Introduction

December proved to be a positive month for the UK market as a “Santa Rally” finally arrived despite the on going concerns in the UK & elsewhere about the spread of the new variant of the Corona virus. It seems that although it has spread rapidly & become the dominant variant it doesn’t, as I hoped, seem to be as severe in terms of the illness that it causes. While some existing vaccine booster shots seem to reduce the risks of hospitalization further and new pills for treatment are either imminent or on the horizon. Thus it seems it was right, in the short term not to panic last month. As we entered the New Year traders seemed to be bidding up travel and leisure stocks which seems to indicate that the general consensus is thinking along those lines on Covid. Hopefully we might be through the worst of the latest bout by Spring / Summer without too many more restrictions and learn to live with it longer term thereafter – hopefully.

Performance Review

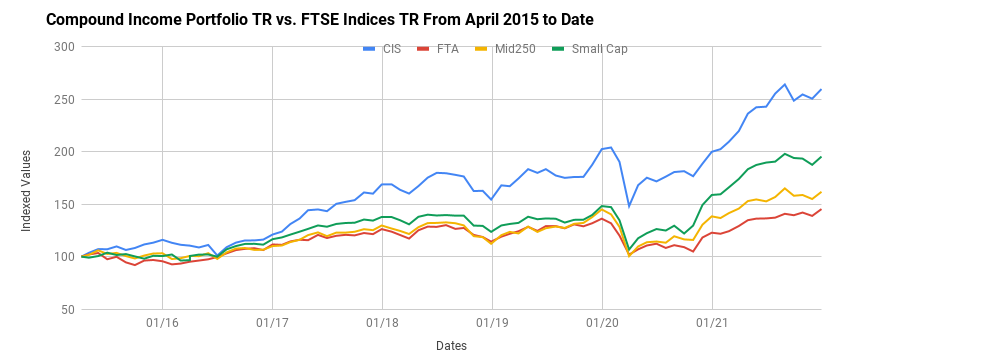

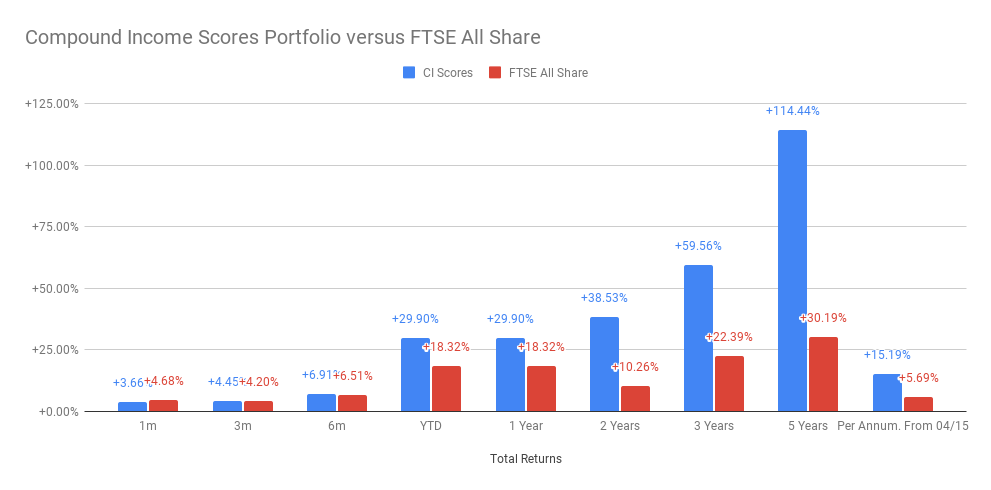

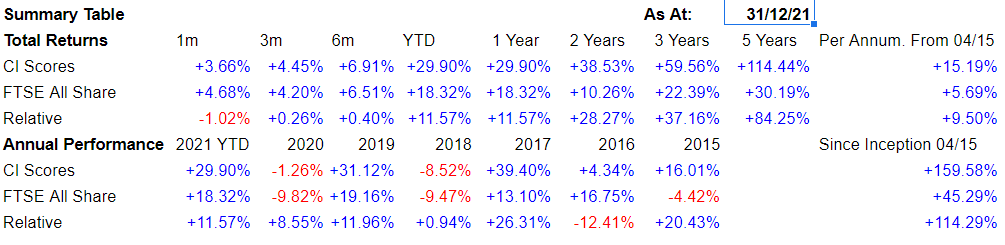

The UK market as measured by the FTSE All Share index (which I use as a benchmark) produced a total return of +4.68% in December and +18.32% for the year. The Compound Income Portfolio underperformed this month with a 3.66% return but did still have a terrific outcome for the year of +29.9%. I calculated the returns that could have been had from just holding the same portfolio from the end of last year and also one selected from the Top Scoring Stocks alone. Both of these returned around 20% for the year, so still a modest outperformance, but it does suggest that this year at least, the process of monthly screening have added value – which is what I have found in the past too So I’ll stick with that again for the year ahead.

Big winners during the year included Ashtead Ashtead (LON:AHT), Airtel Africa Airtel Africa (LON:AAF) and £IMI which have all grown to become top 10 holdings. While Renew Holdings Renew Holdings (LON:RNWH)) which enjoyed a re-rating and Ultra Electronics (ULE) which received a bid were also big contributors although they have since exited the portfolio. Another former position that did well was Dotdigital Dotdigital (LON:DOTD) which I…