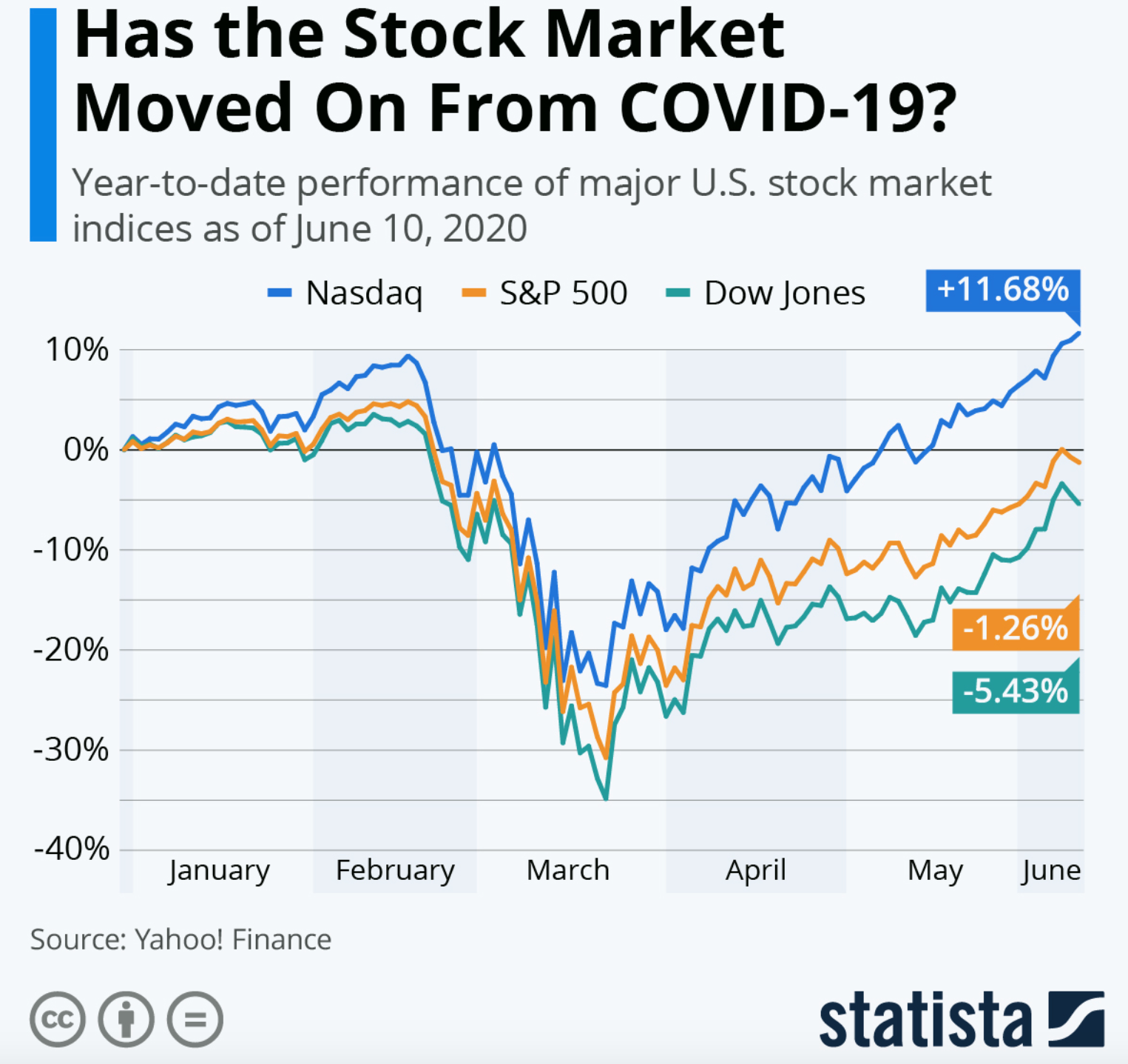

One of the few sectors to have emerged in a stronger position as a result of the Covid-19 pandemic has been the Technology sector. Around the world, tech focused indices and equities have significantly outperformed the broader markets. Whilst revenues and sales have plummeted across most sectors and industry groups, Software & Computer Services and Hardware & Equipment providers have benefitted from increased uptake from individuals and businesses alike.

The pandemic seems to have accelerated the secular growth trends in the Technology sector. Boosted by work from home, technological adoption has reached new heights in recent months and this trend looks set to continue for the foreseeable future. The speed of the digital adoption has been so quick that we have effectively made 5 years’ worth of progress in roughly 8 weeks, according to research by McKinsey.

However, whilst US Tech and the Nasdaq have reached all-time highs, the UK Technology sector hasn’t performed quite so well. The FTSE All Share Technology benchmark has fallen -3.67% since the start of the year, far better than the -20.16% that FTSE All Share has returned, but substantially worse than the Nasdaq’s 25.92% appreciation. Though the Nasdaq offers greater variety and exposure to tech industries, UK Tech may be comparatively undervalued.

This article will examine the impacts of the pandemic on the Technology sector and discuss the performance of the industries within the sector in more detail. The article will also assess the industry groups from a valuation perspective and evaluate how the top-ranking stocks in the sector are rapidly evolving to cope with the effects of Covid-19.

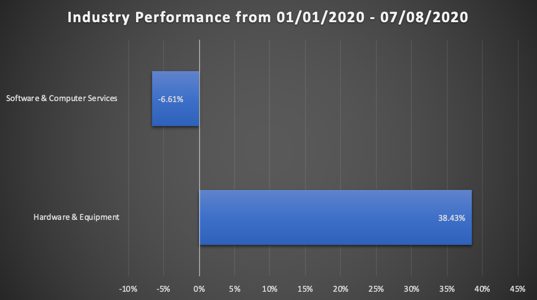

Performance of the Industry Groups

The performance of the Software & Computer Services industry group has been underwhelming so far this year, falling by -6.61% overall. Some companies in the industry have greatly suffered from contracts deferrals by their clients, who have been more significantly impacted by the pandemic. The knock-on effects of such actions have taken their toll on Micro Focus International in particular, with its share price down by over 70% since the start of the year. The company recently reported a statutory operating loss from continuing operations of $906.7 million for the six months ending April 30 as new sales activity has also been disrupted…