Good morning!

Spreadsheet that accompanies this report: link.

11.15am: Roland and I have made a clean sweep of today's announcements. See you tomorrow!

US Jobs Report

The collapse of the Trump-Musk relationship has been dominating news headlines in recent days, but the actual economic data so far - in particular the US jobs report - has been far less explosive than the headlines might suggest.

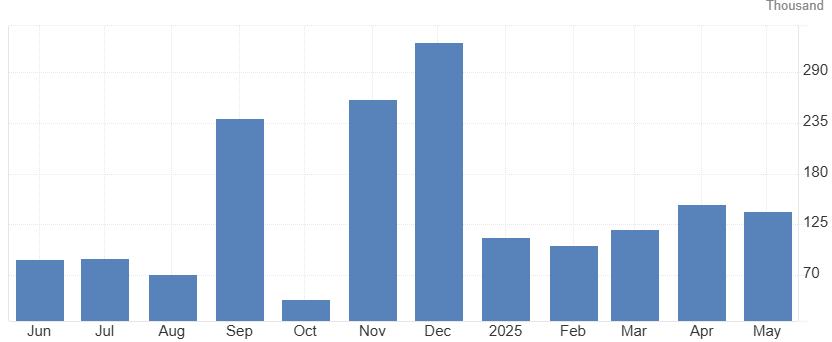

On Friday, the May jobs report came in slightly better than expected, with 139,000 jobs added, vs. 130,000 forecast.

This is not very strong growth - it's lower than April, and there are of course major concerns about the potential impact of tariffs. But for now at least, it seem inarguable that the US economy continues to perform reasonably well. Overall jobs growth has occurred despite sizeable cuts at the Federal government itself, which has been cutting jobs since January.

According to CNN, it is the 53rd consecutive month that the US economy has added jobs. This is the second-longest string of employment growth ever recorded.

US Non-farm payrolls. Source: tradingeconomics.com

The US unemployment rate is unchanged at 4.2%, which I interpret as "full employment".

So despite all of the dramatic headlines we've seen in recent days - and recent months - the economic reality when it comes to the domestic US economy is, for now, remarkably tranquil. Investors who have ignored the news continue to do well!

S&P500. Source: stockopedia.com

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Alphawave IP (LON:AWE) (£1.1bn) |

Alphawave has agreed a recommended cash offer of $2.4bn from Qualcomm (NSQ:QCOM). This is equivalent to $2.48 per share, or 183p. Shareholders can opt to receive Qualcomm shares instead. This offer gives a 59% premium to the six-month average price prior to bid speculation. | PINK (Roland) Today’s offer still leaves AWE shares trading c.50% below their 2021 IPO price. On a near-term view, the valuation of the bid looks strong, especially given the group’s debt position and negative free cash flow. However, on a longer-term view, my impression is that this business may have been approaching an inflection point for growth, so there’s probably still some value here for Qualcomm. In any case, this deal looks certain to go through in my view, given… |