The Consumer Goods sector has been one of the more resilient sectors to the devastating effects of the pandemic. As is often the case, even in more precarious times, consumers will continue to demand the bare necessities of life.

Many consumer goods products often have small or even negative income elasticities of demand. This means that the general fall in income levels, which are typically seen during a recession, will be met by a proportionately smaller fall in the number of consumer goods demanded, or even an increase for certain inferior goods.

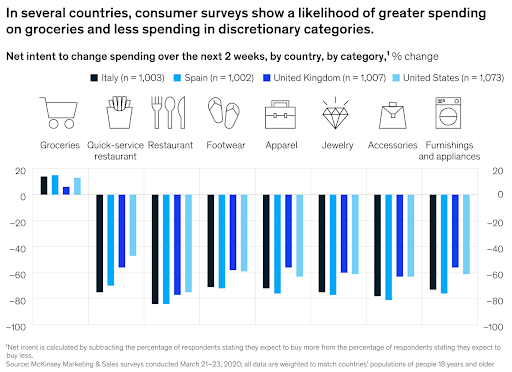

When there is such economic uncertainty, consumers tend to shift their focus away from luxury goods to more value-oriented products, which has been to the benefit of consumer goods companies. Research carried out by McKinsey provides further evidence of this. Purchases on nondiscretionary products such as food, household and personal care products have increased, whereas discretionary product purchases, such as apparel and furnishing have dropped. In fact, consumer surveys have shown that groceries are the only goods where spending is likely to increase.

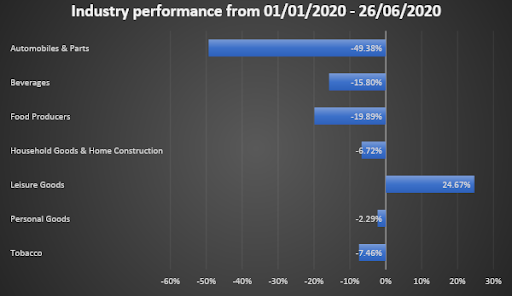

As a result of these trends, the FTSE All Share Consumer Goods sector benchmark has seen a relatively modest fall of -9%since the start of the year, as opposed to a -19.5% decline in the FTSE All Share. However, performances across the industry groups within the Consumer Goods sector have varied substantially.

This article will examine the Consumer Goods sector and its industry groups in detail, highlighting the performances of the industries so far. The article will also assess the industry groups from a valuation perspective and take a look at the top-ranking stocks within the sector to gauge how these companies are responding to the changes that the pandemic has brought about.

Performance of the Industry Groups

As can be seen from the table above, the Automobiles & Parts industry group has been by far the worst performer of the Consumer Goods sector, collapsing by -49.38%.The short-term impacts of car factory closures and potential supply chain issues, in addition to the long-term structural changes in the way people will travel moving forward, has pointed towards a very bleak outlook for the industry.

Though the FTSE All Share Automobiles & Parts benchmark only tracks the performance of Aston Martin Lagonda Global Holdings and