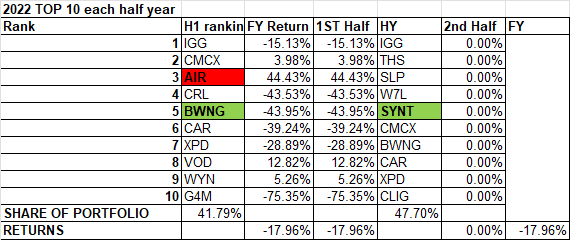

Deflated by 1st half of 2022, New List for 1st July 2022 - Top 10

Well, a disappointing 1st half performance for my top 10 picks, so I think we can honestly say there is just as much luck as judgment involved in selecting this top 10 list. Still, this remains my preferred method for selecting and holding my portfolio. I console myself with dividend pay I can reinvest, cash on standby for a crash, and valuations that are still holding up well with each trading update.

2022 1st half performance, and new list for 2nd half -1st July 2022

This is for me personally to publish a list and compare performance which I can't manipulate post the event. Really no need for anyone to read further or comment.

Red indicates position completely closed

Green indicates a new position being built

As Always DYOR

BSV

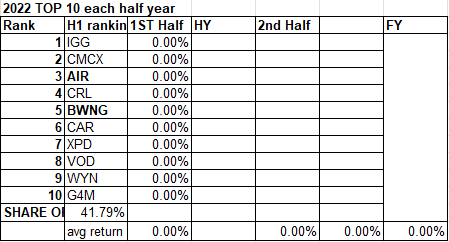

2nd of Jan 2022 - Supercharging returns deflated by second half by ranking portfolio holdings, New 1st JAN 2022 - Top 10

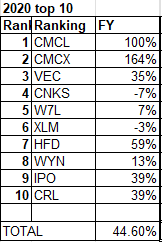

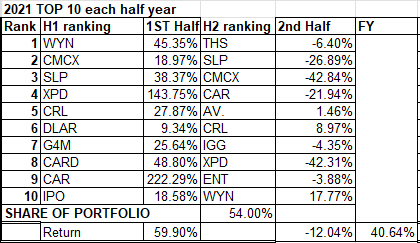

Well after enjoying 6 quarters of electrifying growth since 2020 (245% trough to peak), the portfolio for the 2nd half of 2022 finally stumbled, with a 16% pullback overall. My top 10 ranking still continues to perform better than the rest of the portfolio. (top 10 - 40.6% for 2021 compared to the overall performance of 26.6%). Anyway, I listed 2020/21 with performance and the top ten for 2nd Jan 2022. This is for me personally to publish a list and compare performance which I can't manipulate post the event. Really no need for anyone to read further or comment.

Past performance 2020/21

List for 2022

New to the portfolio are AIR and BWNG.

As always DYOR

BSV

1st July - Supercharging returns by ranking portfolio holdings, 1st July 2021 - Top 10

So I've now enjoyed 6 Quarters of excellent performance. I want to post the top 10 rankings before the start of the second half-year. Let's see if this outperformance continues. and if this is a process that works or is just dumb luck.