Former readers of the, now defunct, Motley Fool (UK) bulletin boards will no doubt recall that there was a personal finance section on the boards going by the same title as this article. This piece has nothing to do with that subject whatsoever, but I thought it made a snappy title.

This piece is actually triggered by accounting changes coming about from the adoption of IFRS16.

Changes to the definition of debt.

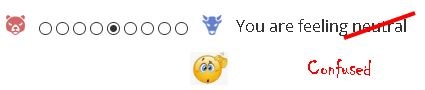

Well done! Your eyes have obviously not glazed over and you carried on reading beyond the uninspiring sentence above.

Before I go on I should point out that I am not a qualified accountant and this is just my layman’s interpretation of the reporting standards – do not take it as gospel.

Also if you are only moderately interested in this subject, you might what to skip the next section and go straight down to the heading “radical stepchange”.

IFRS16 requires companies to show on the balance sheet the liability arising from inescapable lease commitments and to balance this off with rights of use assets reflecting the future value of using these leases (or to be a little more precise – the future cost, effectively recognised in advance, of using these leases.

At face value this is a sensible step. Anyone that has looked in any depth at “bricks and mortar” retailers will be aware that many face a significant challenge from the fact that they have committed to Long Term leases on their stores at rents that are well above the current going rate. They cannot easily shut or downsize these stores as they remain liable to pay the rent for the full term of the agreement whether they use them or not.

I have thought in the pas t that some investors fool themselves by implicitly assuming that a company’s Net Tangible Assets Value (NTAV) is somehow indicative of how much they as an investor would get back should the business cease to trade.

Not true! There are liabilities not on the balance sheet :

- Up until comparatively recently (net) pension deficits were not on the balance sheet .

- Now lease liabilities are also there (although one needs to discount the rights of use assets to get towards a ‘realisable’ asset value).

- Statutory redundancy costs and probably a whole host of other liabilities,…