Bull markets can be a mixed blessing for value investors. On one hand, a rising tide of prices can quickly propel undervalued stocks back to their intrinsic valuations (and beyond), which is exactly what a value junky wants. But the problem is that the pool of mispriced stocks soon dries up. And that makes it difficult to recycle capital back into the market. With that in mind, it's interesting that two of the best performing guru-inspired strategies tracked by Stockopedia this year are both value-focused contrarian approaches. It suggests that despite the bullish conditions there are pockets of value out there… and the quality is there too, if you look carefully.

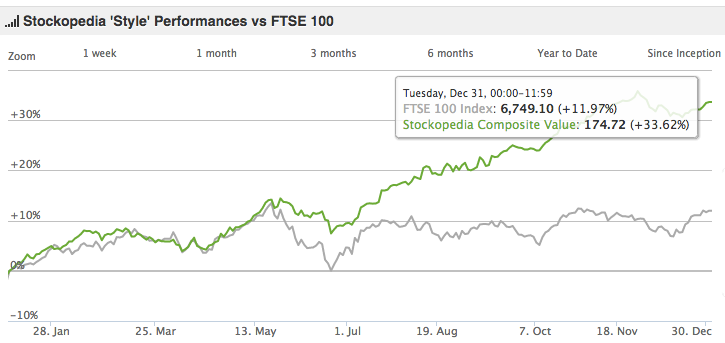

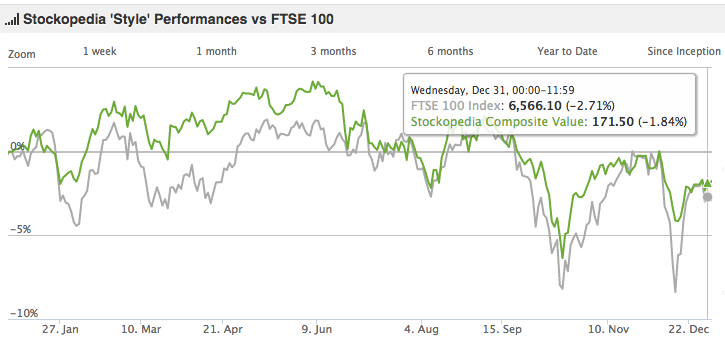

To get an idea about how racy conditions affect value, just take a look at 2013 (in the top chart). Back then funds flowed freely into small and mid cap stocks and value strategies were some of the big winners that year. But in 2014 there were far fewer good quality value opportunities around and the same strategies undershot the market. This sort of pattern is familiar to academics - researchers from Cass Business School examined it in detail here.

Where is the value?

Opinions are divided on how far up the bull curve the UK stock market is, but many would agree that 2015 has got off to a reasonably positive start. The FTSE 100 has been hitting new highs and the FTSE All Share is up by 6.2%. But two of the value strategies we track at Stockopedia are easily outpacing them:

- The David Dreman Low Price to Earnings and Low Price to Book screens are both up by 24.5% and 21.4% in 2014

- The John Neff Value screen is up 15.6%

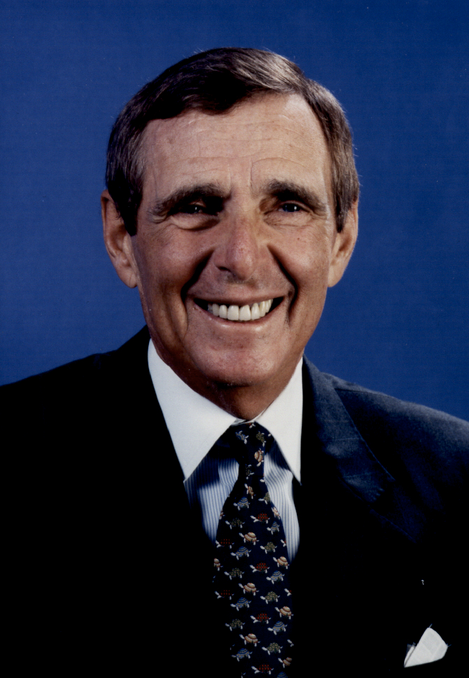

What makes these strategies interesting is that they riff on the concept of contrarianism. John Neff, a highly regarded US fund manager, made his name as a contrarian value investor although he preferred the term “low price-earnings investor". He focused on buying good companies with moderate growth and high dividends while they were out of favour, and then selling them once they rose to fair value.

What makes these strategies interesting is that they riff on the concept of contrarianism. John Neff, a highly regarded US fund manager, made his name as a contrarian value investor although he preferred the term “low price-earnings investor". He focused on buying good companies with moderate growth and high dividends while they were out of favour, and then selling them once they rose to fair value.

David Dreman took a similar view. In his book Contrarian Investment Strategies, he acknowledged that he…

David Dreman took a similar view. In his book Contrarian Investment Strategies, he acknowledged that he…