During the credit crisis of 2008-2009, the Financial sector was inevitably one of the worst affected. After the demise of Lehman Brothers and the daunting prospect of a collapse of the entire financial system, new banking and financial institution regulations were put in place to avoid a repeat ever happening again.

More stringent capital adequacy ratios were implemented after the crisis and the continued prudent supervision by industry regulators meant that banks and financial institutions entered the pandemic in the strongest position they have been in for decades. Despite this, the sector remains one of the worst performers since the start of the Covid-19 outbreak. The FTSE All Share Financials sector benchmark has dropped -20.17% since the start of the year, whereas the FTSE All Share has depreciated by -15.89%.

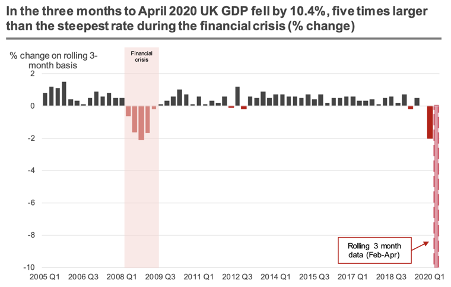

Source: PwC

This article will examine the Financials sector and its industry groups in detail, highlighting the performances of the industries so far. The article will also evaluate the valuation metrics of the industry groups and focus on a few of the top-ranking stocks within the sector to identify how these companies are responding to changes in the financial system as a result of the pandemic.

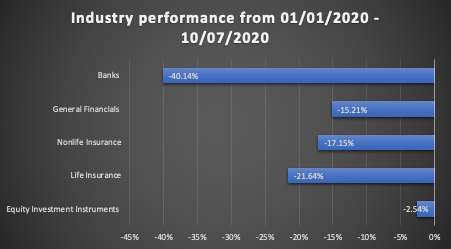

Performance of the Industry Groups

Falling by almost twice as much as any other industry in the Financial sector, the Banking industry has suffered staggering losses so far. Its -40.14% fall puts it amongst the worst performing industries across all economic sectors.

The major banks have had to make significant provisions for potential loan losses and have had to cut their workforces to streamline cost structures. Lloyds, RBS and Virgin Money have all seen their values halve since the start of the year as a result of the ongoing challenges the businesses are facing.

Lloyds, for example, has seen its first quarter profits plummet by 95% and has had to set aside £1.43 billion to account for potential loan defaults. It has also scrapped its dividend. HSBC, which generates the majority of its revenues in Asia, has also seen its profits drop by 48% in its latest quarterly results. It has decided to set aside £2.4 billion in anticipation of greater loan and credit card defaults and has suspended share buy-backs for the next 2…