Questions of quality

I like Cranswick (LON:CWK) as a business. Much like Howden Joinery, it was one I bought back when I started the portfolio because it sort of fitted what I knew I was supposed to be looking for, but didn't understand that well why. In hindsight, and having looked at quite a few more companies since then, it still strikes me as a company of significantly above average quality. (As a (sort of) economist, I can't help but add that the previous sentence is home to all sorts of selection bias; I am a value investor, so I am probably more likely than most to be looking at poorer-quality companies and not the ingenious new startups.) Self-chiding aside, quality is all well and good, but it's the price/quality that we really care about. I guess that's what stuff like the P/E hopes to give you an indicator of - price vs. quality, in that ratio how much money it's making. In those simple terms, what we're really trying to do as investors is refine that 'E' so we get a picture of future cashflows far more intuitively and powerfully than just looking at last year's net profit number.

I like Cranswick (LON:CWK) as a business. Much like Howden Joinery, it was one I bought back when I started the portfolio because it sort of fitted what I knew I was supposed to be looking for, but didn't understand that well why. In hindsight, and having looked at quite a few more companies since then, it still strikes me as a company of significantly above average quality. (As a (sort of) economist, I can't help but add that the previous sentence is home to all sorts of selection bias; I am a value investor, so I am probably more likely than most to be looking at poorer-quality companies and not the ingenious new startups.) Self-chiding aside, quality is all well and good, but it's the price/quality that we really care about. I guess that's what stuff like the P/E hopes to give you an indicator of - price vs. quality, in that ratio how much money it's making. In those simple terms, what we're really trying to do as investors is refine that 'E' so we get a picture of future cashflows far more intuitively and powerfully than just looking at last year's net profit number.

The good

As I said, it's a 'quality' company. To put numbers or intuition to it, it consistently earns returns above its cost of capital, as a big company, without overleveraging (either on debt or operating leases) and with reasonable consistency. It's dipped since the recession, as could be anticipated, but still earns returns figures upwards of 20%, having capitalised operating leases. This, to me, is probably the simplest definition of quality. Where it comes from is another, more complex question, but by the simplest yardstick a company able to consistently grow and keep returning more than is required to fund that growth is a sound one. That seems obvious, but that point is sometimes in considerable doubt. I spend a good deal of time trying to decipher whether a company's returns are just depressed for a idiosyncratic or cyclical reason, or whether it's simply in terminal decline. Cranswick does not worry me with the same questions.

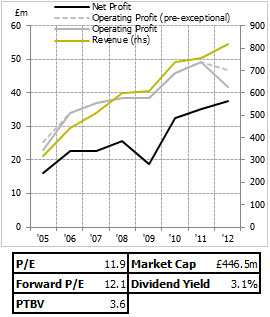

By the most obvious measure, it's not hugely expensive, either. It trades on about 12 times forward or historic earnings, having grown consistently for the last 10 years.…

.png)