A few weeks ago, my 14-year-old brother who has just started studying for his GCSE maths exams asked me to help with with a question on compound interest. As a passionate advocate for the importance of teaching investment concepts in schools, I was delighted. Compounding is one of the most valuable lessons a novice investor can learn and (for those with a quality-first mindset) is a sure fire way of instilling enthusiasm for the power of the markets.

Compounding is often taught in the context of personal finance: investor A spends the profits from his investments every year while investor B reinvests them, after 20 years investor B has 50% more money in his portfolio. That sort of thing.

But how about in the context of business reinvestment? The principles of compounding are the same: earnings are reinvested to generate additional earnings over time. But how do businesses do that? And why are some so much better at it than others?

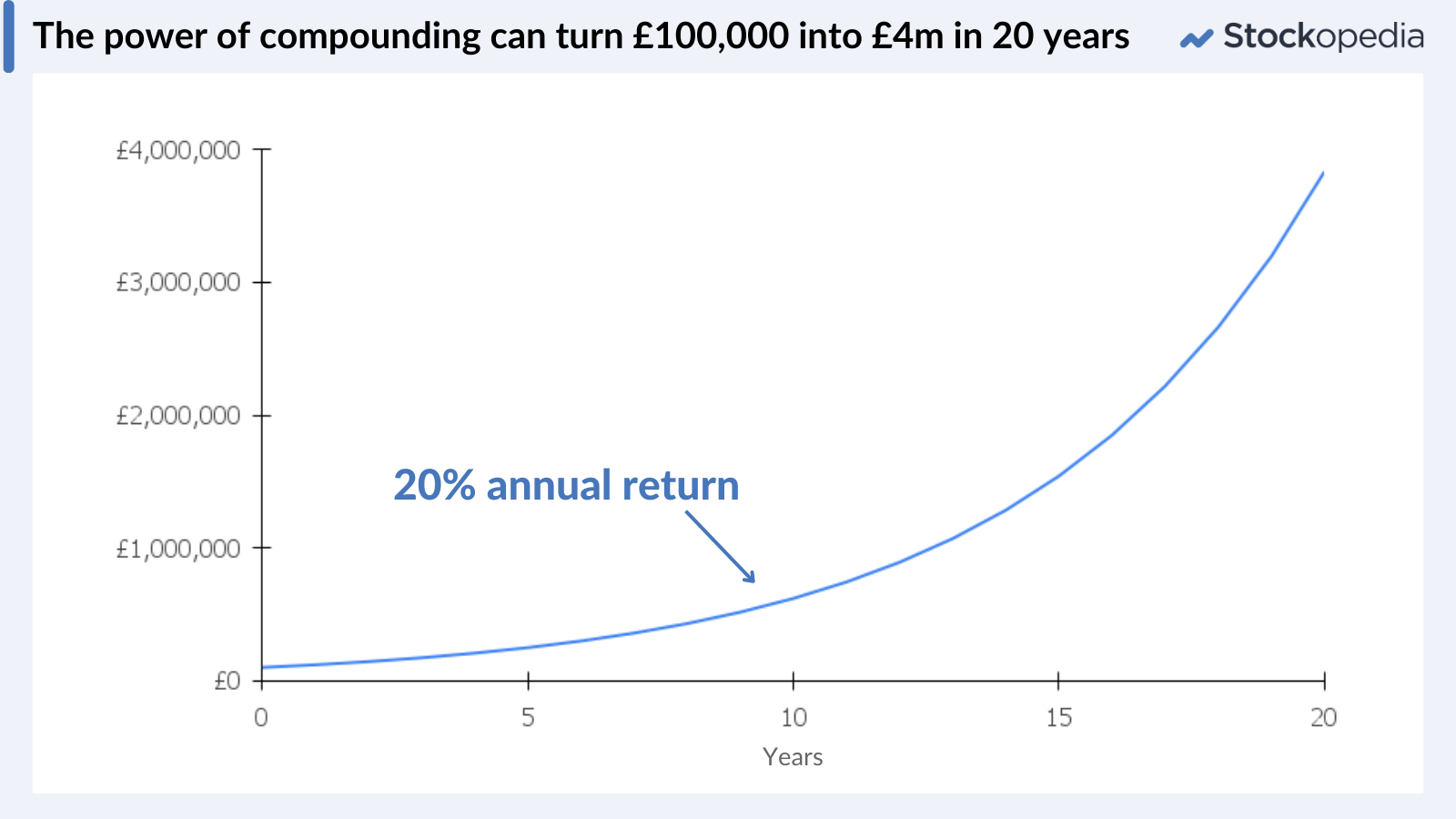

The answer lies in a company’s ability to squeeze profits from its operations. Highly profitable businesses have a greater capacity to reinvest in expanding their business. As the chart below shows, that reinvestment initially leads to a gradual increase in profits, but over time this accelerates.

When it comes to compounding, it is important to remember that lines can bend.

All of this matters because the first investment strategy we have chosen to focus in our series is Quality Compounding, which works because the reliable and enduring profitability of some businesses means they can reinvest to stimulate accelerating profitable growth.

It’s an investment strategy employed by some of the world’s most revered investors. Warren Buffett, for example, who’s “favourite holding period is forever” and Terry Smith who seeks to buy great companies, not overpay and then “do nothing.”

But employing this strategy is not easy. To build a robust quality portfolio not only requires a good understanding of the concept of compounding, but also depends on patience, diligence and discipline. This article aims to:

- Help you assess whether your mindset and timeframe are suited to the “compounding quality” investment style

- Demonstrate why quality compounders are the ideal stocks for patient, diligent investors

- Show you how to identify compounding quality companies

- Demonstrate ways to implement this strategy

- Illustrate the pitfalls that investors seeking quality compounders should…