Conviviality (LON:CVR), one of Britain’s largest wholesalers, has gone from strength to strength since it floated on AIM back in August 2013. The share price has risen by more than 270% while earnings have grown each year without fail. Dividend hunters may be particularly interested in Conviviality because the firm paid its maiden dividend in February 2014 and the forward looking yield is now 3.5% - above the market median of 3%.

The elephant in the room is that the company has also gone on a spending spree. It acquired Matthew Clark, the alcohol supplier for its hotel division in 2015. Then in 2016 it bought Bidendum Group, one of the largest alcohol distributors in the UK. In his commentary to The Intelligent Investor, Jason Zweig said that if a ‘company itself would rather buy the stock of another business than invest in its own, shouldn’t you take the hint and look elsewhere too?’ This is an interesting question because Conviviality’s acquisition programme does raise questions about the company’s capacity to sustain dividends. Let’s take a closer look...

Have acquisitions improved Conviviality’s balance sheet?

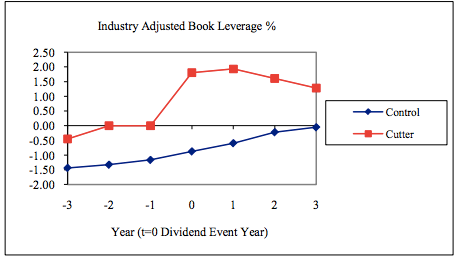

A 2010 paper titled To Cut or Not to Cut by Laarni T. Bulan identified several red flags which were apparent in the years preceding a dividend cut. The chart on the top-right has been taken from Bulan’s paper. Dividend cutters (red) are firms that reduced their dividend by 10% or more in a fiscal year. Control firms (blue) are firms that did not reduce their dividend.

A 2010 paper titled To Cut or Not to Cut by Laarni T. Bulan identified several red flags which were apparent in the years preceding a dividend cut. The chart on the top-right has been taken from Bulan’s paper. Dividend cutters (red) are firms that reduced their dividend by 10% or more in a fiscal year. Control firms (blue) are firms that did not reduce their dividend.

Bulan found that firms with ‘poor financial flexibility (low cash holdings and high leverage) are more likely to cut their dividend’. Clearly, if a company is highly leveraged, and is having trouble meeting its liabilities, then this is going to be a big red flag for the dividend.

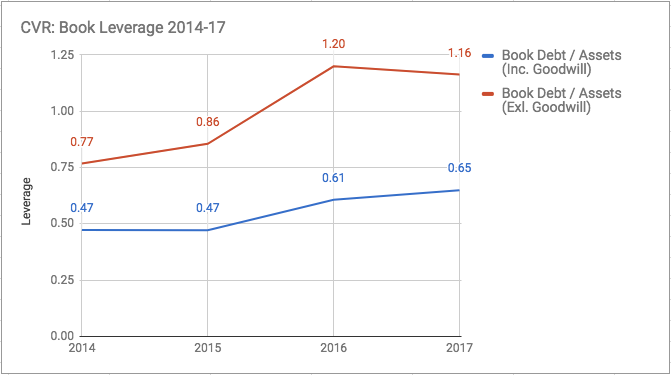

Notice on Bulan's chart that book leverage increased during the three years preceding a dividend cut. We can also see from the second chart above that Conviviality has likewise increased book leverage over the last three years. Conviviality’s acquisition programme has been an important factor driving this trend. Let’s explore this further...

Bulan defined leverage as the ratio of book debt to total assets, where book debt is equal to total liabilities plus…