The Consumer Services sector has been one of the hardest hit by the global pandemic. The full-scale lockdown, which lasted for 7 weeks here in the UK, and continued social distancing measures currently in place, have taken their toll on all consumer facing services activities.

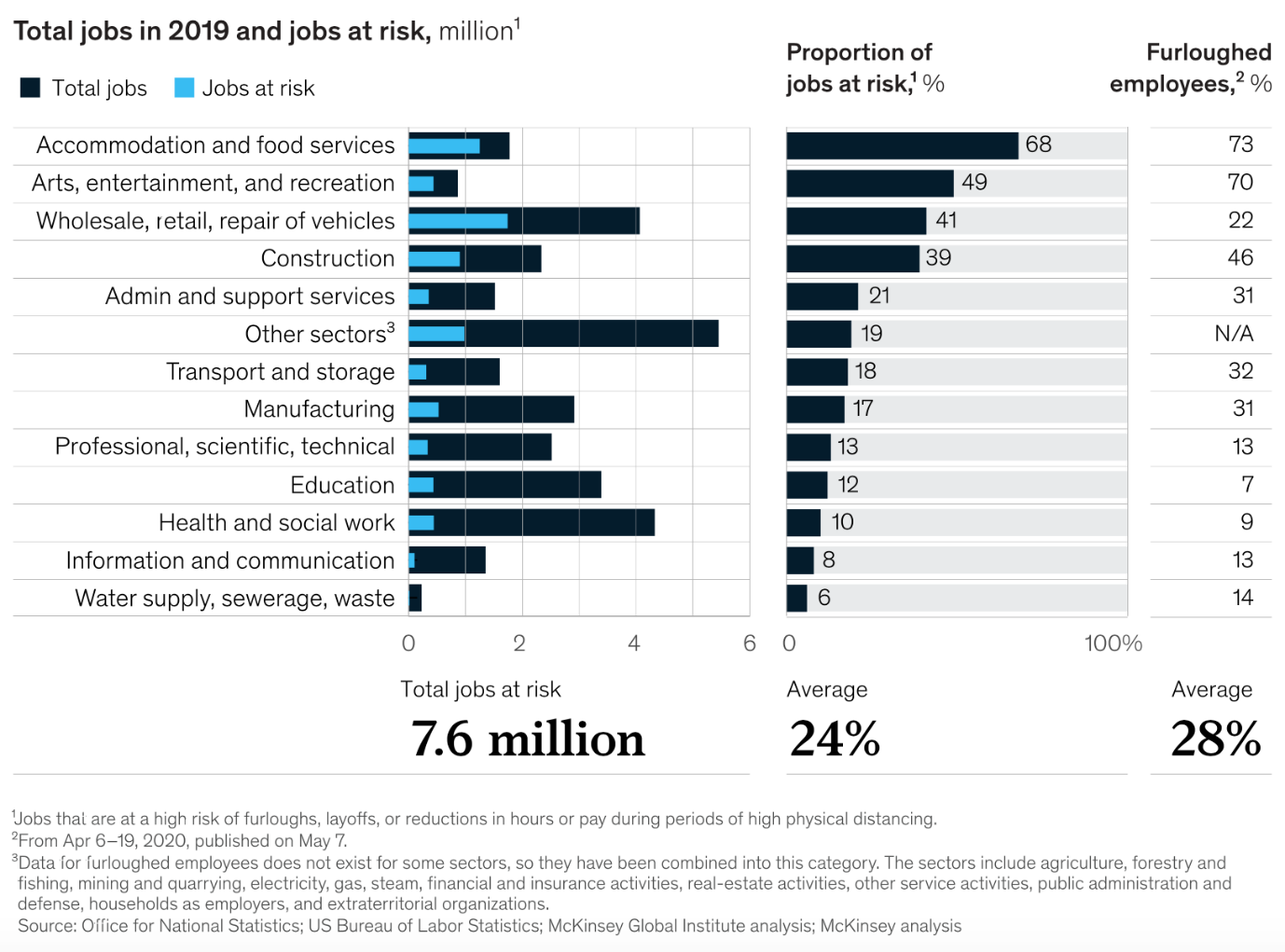

The impact upon the Food & Drug Retailers, General Retailers, Media and Travel & Leisure industries has been far worse when compared to other sectors. Research carried out by McKinsey has shown just how disproportionate the effects will be on employment within different sectors of the economy. As can be seen by the chart below, Accommodation and food services, along with Arts, entertainment, and recreation are expected to experience the worst job losses of any sectors.

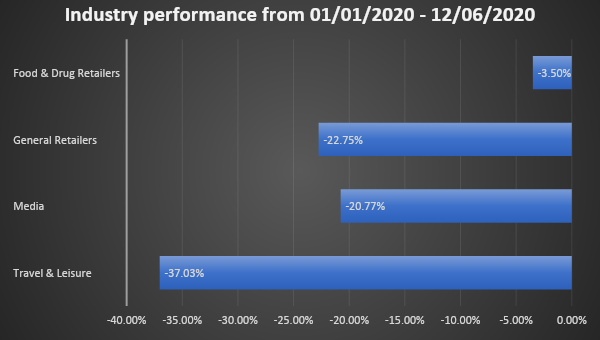

Unsurprisingly, the Consumer Services FTSE All Share sector benchmark has fallen by -24.7% since the start of this year, slightly worse than the -20.1% fall in the FTSE All Share. However, with the economy slowly re-opening and talks of Boris Johnson reconsidering social distancing measures, the Consumer Services sector may offer plentiful opportunities in the event of a return to some form of normality.

This article will examine the Consumer Services sector and its industry groups in some more detail, highlighting the performances of the industries so far. The article will also assess the industry groups from a valuation perspective and take a look at the top-ranking stocks within the sector to evaluate how these companies are adjusting to the current climate.

Performance of the Industry Groups

The best performing industry group since the turn of this year, by quite some margin, has been the Food & Drug Retailers, witnessing a minor -3.5% fall. Indeed, when panic started to kick in at the end of March, Food & Drug Retailers were the first to benefit, with people stocking up on essential goods. This led to a record £10.8 billion worth of sales for British supermarkets in March alone.

However, most Food & Drug Retailers have, so far, failed to translate the substantial increase in revenues into bottom line profits. Sainsbury’s, for example, has predicted a £500 million hit in profits due to the additional costs it has incurred as a result of the pandemic. Supply chain issues, and a fall in merchandise and clothing…