Imagine you're offered $1 for 50¢ - would you take it? Welcome to the world of deep value investing: where you try to buy stocks at a significant discount to their intrinsic value.

It sounds simple, but nothing ever is. The $1 note might be torn, and a bit inky. Your friends may warn you it's not even legal tender. Beyond that, parting with 50 cents today can seem tough if the wait to receive $1 is uncertain. Herein lies the problem. Mr Market may offer you a stock market bargain because he’s depressed, but there’s no guarantee that he’ll get excited again in the future. Perhaps this piece can help you find the patience, tenacity, courage, and contrarianism to take the deal. These are the traits you’ll need.

In this article we’re going to dive deep into Deep Value. Read on and you’ll learn:

- The history of Deep Value investing and some of the luminaries gracing the field

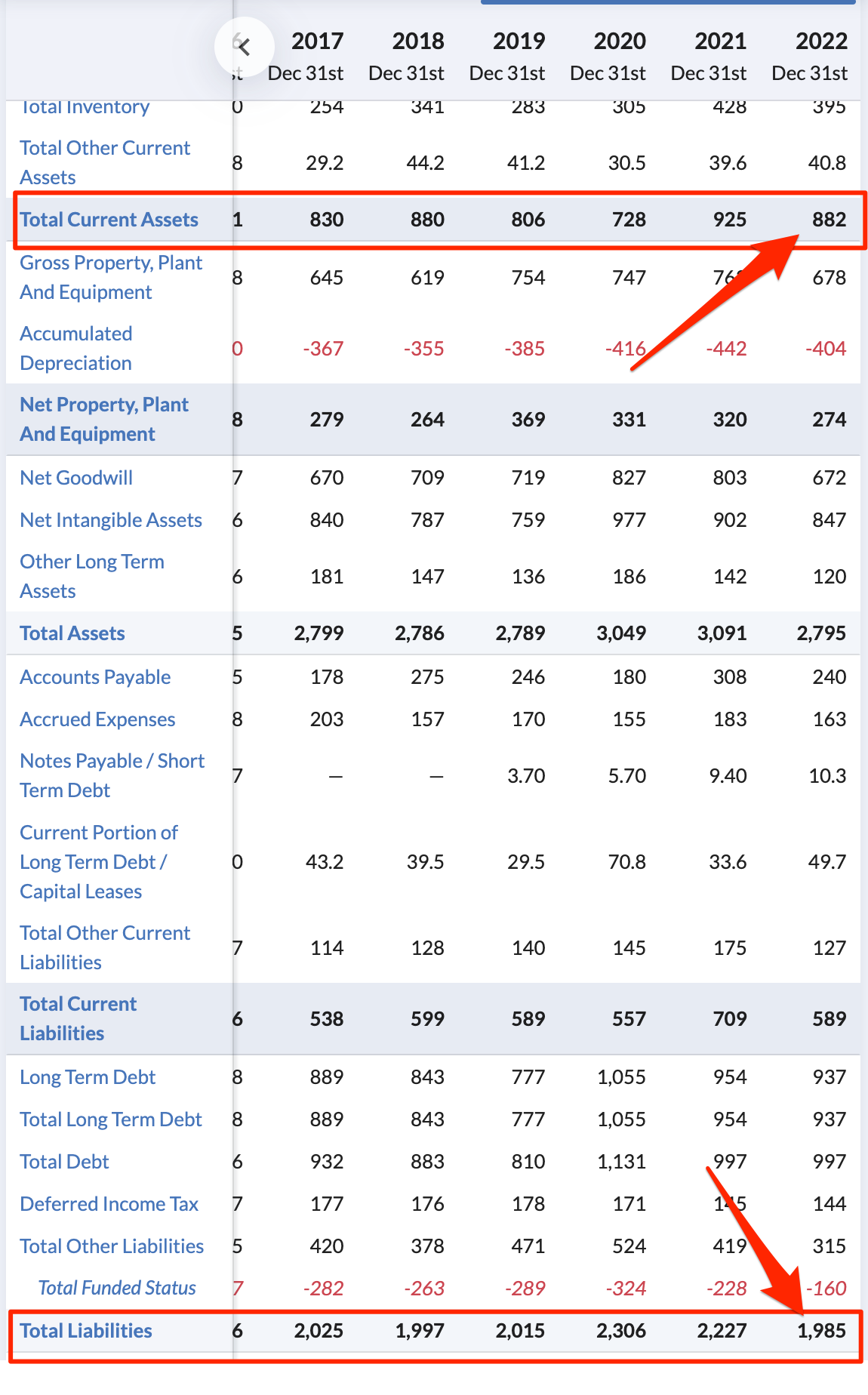

- The financial ratios and screening approaches needed to find these stocks

- The risks and limitations that the canny investor needs to be aware of

- The best books to read to further your knowledge.

Is Deep Value the right investment style for you?

This is a game custom made for the brave and contrarian individual investor. It’s a game that the professional investor struggles to play as so often the cards that are dealt out are small caps. Typically, stocks get cheap when the share price falls dramatically. As a result, the “liquidity” in the stock dries up.

As passive indexing has grown in popularity, mega passive index funds like Vanguard now manage trillions. Pressure on fees continues, forcing active funds to get larger and larger to compete. This leaves a dearth of professional investors hunting in the small and micro cap areas of the market. They just can’t play in this game, leaving opportunity for the bold individual investor.

Of course, tight liquidity is a double-edged sword. It’s hard to buy positions in illiquid stocks, and it can be hard to get out when markets fall. So nobody should play in this game with money they need in the short term or that they can’t afford to lose.

The opportunities offset these issues. In spite of periods of underperformance, Deep Value investing is one of the most consistent return sources in markets. But…