What am I thinking, looking at:

- A Mining company (hated sector)

- A Gold mining company (loathed commodity)

- A company with operations in Zambia and Zimbabwe (talk about geopolitical risk)??

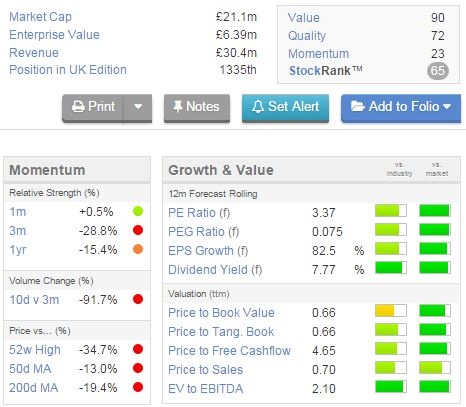

I have looked at Caledonia Mining (LON:CMCL) before, as it ranks well on Stockopedia's StockRanks with a 90 Value rank and a 72 Quality rank (Figure 1), which is very high for a mining stock.

1. Caledonia Mining: StockRanks

Well, my interest was re-ignited in Caledonia on the back of this detailed Seekingalpha article on the stock.

Obvious Value

And yes, the valuations do look rather compelling at 3.4x P/E, 2.1x EV/EBITDA and 7.8% dividend yield...

Looking at deep value, the market cap. of £21m is only £3.6m more than the stated working capital of C$31.1m (at a £/C$ FX rate of 1.78), which itself is mostly cash. Put another way, you are paying no more than 10% of the book value of the net fixed assets after subtracting this working capital...

A Low-Cost Gold Producer

It has to be pointed out that with their 49%-owned Zimbabwean Blanket mine, Caledonia is a low-cost gold producer, with a claimed 267% internal rate of return (IRR) - see the CFO's Video discussing this here.

According to the Q3 results, for 9m 2014 production of 31,354 oz of gold was sold at a price of $1,266 per oz, versus an all-in cash cost of $938/oz. While both production and the average selling price were both down in Q3 2013, resulting in a lower profit, bear in mind that the company also managed to lower the all-in cost from $972/oz over the first 9m of 2013.

Moreover, according to the company,

Blanket remains on course to achieve its target production of approximately 40,000 ounces of gold in 2014

and

On-mine costs at Blanket remain low and are better than was expected

But Quality Too

Let's start with the balance sheet and cash flows, since these are primordial for high-cost industrials like miners. The good news is that Caledonia has net cash of C$27m (with an increase of C$1.1m over Q3 2014), representing around 70% of the market cap. Very strong balance sheet then.

The dividend cover is a prospective 1.7x for this year, rising to 4x for next year. Pretty solid.

Despite the crash in gold prices, both operating margins and…