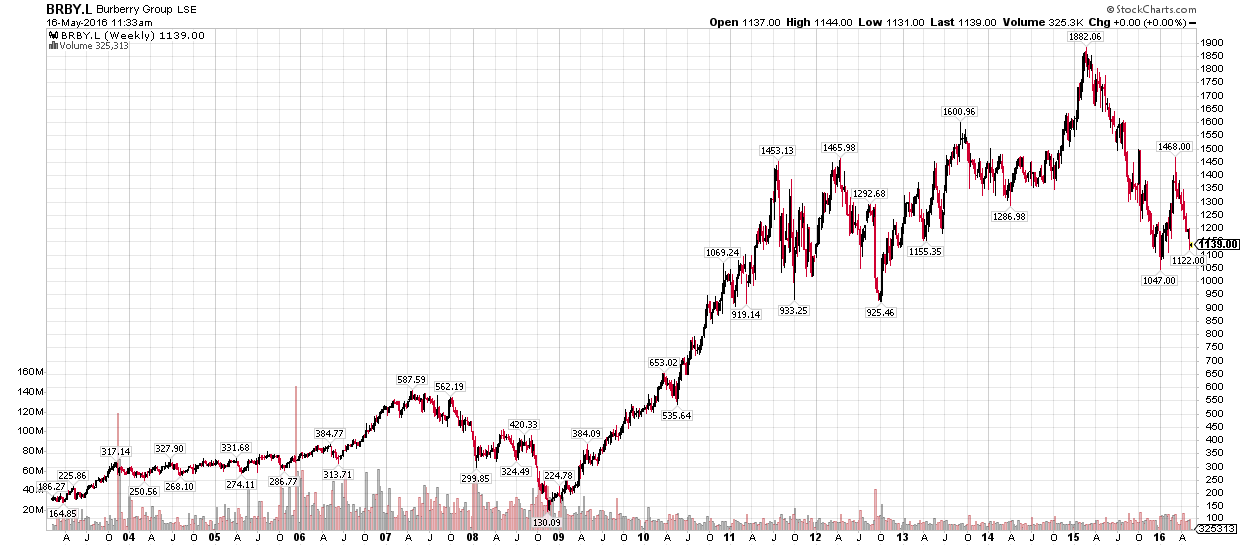

Burberry’s share price has risen from £1.5/share to a high of nearly £20/share before falling back to £11/share.

For a separate display of its share price, see below:

Source: Stockchart.com.

(N.B.: For a clearer picture, click here.)

However, the company is highly-cylindrical because, during the GFC, when its earnings went negative this caused the share price to cratered by 70%.

Although the share price has fallen by 40%, the share price is still above its peak in 2007!

However, there are several key financial items to make a ‘mental note’ to avoid future stock declines, these are:

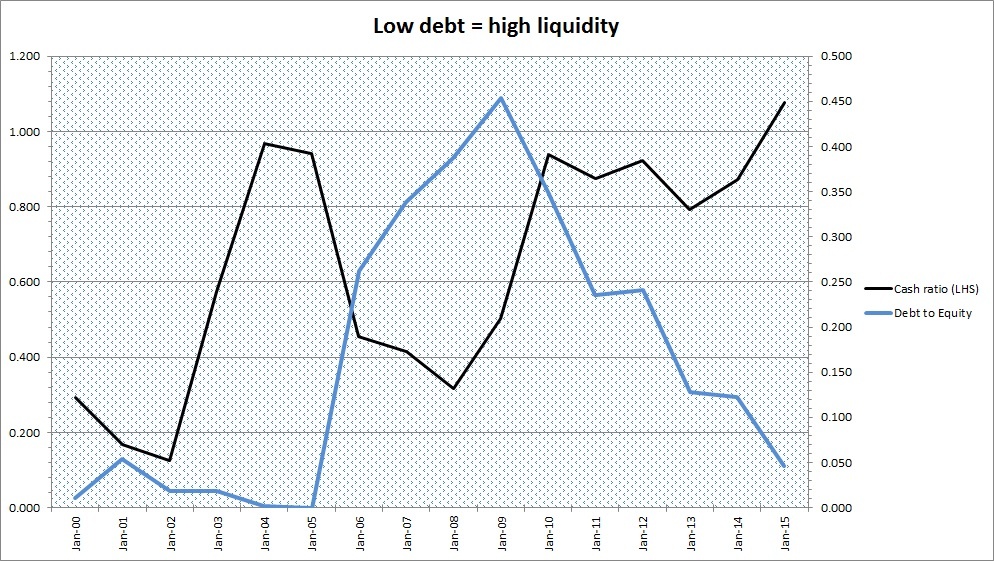

1. Debt and liquidity

Source: Burberry’s annual reports.

Debt is almost non-existent, and it has an abundant of cash because its cash ratio covers all its short-term liabilities without liquidating assets.

If both these financial items deteriorate meaning increase financial risk, therefore leading to downward pressure on its share price (like in 2005-08).

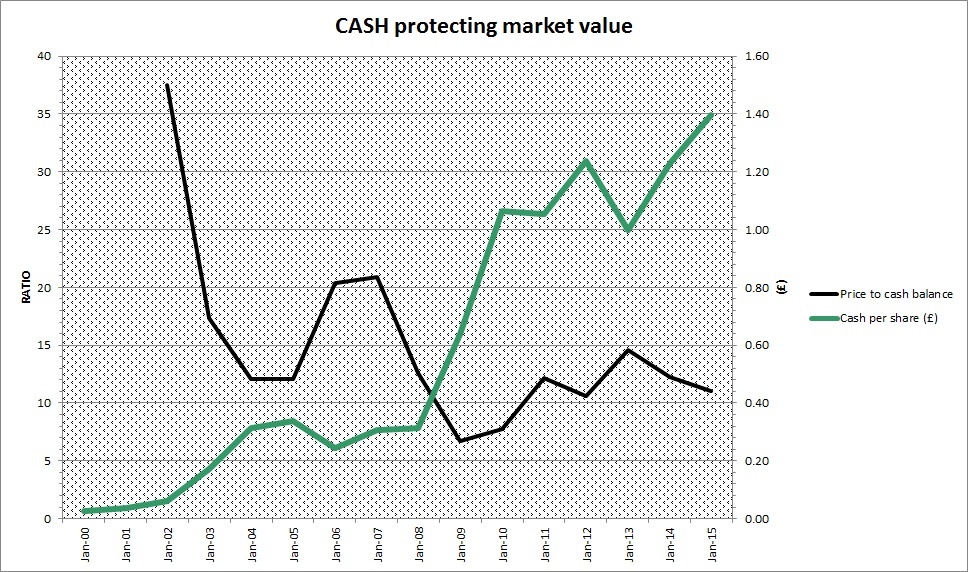

2. Cash protection

Source: Burberry’s annual reports.

Burberry “cash pile per share” makes it a rather money-making fashion brand icon. The cash alone covers 12% of its market value! At the same time, this cash balance increase makes it cheap on a market value basis, despite the stock gaining 800% since the lows of 2009.

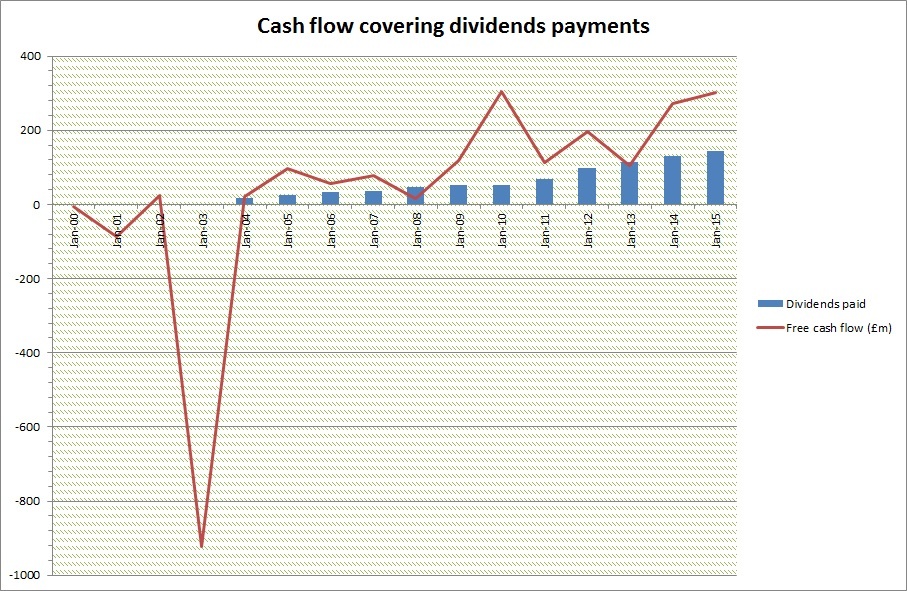

3. Free cash flow covers dividends

Source: Burberry’s annual reports.

Burberry has been producing “positive” free cash flow since 2004 and the majority of these years, the business were able to pay its dividends without drawing down its cash balance.

Situation with Burberry

The primary reason why Burberry’s share price has nearly half is that of uncertainty in China’s economy and the effects it has on Burberry’s sales. Therefore, analysts are expecting Burberry to report lower earnings of £0.71 per share in EPS (down 6% from last year) with revenue coming in flat.

But with the share price down by 40% from its peak, it shouldn’t surprise anybody if Burberry beats earnings its stocks could advance towards “double digits”. However, a slight miss wouldn’t damage the share price.

On a technical perspective, investors should watch for share price range of £9/share to £9.30/share because…