Despite the historic supply cuts that have been implemented by OPEC and many of the largest oil producing nations around the world, such as Russia, Canada and the USA, Brent crude oil prices remain 34% below where they started the year, as global demand has collapsed.

The lockdowns implemented in most nations around the world have impacted almost all energy consuming sectors of the economy. Factory closures have led to reduced demand from industry, road and rail travel has been impacted by individuals making fewer commutes, and the demand for aviation fuel has almost completely disintegrated as nations closed their borders.

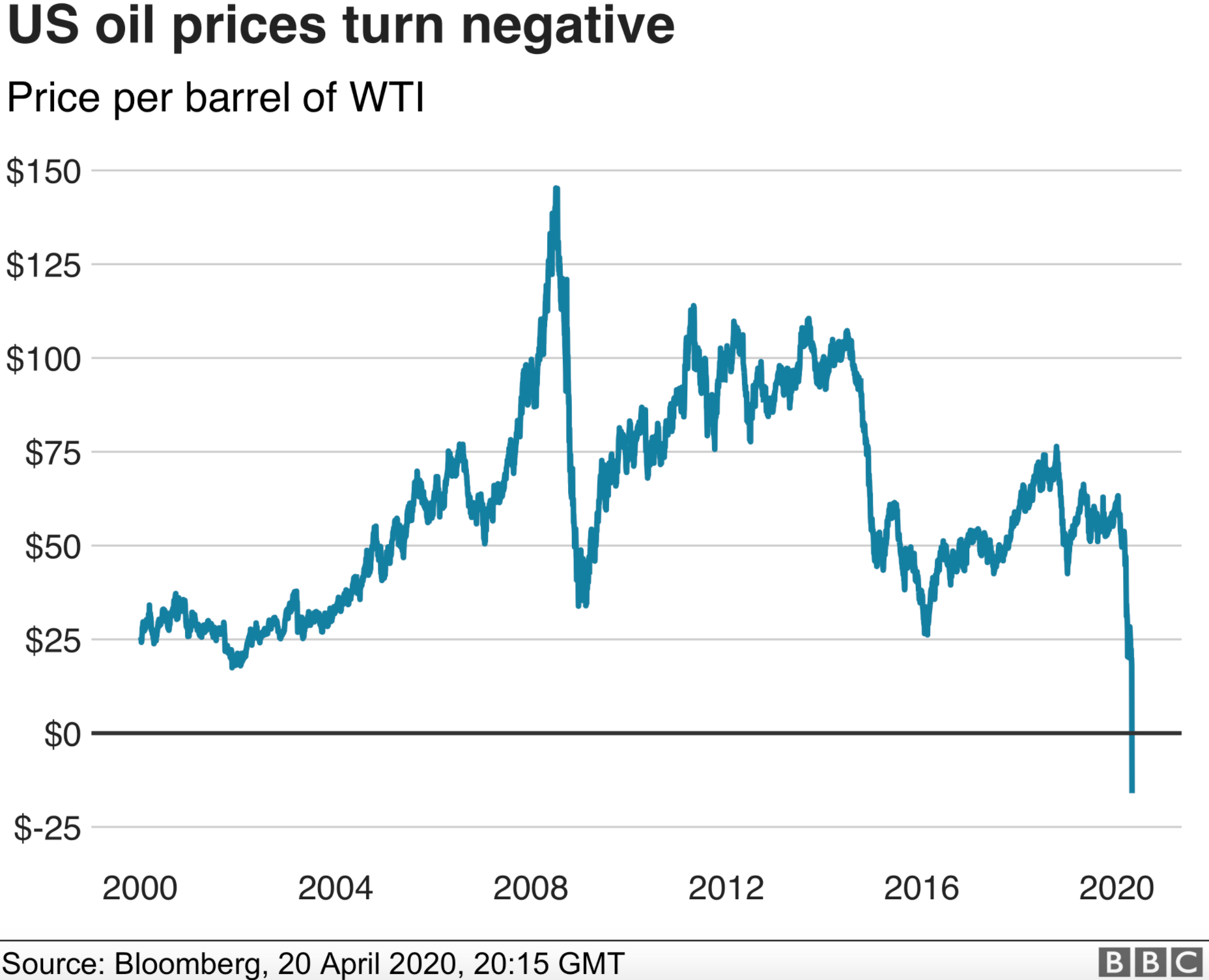

Faced with a drastic oversupply, WTI crude oil prices even turned negative for the first time ever in April, reaching almost -$40 a barrel. Oil producers were, for a short time, paying storage facilities to take their oil. Oil prices have since recovered as a result of supply cuts catching up to the falls in demand. However, there is still much uncertainty ahead for the Oil & Gas sector.

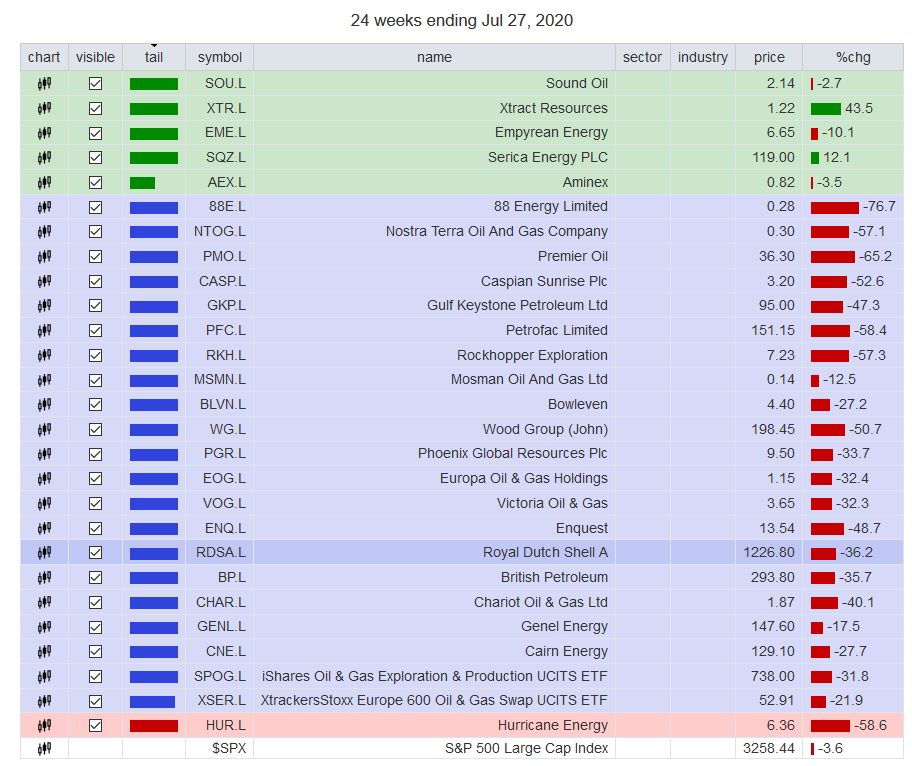

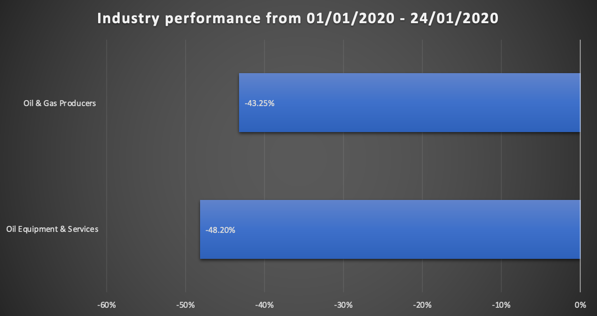

The downward pressure on oil prices has inevitably taken its toll on margins enjoyed by Oil & Gas Producers and on the contractual work of Oil Equipment & Services providers. Overall, the FTSE All Share Resources benchmark, which tracks the performance of these two industries has fallen by an astonishing -43.9% since the start of the year. This is far more than the fall experienced by the broader market, with the FTSE All Share down -20% to date.

This article will examine the impacts of the collapse of oil prices on the Oil & Gas sector and discuss the performance of the industries within the sector in more detail. The article will also assess the industry groups from a valuation perspective and evaluate how the top-ranking stocks in the sector are responding to the changing supply and demand-side dynamics in the Oil & Gas sector as a result of Covid-19.

Performance of the Industry Groups

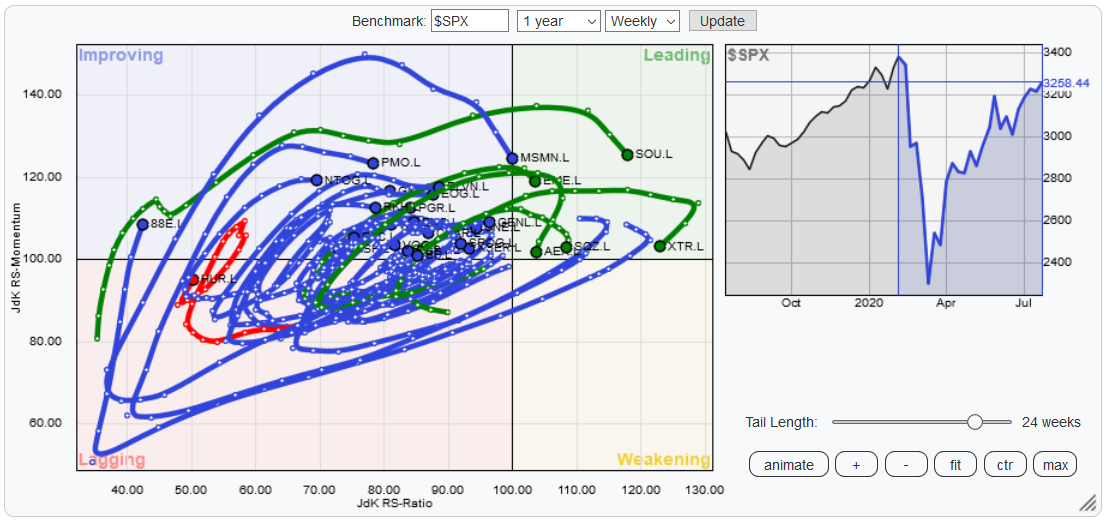

The collapse in oil prices and uncertainty over future demand has decimated both the oil & gas producers and equipment & services industries. The Oil & Gas Producers FTSE All Share benchmark, which tracks the performance of industry heavyweights such as BP and Royal Dutch Shell, has seen some of its constituents fall…