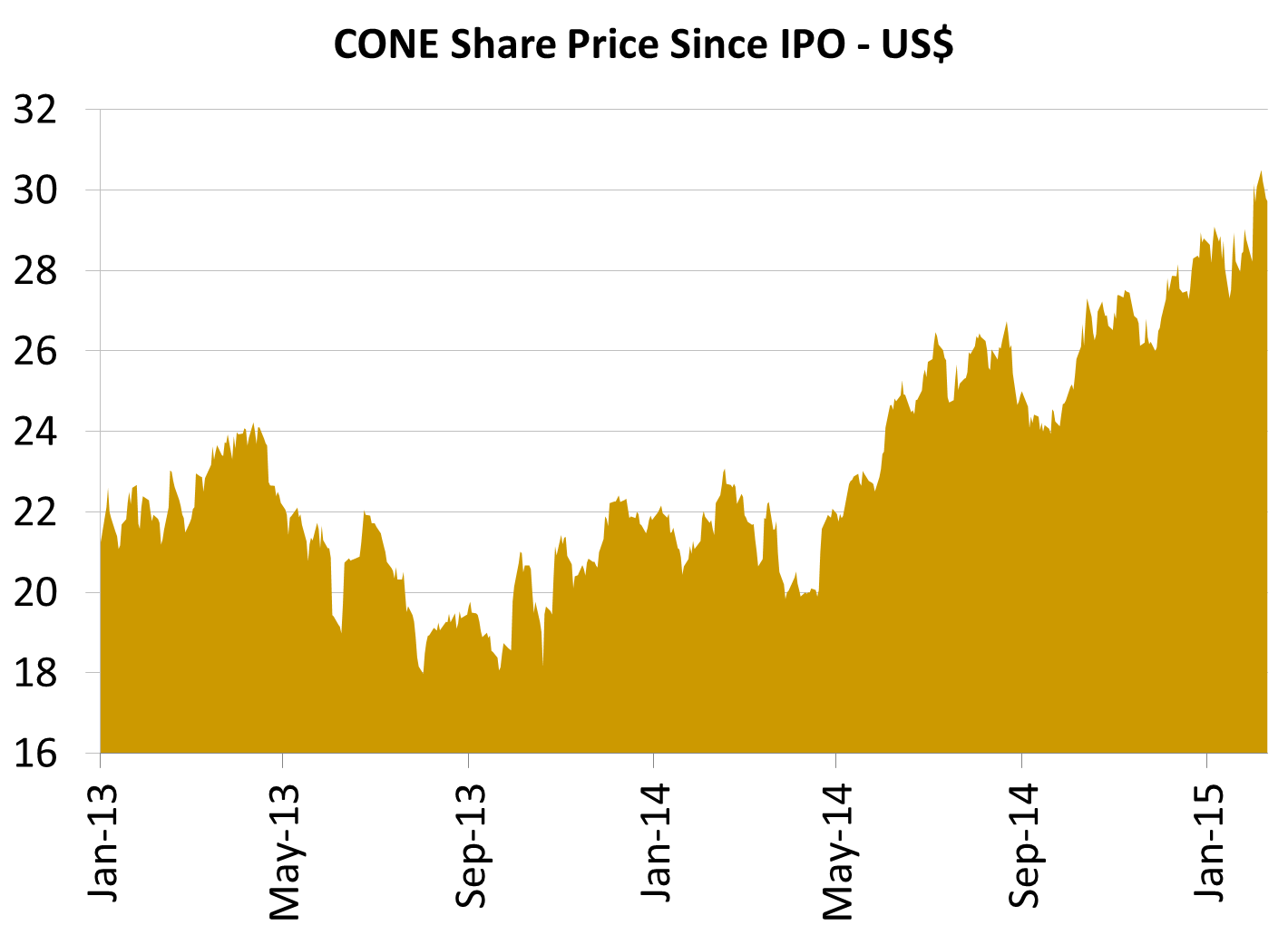

CyrusOne (NASDAQ:CONE) is one of the fastest growing companies in the data center REIT sector in the US. However, that doesn't make it an easy buy. Although the company is well positioned in a market where the fundamentals have been strong, CyrusOne is already trading at a reasonable value. Taking into consideration the company's 2015 guidance, as well as its history and peers, the current share price is already the correct valuation for 2015.

Source: Yahoo Financials

Company Description

Entering its third year as a public company, CyrusOne is a small cap company (market capitalization of US$1.1 billion) that develops, owns, and operates data center properties. It has 25 operating data centers in eleven distinct markets (nine cities in the U.S., as well as London and Singapore) that include power, cooling, and telecommunications systems, which enable interconnectivity between data centers and a range of telecommunication carriers. These data center facilities are critical to the continued operation of its customers' information technology infrastructure.

CyrusOne generates recurring revenues by leasing colocation space, and nonrecurring revenues from the initial installation and set-up of customer equipment. It provides customers with data center services pursuant to leases, with a customary initial term of three to five years. At the end of the lease term, customers may sign a new lease or automatically renew pursuant to the terms of their lease. As of December 31, 2014, the weighted average initial lease term was 69 months, and the weighted average remaining lease term for the top 20 customers was 34 months.

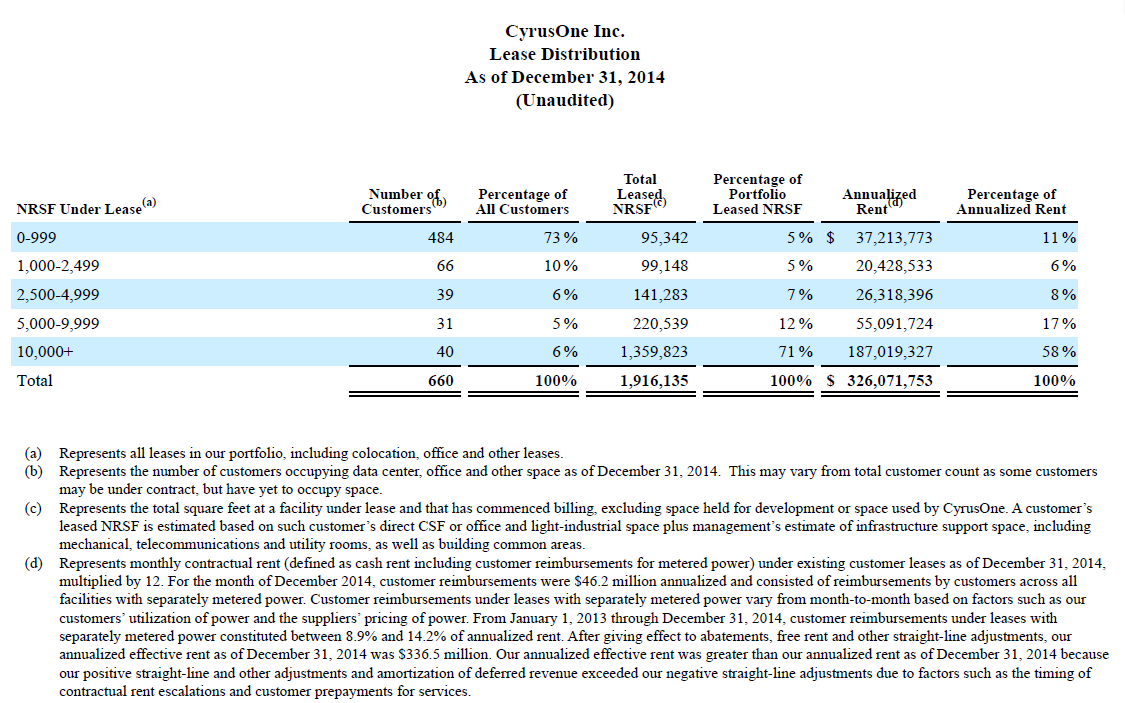

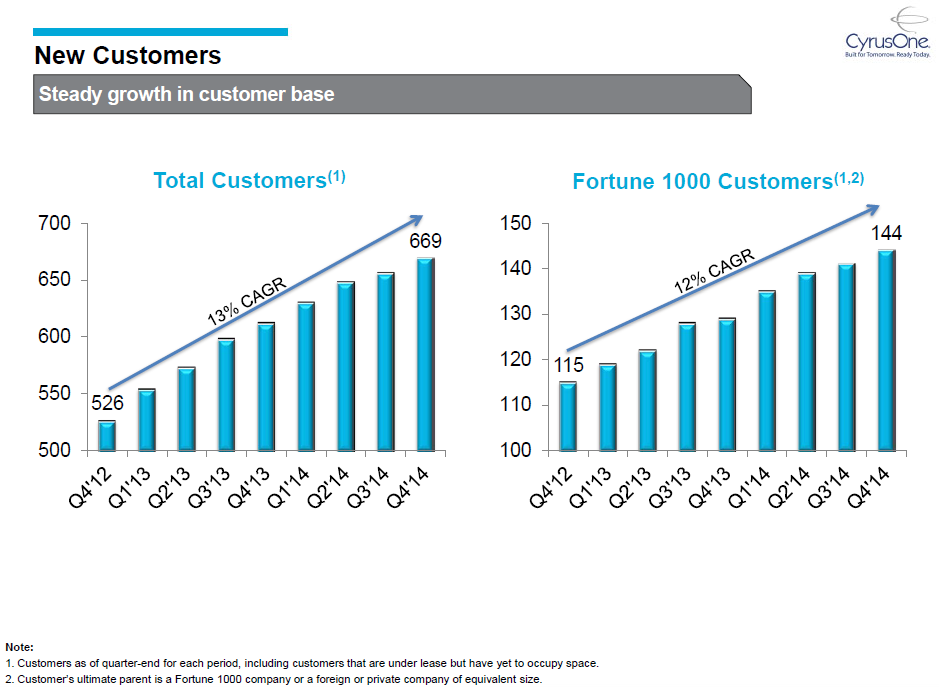

Recognizing the growth potential of outsourcing in a market where only a portion of large U.S. enterprises use third-party data center colocation services, CyrusOne focuses on high-revenue clients – out of 669 customers, 144 are in the Fortune 1000. This strategy has led to revenue concentration within a small pool of customers: 40 customers account for 71 percent of leased space and 58 percent of annualized revenues.

Source: CyrusOne Fourth Quarter 2014 Earnings Report

In 2014, CyrusOne's growth was fueled by both new and existing clients, leading to an increase in leased colocation area of 20 percent, and to a corresponding increase in revenues by 20 percent, with the help of escalators, ancillary and services products, and interconnection.

Source: CyrusOne…