Not a direct share topic but just wondering if there were folks out there that have US stocks in ISA / SIPP portfolios and how if any way they hedge on the exchange rate within those wrappers?

It's a long time since I was involved in that field, but my recollection is that 10 years ago the accepted wisdom amongst investment professionals was that (as a risk reduction measure) currency hedging made sense for overseas bonds but had little merit for overseas equities (for the usual arguments of exchange rates correlation with economic growth etc).

If you decide to hedge, eg for tactical reasons, then I guess CFDs/spread bets are the obvious routes but you'd need to calculate your exposure, margin requirements etc. Or micro futures contracts eg https://www.cmegroup.com/tradi... You'd have to hold these outside your ISA/SIPP I expect. Brokers may insist on a basic online test before allowing access to complex instruments.

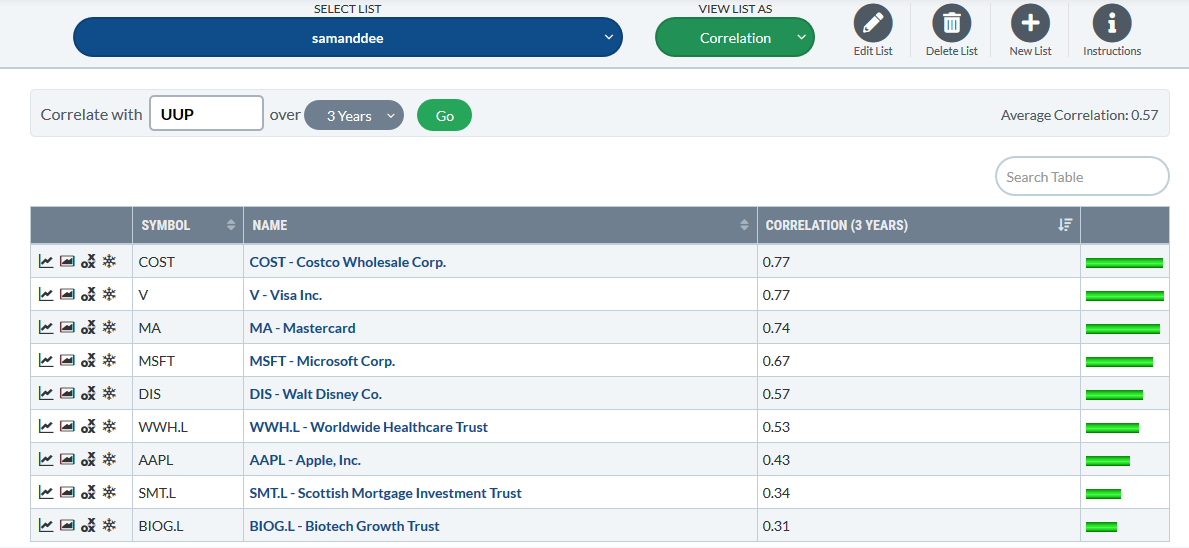

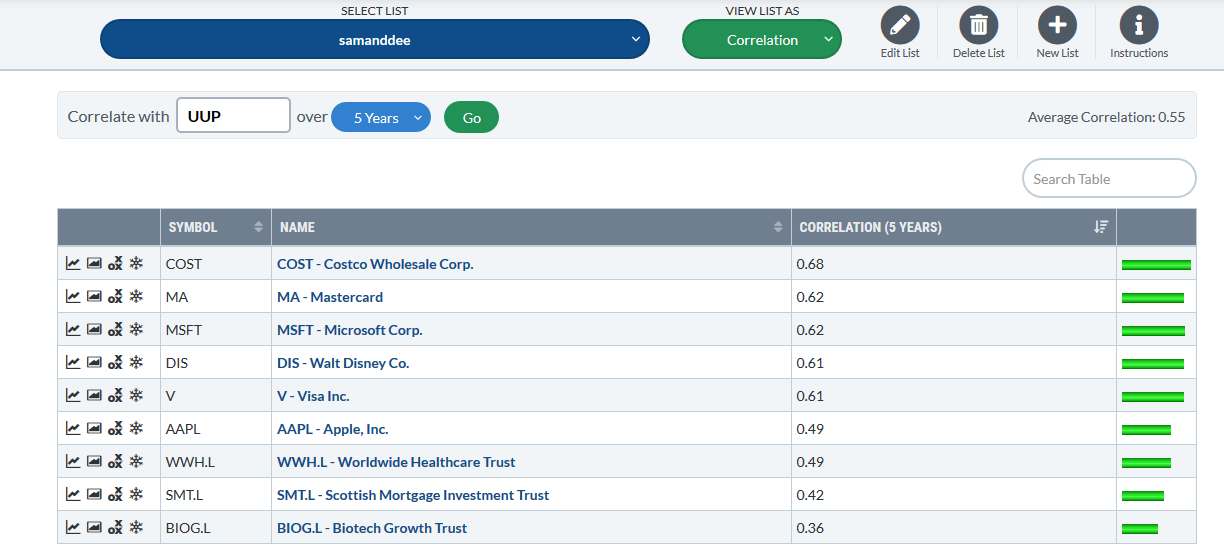

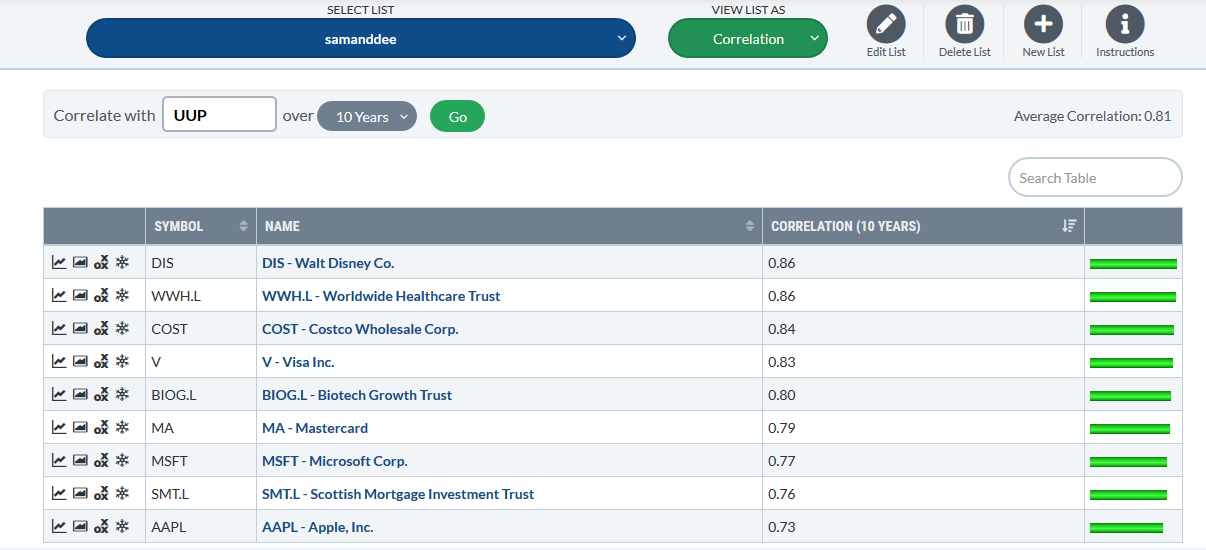

Alternatively there are currency ETFs that might be worth investigating eg https://etfdb.com/etfdb-catego... In my limited experience UK brokers tend not to offer the whole plethora of ETFs. It might be worth asking your broker what instrument they recommend.

If you're using index ETFs to gain your overseas exposure, rather than direct stocks, you might find the provider offers both an unhedged and a GBP-hedged version of the same ETF, which could be a lot simpler.