Computacenter (LON:CCC) strikes up long term business relationships by taking care of an enterprise’s IT needs. Michael covered it last Friday from a technical perspective but I think there is a lot to like fundamentally about the company as well...

In its own words, CCC seeks to “create loyalty by providing long-term value for customers, employees and investors… Loyalty is an upward spiral. In a loyalty-based company, profits are a consequence, not a cause.”

These words were written back in 1996. A lot has changed at the company since then, but if it has managed to hold on to this ethos then I would view that as a positive for all stakeholders.

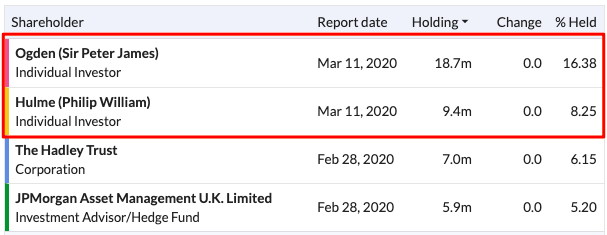

CCC was established in 1981 by British entrepreneurs Peter Ogden and Philip Hulme, both of whom retain sizeable stakes in what is now a c£1.7bn company.

It grew organically in the UK for many years, before expanding into France and Germany in the nineties and noughties.

Over the years there have been a couple of wobbles in its various territories, but the overall story has been one of steady expansion. Today the group reports on segments in the UK, France, Germany, the US, and International (including the Netherlands and Switzerland), with market-leading positions across the first three and good growth potential in the latter two.

In taking care of other enterprises’ IT systems and issues, Computacenter allows them to focus more on their core business. Playing such a role adds economic value by enabling greater productivity. Computacenter’s line of business strikes me as quite secure - in my view, demand for expertise in IT infrastructure will only increase as we migrate to the cloud.

In fact, CCC has recently updated the market to say that trading has been encouraging (more on this below).

Quality, profitability and financial strength

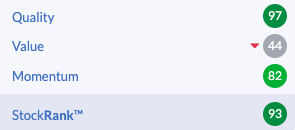

Having read through quite a lot of CCC’s accounts, I am not surprised to see its high StockRanks:

It comes across as a well-run company that puts its customers above profits and invests heavily in people and operations. While this may depress margins, it should go some way to securing its long term market position. And looking at the way this company’s finances are run, you do get a sense that this is one outfit managed for the long term.

The group’s…

.jpg)