Beauty is very much in the eyes of the beholder when it comes to the stock market. Indeed a ‘Surefire Buy’ to some, can equally be a ‘Deadcert Sell’ to others.

The problem for me in the first three months of 2024, is that my portfolio hasn't been exposed enough to some of today’s mega trends - such as AI, the 'Magnificent Seven' and/or GLP-1 anti-obesity drugs.

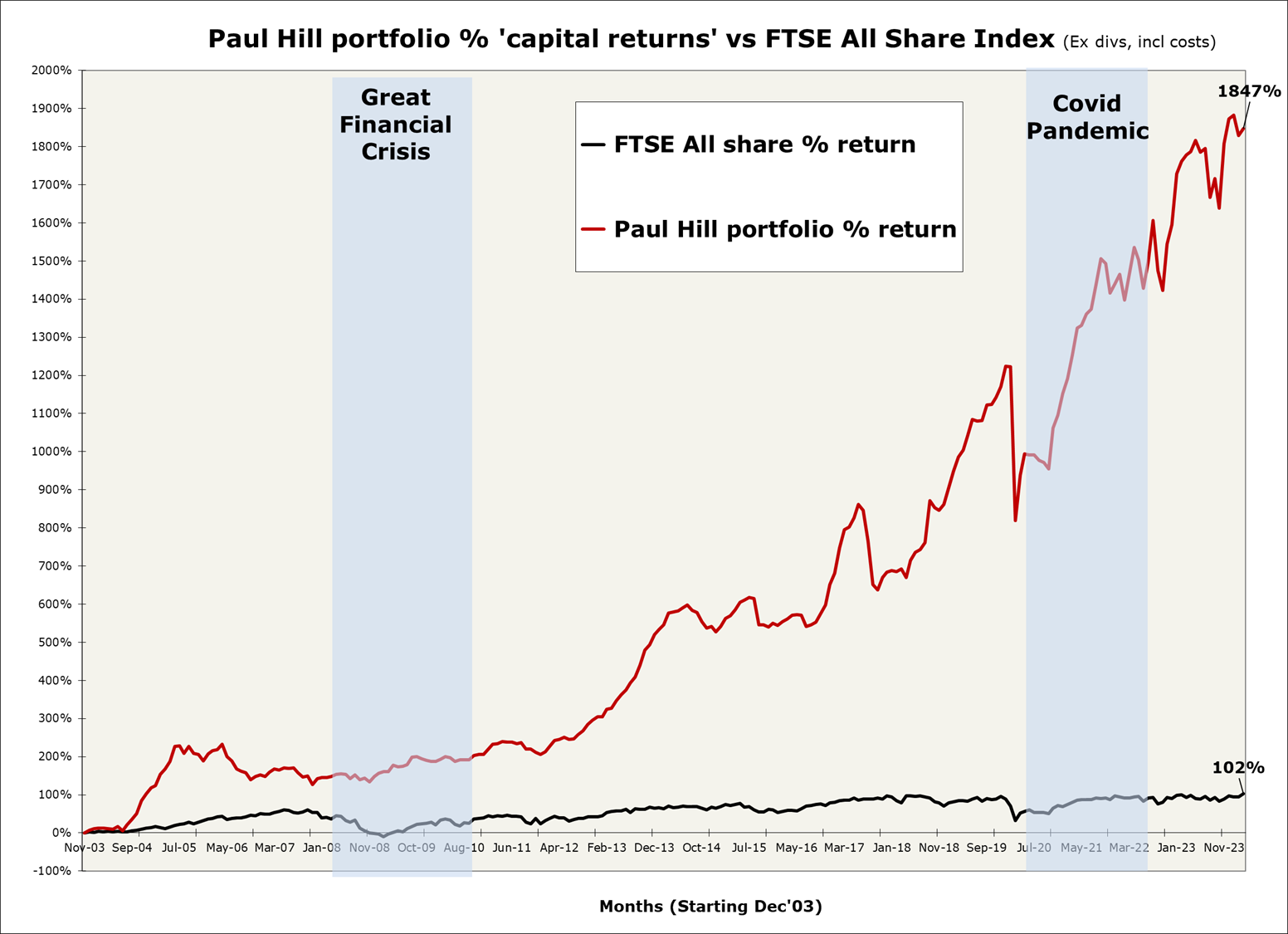

Nonetheless, having run my own money for more than 30 years, this underperformance doesn't worry me one jot. Rather, I remain optimistic about the long term prospects of UK smallcaps, where there appears to be significant upside.

That said, what will be the catalyst for a re-rating? Particularly as valuation alone is rarely a reliable indicator of short-term performance.

Here once again, I unfortunately don’t have a magic wand. Albeit I wouldn’t be too surprised if UK CPI fell below 2% sometime in Q2 as the energy price cap resets lower.

Hopefully allowing the Bank of England to begin cutting interest rates in the summer. Which should (in theory) provide a lift to sentiment, as UK smallcaps operate at the front end of the yield curve (re bank loans).

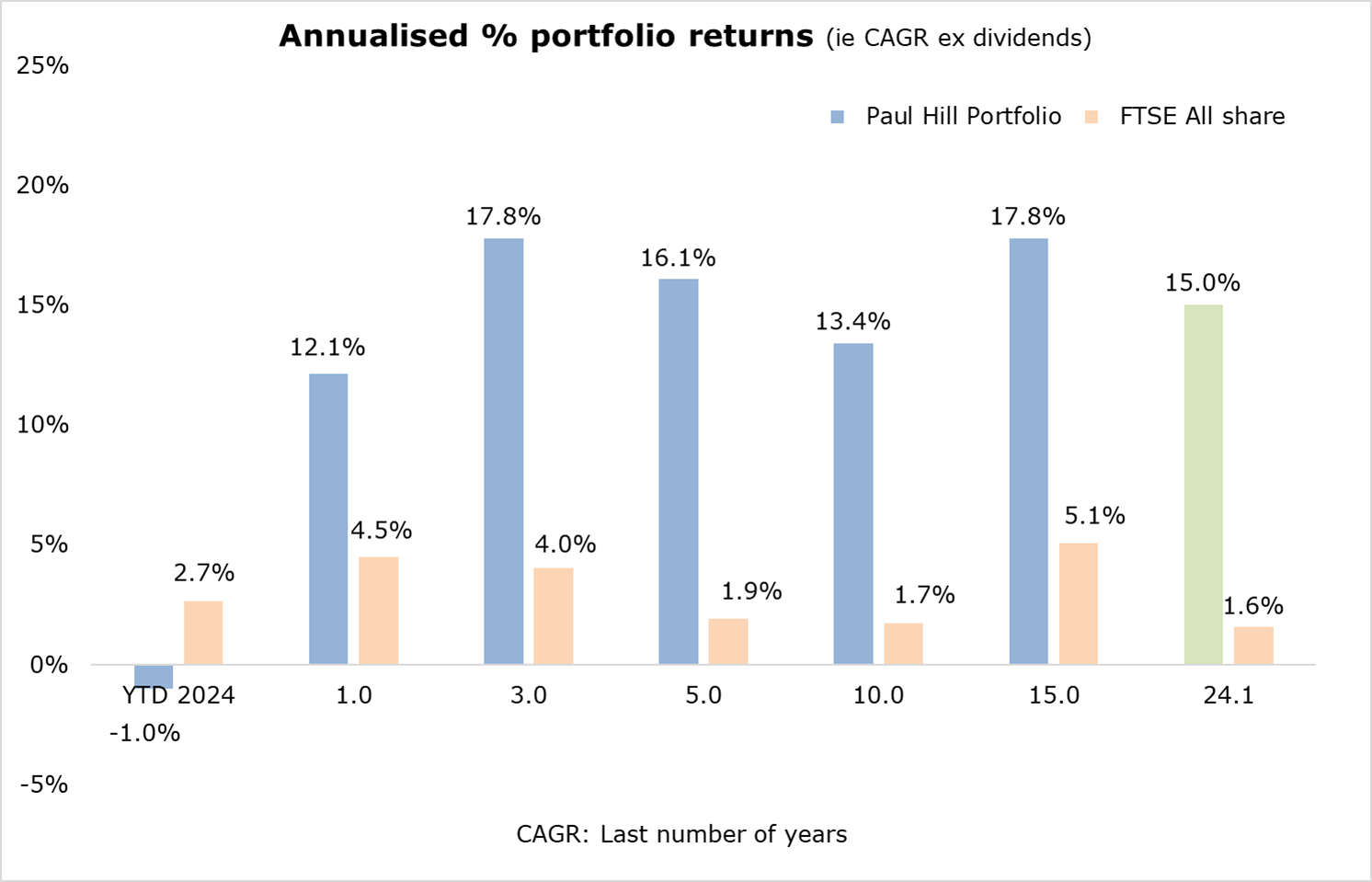

In the meantime though, its simply a case of being patient and rolling with the punches. With my portfolio (see below) currently down -1% YTD compared to +3% for the FTSE Allshare.

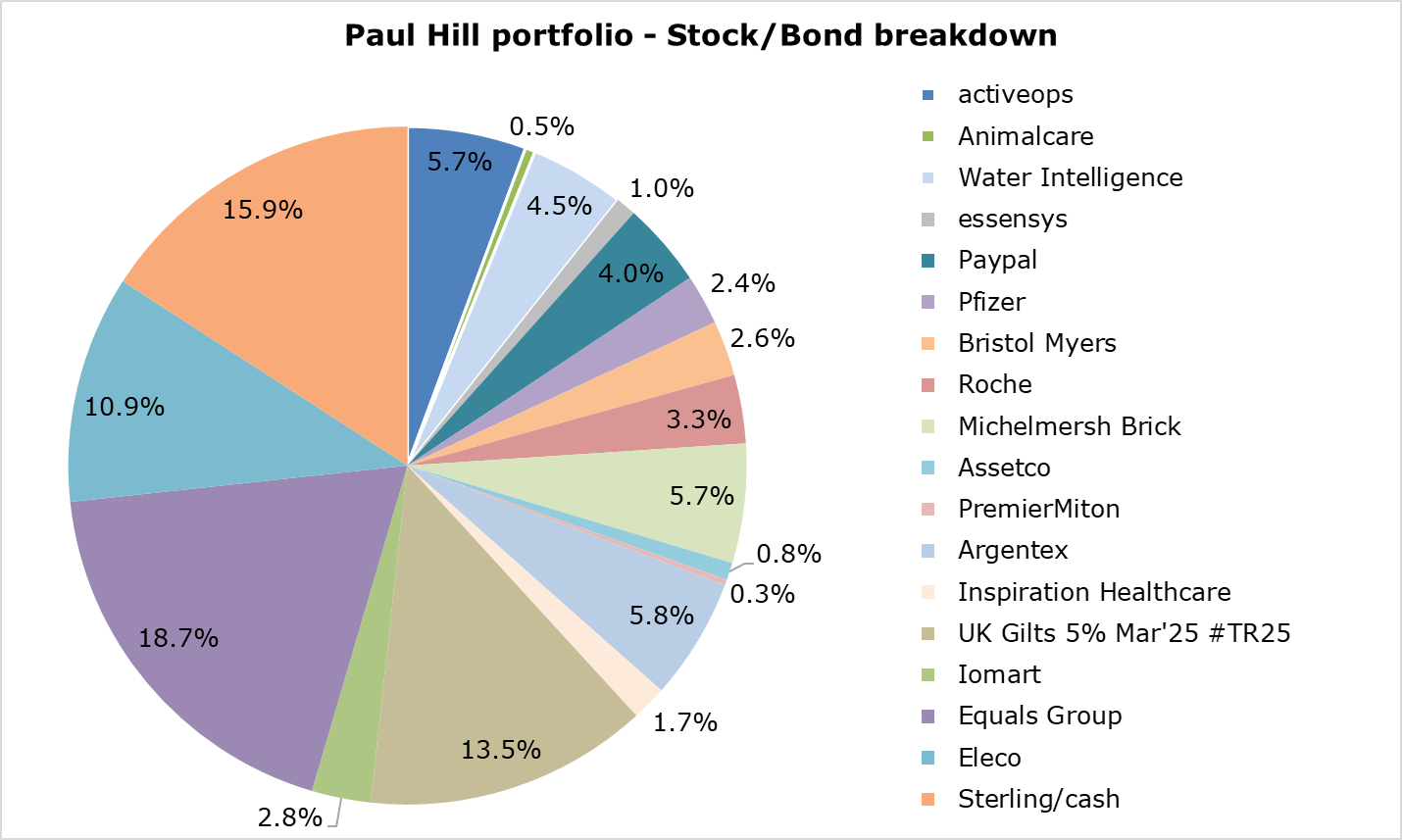

Granted not ideal, but neither is it a total disaster. My only significant Q1’24 purchase being a half position in data centre and managed services firm iomart (LON:IOM) .

So as my old school song neatly taught me:

“Forward where the knocks are hardest, some to failure, some to fame;

Never mind the cheers or hooting, keep your head and play the game."

Happy easter everyone, & for the next 4 days 'enjoy the silence'.