I often shock people when I tell them how I manage my personal investments.

Why? I regularly have more than 100% of my savings invested in just seven stocks. That's concentration!

It's not a strategy which I recommend for friends or family. These are the reasons why it works for me:

- I carry out a lot of stock-specific research, looking for stocks which are available at a significant discount to fair value. This is difficult. And so when I am lucky enough to find something at a discount, I want to be heavily involved. I don't want to dilute the opportunity by not holding enough of it or by mixing it with stocks which I believe are at a smaller discount, or even no discount at all. I might as well save myself all the effort and just buy an ETF.

- I keep detailed records of what I do and stay up to date with each of my holdings. More holdings means more distractions and more administrative work, and a lower probability that I'll be entirely up to date with news flow around every holding.

- I have a long time horizon, no fixed liabilities, and am emotionally capable of tolerating concentration risk. In fact, I want concentration risk: it forces me to work harder on my research and to learn faster from my mistakes, which I'm confident will prove beneficial in the long run.

In my long-only stock portfolio (I also do a little short-selling, but more on that some other time), there are two "Book Value" investments where I invested because of the tangible asset backing. On average, their book values are currently 174% of their market prices and consist almost entirely of property (real estate), cash, receivables and inventories. I also believe that this accounting figure understates the value which they can generate.

(I prefer to use book value/price, which I call "Book Value Ratio" but is also known as "Book to Market", because I find that putting the price as the denominator improves my thinking.)

The rest of the stock portfolio is split between five companies. Unlike the Book Value investments, I consider all of these to be going concerns: I don't want or need them to liquidate. So let's call these the "Going Concern" investments.

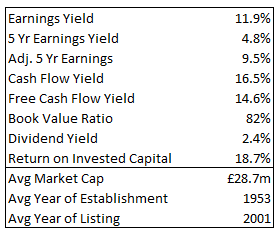

The Going Concern portfolio has the following characteristics:

As you can see,…