Market Musings 150424: All eyes on oil and gold

5 Charts of the week

Oil and gold will give us clues as to the impact of any escalation of the Middle East conflict, now including Iran

5 Charts to Consider

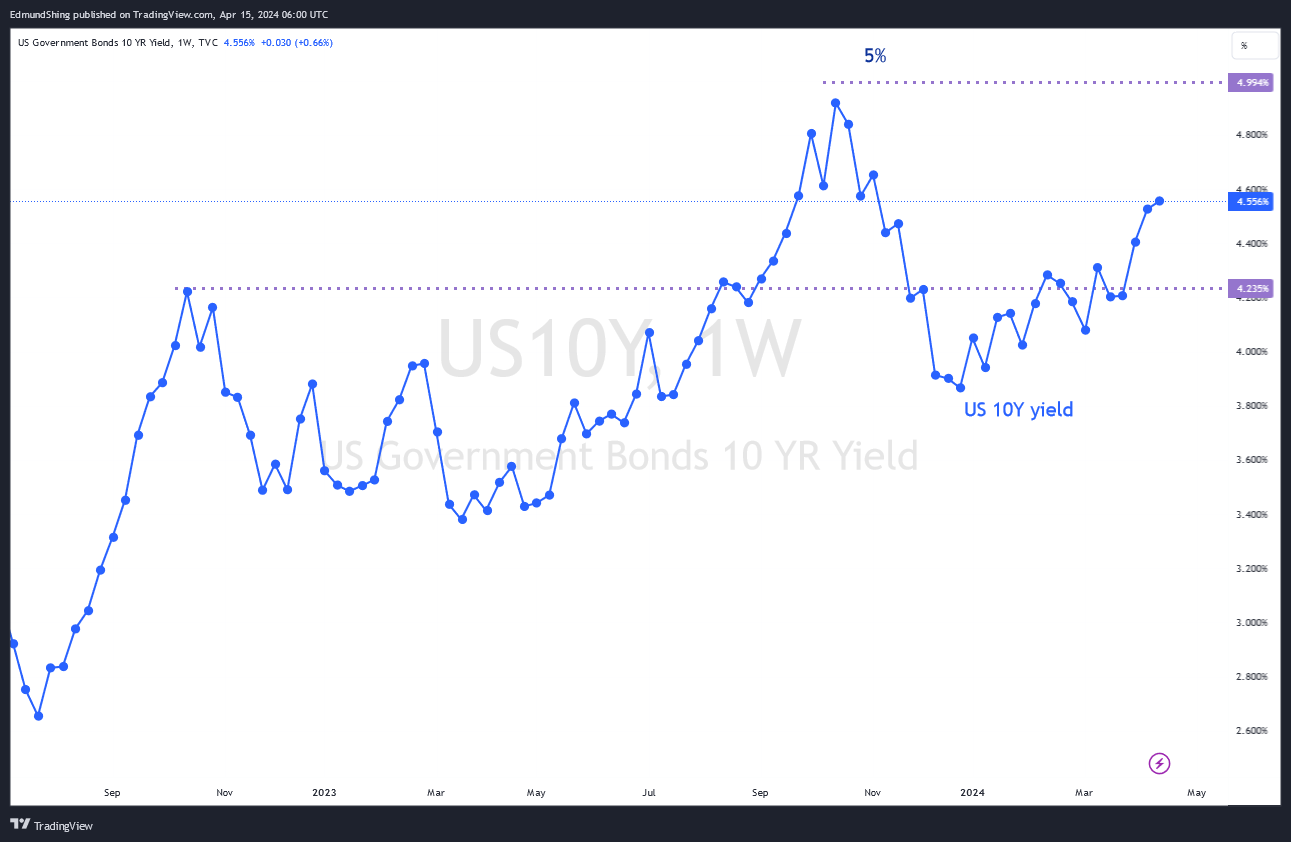

1. 10-year US bond yield rises, threatening stock market valuations

The higher-than-expected March US CPI print, combined with a surprisingly weak US Treasury bond auction, both conspired to push US 10-year bond yields higher, to 4.55%.

If bond yields move closer to 5%, this is likely to put US stocks under more pressure, which could prompt a correction.

Source: tradingview.com

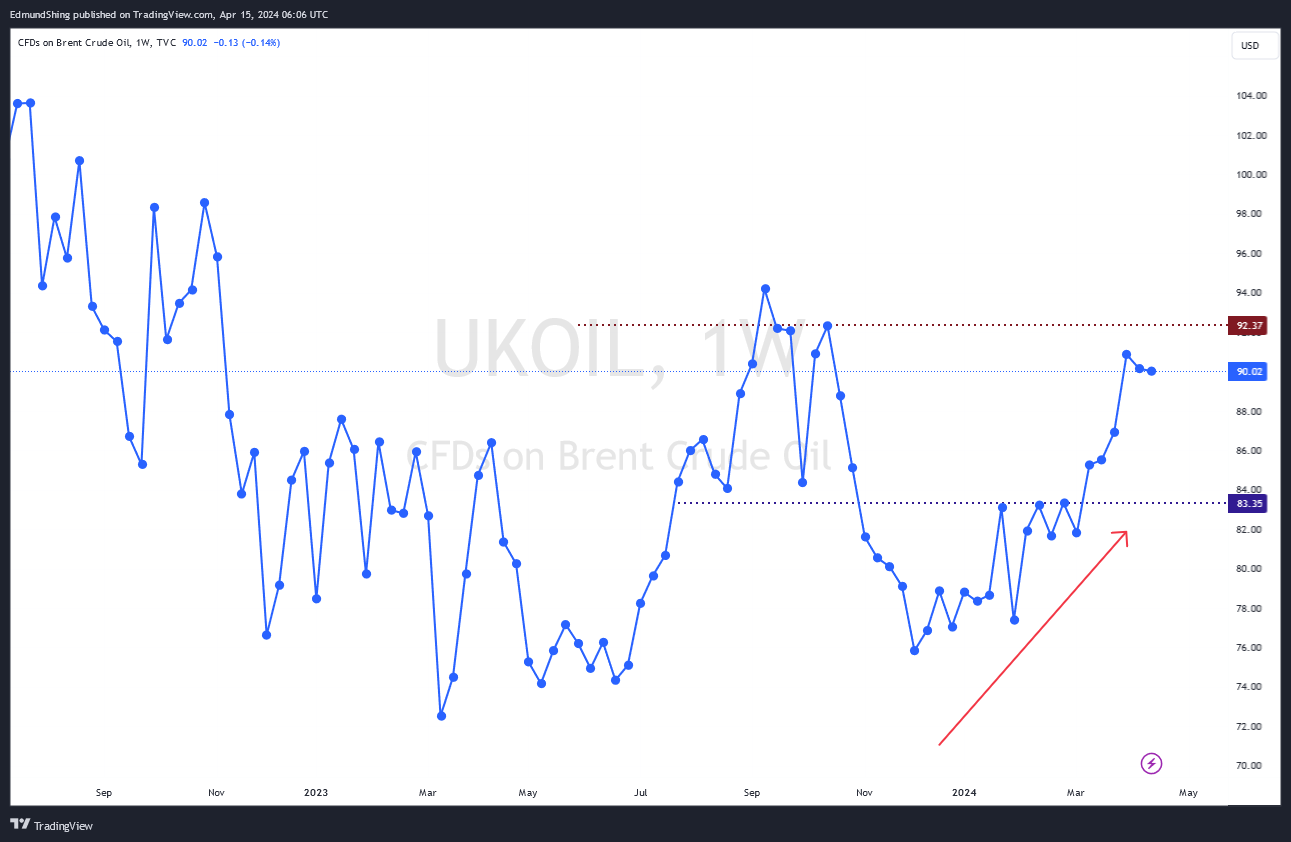

2. Brent crude oil price holds steady at $90/barrel despite Iranian attack on Israel

No move (yet) higher in the geopoltical risk premium in the oil price despite the Iranian missile + drone attack on Israel.

Key will be the level of any Israeli retaliation, with the US noticeably urging Israel not to overreact to this telegraphed strike.

President Biden is keen not to see US households impacted by a further surge in gasoline prices, which could hurt his chances of re-election.

Source: tradingview.com

3. Gold and Silver move to new highs, in spite of a slam on Friday

The spike of gold and silver prices was slapped back down quickly - nevertheless, they both posted gains yet again over the week

to new highs. There remains plenty of potential for silver relative to gold, given the elevated gold/silver price ratio.

Source: tradingview.com

4. Copper consolidates, but may move higher on a new ban on Russian metals

"The London Metal Exchange (LME) on Saturday banned from its system Russian metal produced on or after April 13 to comply with new U.S. and UK sanctions imposed for Russia's invasion of Ukraine. The sanctions aim to restrict revenues for Russia from the export of metal produced by companies such as Rusal and Nornickel that help to fund its military operations in Ukraine. The U.S. Treasury Department and the British government on Friday prohibited the 147-year old LME and the Chicago Mercantile Exchange (CME) from accepting new Russian production of aluminum, copper and…