Interested in IPOs? You can now read our free IPO Survival Guide. In it, the team at Stockopedia provides unique insights into the world of IPOs, derived from an analysis on 258 IPOs between 2016 and 2021. These insights will allow you to make better and more informed investment decisions when presented with the next 'hot' IPO. You can download the full guide for free here.

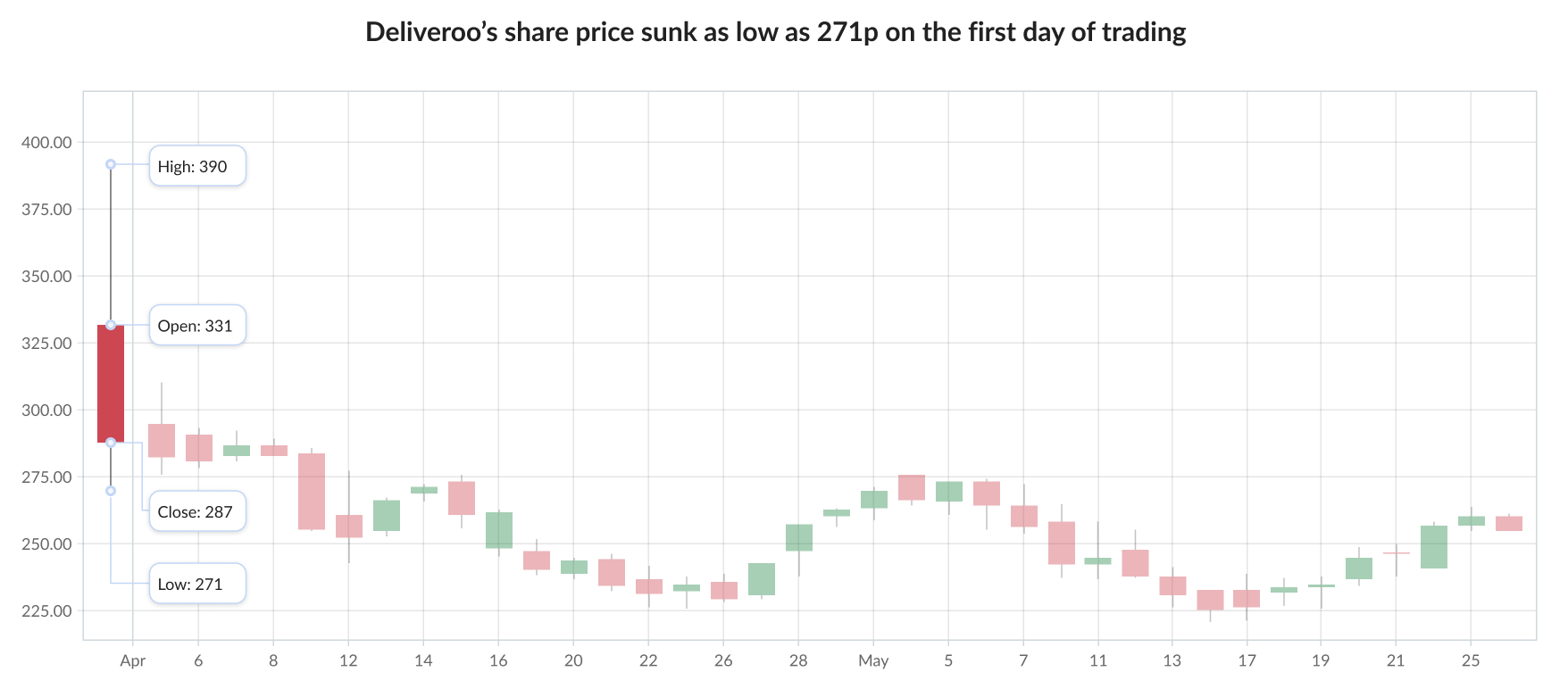

When Deliveroo floated on the London Stock Exchange on 31st March 2021, it was one of the most highly anticipated IPOs that the London market had seen in years. But when the share price quickly collapsed, it was a reminder of just how risky these heavily promoted new listings can be - and why investors should be extremely wary of them.

Deliveroo’s IPO offer price of £3.90 per share valued it at around £7.6 billion, but less than a month later the price had fallen to £2.28, taking the valuation to £4.4 billion. The performance led to some undesirable headlines as the worst IPO in London’s history. In terms of absolute paper money losses, only time will tell.

However, at a time when tech company valuations are often eye-watering, and IPOs are seemingly a foolproof way for directors and existing shareholders to make money, what went wrong with Deliveroo? What were the warning signs that should have been heeded in all of this - particularly for those buying shares in what was one of the biggest IPOs in recent years?

The City’s hype machine lured investors in

The continuous flow of compelling promotional activity by news outlets, financial institutions, and the company itself, seems to have lured private investors into what many now see as an expensive and enthusiastically hyped IPO. Many of these investors are now nursing substantial paper losses.

On the 27th of March, the Sunday Times wrote that ‘Deliveroo is poised to swerve around doubters in the City and roar towards a blowout float this week, despite mounting concerns about its use of gig-economy workers.’

The Sunday Times added ‘the online takeaway giant…is set to price its listing towards the top end of the £8.8 billion range after filling demand for its offering on the first morning of the so-called roadshow on Monday, with strong interest from investors outside the UK.’