Please give a warm welcome to a new column from Edmund Shing. Edmund Shing has a first class pedigree as an institutional investor and is currently a Global Equity portfolio manager at BCS Asset Management, focusing on a combination of high-level investment themes and fundamental stock-picking. He's also a prolific blogger who likes to focus on systematic equity strategies. His equity strategy focuses on what he calls VQM - value, quality and momentum - there's a lot of overlap with what we do at Stockopedia and I hope readers appreciate it. Also - this one's about oil which should go down well with the original Stockopedia community members.

That the Isis rebels are advancing on Baghdad has sent shudders through the crude oil market, with Brent Crude oil prices breaking above their 9-month trading range to hit over $113/barrel today (Figure 1).

1. Brent Crude Oil futures head back to the 2013 highs

Source: Bloomberg

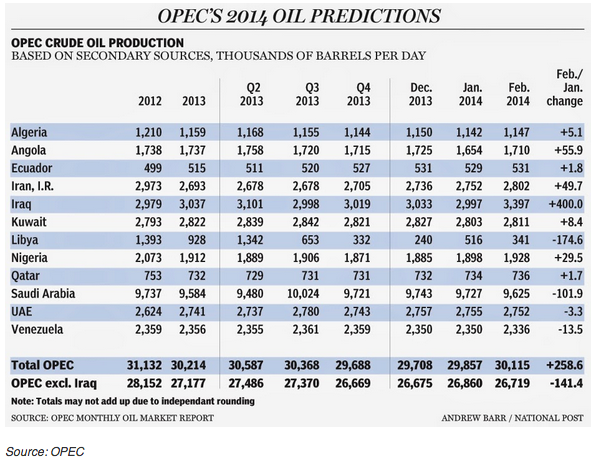

Iraq is projected to be 11% of OPEC output this year

With OPEC representing over 40% of global crude oil production, and Iraq forecast to produce 11% of OPEC's crude output this year, any long-lasting disruption to Iraqi oil production could keep crude oil prices higher than expected, in spite of the burgeoning production of oil and gas from US shale deposits.

2. Iraq is projected to produce 11% of OPEC's Oil Output This Year

Source: OPEC

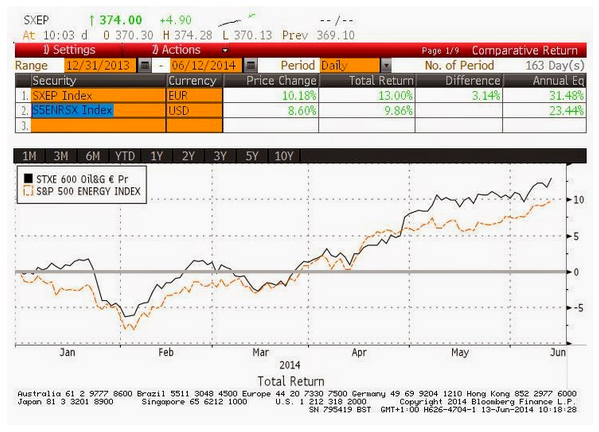

UK, European, US Oil Companies Outperforming

At a time when global stock markets could finally be stalling in the short-term after breaking new all-time highs, the oil & gas sectors on both sides of the Atlantic have maintained strong upwards momentum thanks in part to this geopolitical boost, comfroatbly outstripping the wider benchmark stock indices.

3. European and US Oil Stock Gains in the Double-Digits This Year

Source: Bloomberg

So Which Oil Stocks Look Particularly Attractive Right Now?

In the US, my attention has been drawn to oil-related stocks that have under-performed up to now, but which are starting to rebound sharply. Noble Corporation (US code: NE) is one such company, an offshore drilling contractor which is very cheap at 9.5x forward P/E, 0.9x price/book and offers a tempting 4.3% dividend yield (more than twice that offered by the S&P 500 index).